Renters Rebate Form 2024 – Renters Rebate Form 2024 serves as a valuable resource for tenants, offering financial assistance to eligible individuals. This article aims to provide a comprehensive guide to understanding and utilizing the Renters Rebate program effectively.

Understanding the Purpose of Renters Rebate Form

Renters Rebate Form is designed to alleviate financial burdens on low to moderate-income renters by providing rebates on a portion of their rent and utility payments. It aims to ensure affordable housing options for individuals and families facing economic challenges.

Eligibility Criteria for Renters Rebate

Eligibility criteria for the Renters Rebate program include income and residency requirements.

- Income Requirements: Applicants must meet specific income thresholds determined by the governing authorities. These thresholds are typically based on the household’s annual income. The exact thresholds may vary depending on the region.

- Residency Requirements: Applicants must be legal residents of the state or locality where the rebate program is offered. Proof of residency may be necessary during the application process.

Meeting these criteria is essential for individuals seeking to qualify for the Renters Rebate program and receive assistance with their rental expenses.

How to Obtain Renters Rebate Form 2024

To obtain the Renters Rebate Form for 2024, there are several channels available:

- Online Platforms: Many states offer downloadable forms on their official government websites. You can visit the website of your state’s department of revenue or taxation to find and download the form.

- Local Government Offices: Local government offices, such as city halls or county tax offices, may also provide physical copies of the form. You can visit these offices in person to request a copy of the Renters Rebate Form for 2024.

- Mail Request: Some states allow individuals to request the form by mail. You can contact the relevant government office or department and inquire about the procedure for requesting the form through mail.

- Community Centers or Libraries: Community centers or public libraries in your area may also have copies of the form available for distribution. You can visit these locations and ask if they have the Renters Rebate Form for 2024.

Ensure to check the official channels provided by your state or local government to obtain the correct and up-to-date form for the Renters Rebate program in 2024.

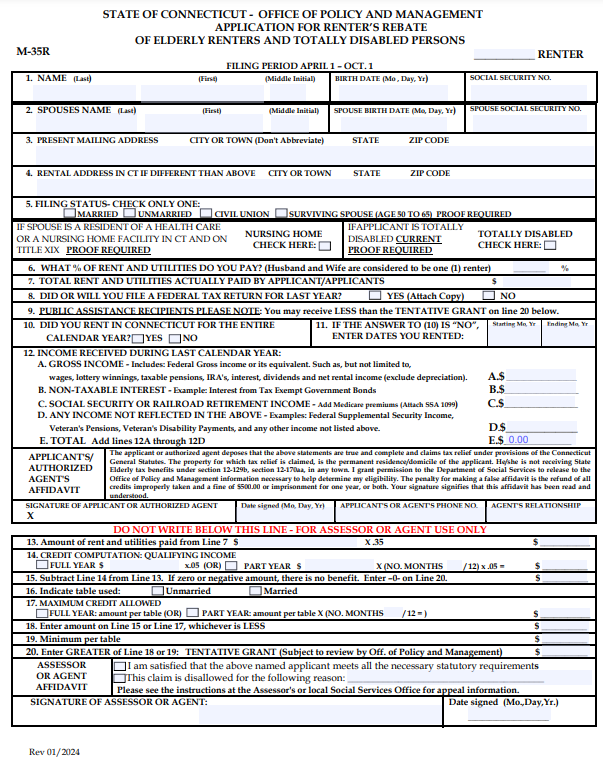

Filling Out Renters Rebate Form

When filling out the Renters Rebate Form, ensure to provide accurate information in the following sections:

Personal Information Section:

- Name: Provide your full legal name as it appears on official documents.

- Address: Include your current residential address where you are renting.

- Contact Details: Provide a phone number and email address where you can be reached.

- Social Security Number: Enter your Social Security Number accurately. This is essential for identity verification.

Income Details:

- Sources of Income: List all sources of income, including wages, salaries, retirement benefits, Social Security benefits, and any other financial assistance received.

- Wages: Specify your total earnings from employment, including any bonuses or overtime pay.

- Additional Financial Assistance: Include any additional income such as alimony, child support, or rental income from other properties.

- Proof of Income: Be prepared to provide documentation to support your reported income, such as pay stubs, tax returns, or benefit statements.

Property Information:

- Rental Property Details: Provide information about your rental property, including the landlord’s name, address, and contact details.

- Rental Agreement Terms: Specify the terms of your rental agreement, including the monthly rent amount and the duration of the lease.

- Utility Expenses: Include details about utility expenses paid by you, such as electricity, water, gas, or heating costs. This information helps calculate the rebate amount accurately.

Ensure to review the completed form thoroughly before submission to avoid any errors or discrepancies. Providing accurate and complete information will expedite the processing of your Renters Rebate application.

Common Mistakes to Avoid When Filling Out the Form

Some common mistakes to avoid when filling out the Renters Rebate Form include:

- Providing inaccurate information

- Missing deadlines for submission

- Failing to include supporting documents

Submitting Renters Rebate Form

- Deadline Information

It is crucial to adhere to the specified deadline for submitting the Renters Rebate Form to ensure eligibility for the program. Missing the deadline may result in forfeiture of the rebate opportunity for that year.

- Submission Methods

Renters Rebate Forms can typically be submitted either online, by mail, or in person at designated government offices. Applicants should choose the method most convenient for them while ensuring timely submission.

Processing Time and Expectations

After submitting the Renters Rebate Form, applicants should anticipate a processing period during which their eligibility and rebate amount are assessed. The duration of this process can vary depending on factors such as the volume of applications received and administrative procedures. It’s important to note that applicants may experience delays in receiving their rebate if there is a high volume of applications or if additional information is required for verification purposes. Generally, applicants can expect to receive notification of their rebate status within a reasonable timeframe, but exact processing times may vary.

Appealing a Renters Rebate Denial:

If an applicant’s Renters Rebate application is denied or only partially approved, they have the right to appeal the decision. The appeals process typically involves providing additional documentation or evidence to support their eligibility for the rebate. Applicants should carefully review the denial letter or notification received, as it may outline the specific reasons for the denial and provide instructions for initiating an appeal. It’s important for applicants to gather any relevant documentation or information that can strengthen their case during the appeals process. Appeals are typically reviewed by a designated authority or panel, and applicants will be notified of the outcome once the appeal is processed.

Additional Resources and Assistance Programs

In addition to the Renters Rebate program, there are several other resources and assistance programs available to individuals experiencing housing-related financial difficulties:

- Rental Assistance Programs: Many local and state governments offer rental assistance programs to help low-income individuals and families afford housing. These programs may provide subsidies to cover a portion of rent costs, emergency rental assistance, or help with security deposits.

- Utility Bill Assistance: Some utility companies and government agencies offer programs to help low-income households with their utility bills. These programs may provide financial assistance, discounted rates, or payment plans to help individuals maintain essential utility services such as electricity, water, and heating.

- Housing Vouchers: Housing Choice Vouchers (commonly known as Section 8 vouchers) are provided by the U.S. Department of Housing and Urban Development (HUD) to eligible low-income individuals and families. These vouchers can be used to subsidize rent in privately owned housing units.

- Homelessness Prevention Programs: Nonprofit organizations and government agencies often run homelessness prevention programs aimed at helping individuals and families at risk of homelessness. These programs may provide financial assistance, case management services, or temporary housing to prevent individuals from losing their homes.

- Legal Aid Services: Legal aid organizations may offer assistance to individuals facing eviction or housing-related legal issues. These services may include legal representation, advice, or advocacy to help individuals navigate the legal system and protect their housing rights.

- Community Resources: Local community centers, churches, and nonprofit organizations may offer various forms of assistance to individuals in need, including food assistance, financial counseling, and housing resources.

It’s essential for individuals seeking assistance to research and inquire about available programs in their area and to determine their eligibility criteria. Additionally, reaching out to local social service agencies or housing advocacy organizations can provide valuable guidance and support in accessing these resources.

Benefits of Renters Rebate Program

The Renters Rebate program offers several benefits to eligible individuals, including:

- Financial relief for rent and utility expenses

- Increased affordability of housing

- Support for low to moderate-income households

Tips for Maximizing Your Rebate

Conclusion

Renters Rebate Form 2024 serves as a vital resource for tenants seeking financial assistance with rent and utility payments. By understanding the eligibility criteria, application process, and benefits of the program, individuals can navigate the process effectively to secure much-needed support for housing expenses.

Download Renters Rebate Form 2024

Frequently Asked Questions (FAQs)

- Can I apply for Renters Rebate if I live in subsidized housing?

- Yes, individuals living in subsidized housing may still be eligible for the Renters Rebate program, depending on their income level and other eligibility criteria.

- Is the Renters Rebate amount taxable?

- The Renters Rebate amount is typically not taxable income and does not need to be reported on federal income tax returns.

- What if I move to a different rental property during the year?

- If you move to a different rental property during the year, you may still be eligible for the Renters Rebate, but you must update your information with the relevant authorities.

- Can I receive Renters Rebate if I receive housing assistance from other programs?

- Eligibility for Renters Rebate may vary depending on the specific terms and conditions of other housing assistance programs. It is recommended to consult with program administrators for clarification.

- How often can I apply for Renters Rebate?

- The frequency of Renters Rebate applications may vary depending on the regulations of the program in your area. Typically, individuals can apply annually, but it is advisable to check with local authorities for specific guidelines.