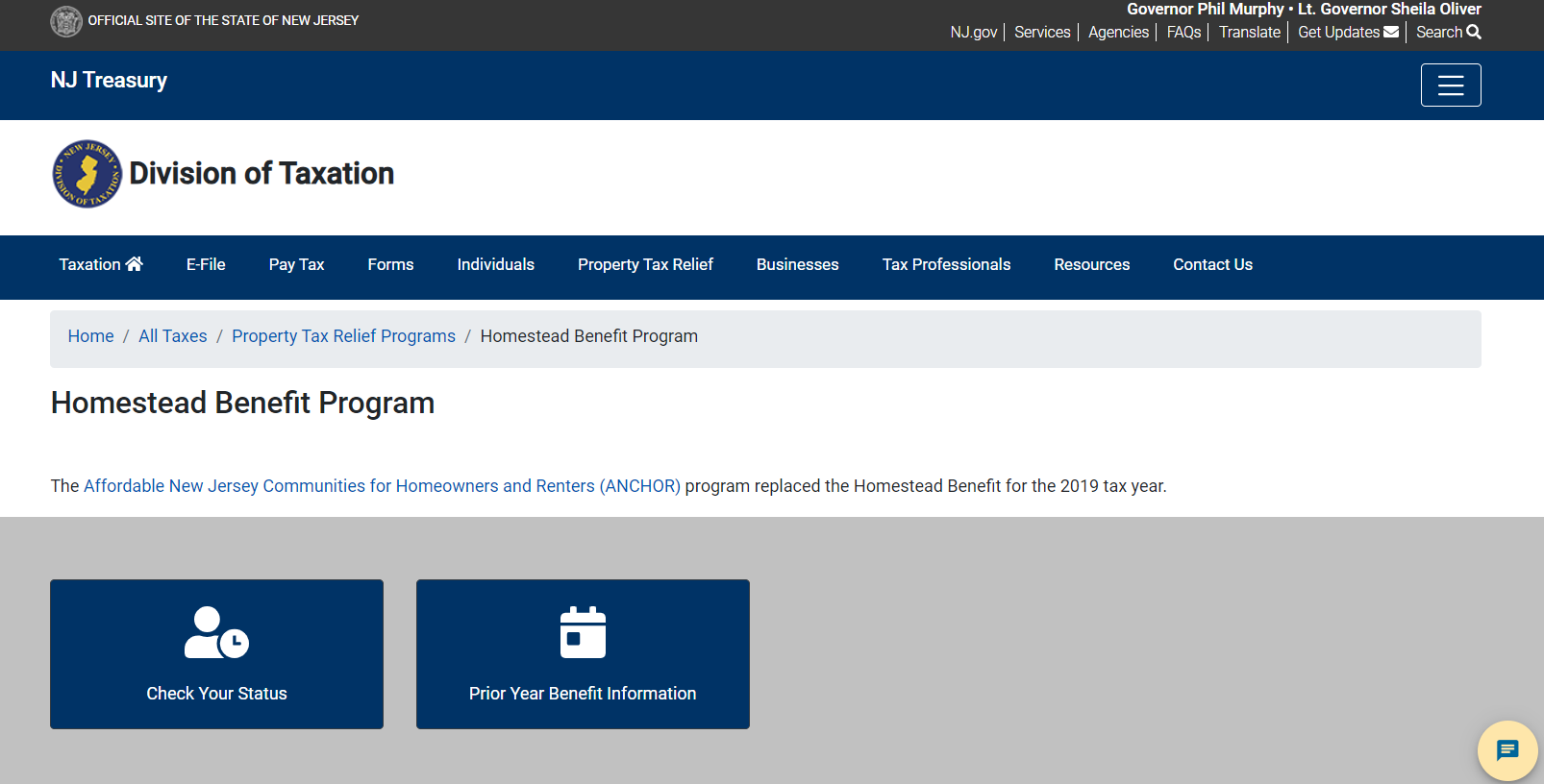

File NJ Homestead Rebate Form Online – A property tax credit known as the New Jersey homestead rebate is given to towns on behalf of homeowners who meet the requirements. The payment for this decrease in property tax obligations is frequently made by cheque or direct deposit. To find out more about the program and how to apply, continue reading. Start by completing the online New Jersey Homestead Rebate Form if you are a homeowner who is interested.

Homestead rebate program in New Jersey

Experience the benefits of the New Jersey homestead rebate program, where eligible homeowners can receive a credit for their property taxes. This program acknowledges the varying income levels of taxpayers, ensuring that the credit size aligns with their specific circumstances. Through this initiative, you have the chance to secure credits of up to $1,500, providing valuable financial relief and peace of mind.

Great news for renters and individuals with low incomes! You are eligible to receive a generous $450. To apply, you have two convenient options: starting in the upcoming weeks, you can easily obtain the application online. Alternatively, you can request an application by mail between September 12 and September 30. Don’t miss out on this opportunity to secure financial assistance!

Although New Jersey’s homestead rebate program offers homeowners property tax relief, the state’s real estate taxes can be quite high. The initiative is designed to aid homeowners in paying their property taxes, despite the fact that the typical tax amount is $28,890. Seniors who might not otherwise be able to afford the higher property tax rates will also benefit from the scheme.

Residents must own or rent a house in New Jersey as of October 1 of the year before applying in order to be eligible for the New Jersey homestead refund. Additionally, property owners must have paid their property taxes for the prior year. Additionally, homeowners over 65 are qualified for a $250 annual discount from their property tax obligations. Veterans who are disabled may potentially qualify for a property tax exemption.

Income prerequisites

You must satisfy the income requirements before you can submit an application for the NJ Homestead Rebate. The required income varies based on your circumstances. For instance, you have to be at least 65 years old, blind or crippled, or have a combined total household income of less than $75,000. Additionally, as of the filing date, you must have made your house your principal residence.

online, over the phone, or through the mail. Every day of the week, you have the option of filing by phone or online. You will get a check if your application is accepted, and the money will be deducted from your upcoming property tax bill. You will need to send your 2018 New Jersey Gross Income if you decide to file by mail.

Depending on the type of property you own, there are different income criteria for submitting an online NJ Homestead Rebate form. You are responsible for paying the property taxes associated with your unit if you own a continuing care retirement facility. Subsidized housing and on-campus accommodation are not included.

application closing date

The New Jersey Homestead Rebate Program was created to reduce property taxes for both homeowners and renters. The homeowner must have paid the property taxes for that year and have a principal residence in New Jersey in order to qualify. Renters must submit an application for the NJ Homestead Rebate as well. The booklet for resident income tax returns contains an application.

Great news for New Jersey residents! Despite the changes implemented by lawmakers, the Homestead program will remain in place for the upcoming tax year. This program offers valuable benefits to eligible homeowners. Don’t miss out on this opportunity – make sure to submit your application before the deadline of December 30, 2025. For those owning property in Passaic County, mark your calendars and apply by September 26 to take advantage of this amazing program!

Low-income homeowners are meant to receive property tax reduction through the NJ Homestead Rebate Program. Other initiatives to assist homeowners in lowering their property taxes are also available in New Jersey. For instance, people 65 and older can deduct $250 from their property taxes each year. If they satisfy certain requirements, veterans may also be eligible for exemptions from property taxes.

How to use

New Jersey’s homestead rebate program aids homeowners in paying their property taxes. The rebate’s amount is determined by the proportion of the home’s property taxes that were paid. You must fulfill specific income requirements and remain in the home as your primary residence in order to qualify. Additionally, you have to have lived in New Jersey for ten or more years. Additionally, you must be 65 years of age or older. You must be 65 years of age or older and make $75,000 or less annually to qualify if you are disabled or blind.

The state will mail you an application if you are eligible for the NJ homestead rebate. You will enter personal data using this form. You must also supply information about your state’s income taxes. You will get your rebate after submitting your application in full. Your rebate could arrive in the mail, via direct deposit, or as a cheque.