Council Tax Rebate Form Kirklees – You’ve come to the correct spot if you’re seeking for details on how to apply for a Kirklees council tax rebate. Here are instructions on how to backdate your CTR, apply for a council tax energy rebate, and submit a council tax rebate application if you have a serious mental impairment.

How to submit a council tax rebate application

You’ve come to the correct site if you’re seeking for information on how to submit an application for a council tax rebate in the Kirklees Council. Residents can now submit applications online thanks to the council. Your rebate should arrive in as little as two weeks after you submit your application, which is straightforward. However, you must first confirm that you meet the requirements before proceeding.

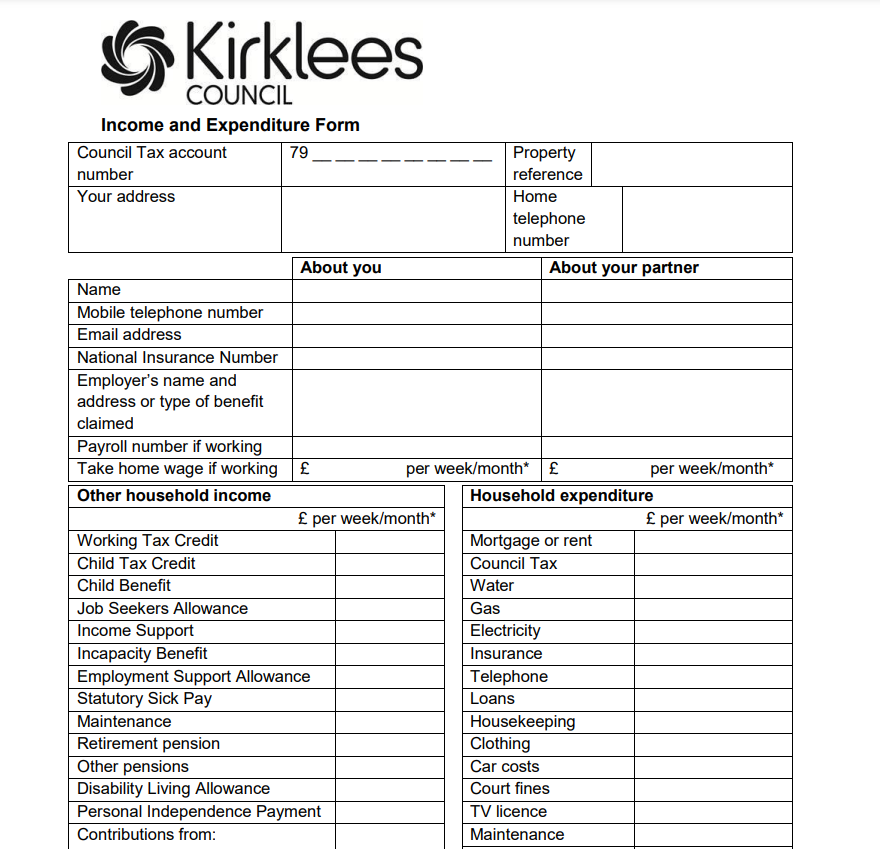

Make sure you have documentation of your income or savings first. The exact documentation needed should be specified on your local council website. Simply write “evidence to follow” on your application form if they don’t specify. Never be reluctant to approach the council to amend your application if you realize you made a mistake. It’s preferable to put your thoughts down on paper and save a duplicate of them so you can refer to them later.

You must also notify Kirklees Council of your new address if you are moving. Numerous services, including your water, council tax, and electoral roll, must be updated as part of this procedure. The procedure is quick and easy, and it may be completed in within two minutes.

How to date your CTR back

You might be able to backdate your CTR if you’ve fallen behind on your council tax payments. You can get the CTR you are entitled to as long as you apply within a month or fourteen days of the initial due date. However, you should be aware of the restrictions on backdating before proceeding.

How to submit a council tax energy rebate application

For people who want to submit an application for a council tax energy rebate, the Kirklees Council has made an online form available. They have made every effort to simplify the application procedure, and they anticipate providing rebates to all qualified residents within two weeks. Here is how to contact them, nevertheless, if you have any queries or worries.

Government policies have been revealed to shield millions of homes from rising energy costs. Those who qualify for the program will receive a one-time payment of PS150. The property must first be included in one of the council tax bands, A through D. Second, the resident must be the sole person responsible for paying the property’s council tax.

In April, the application procedure will start. 10,000 applications will be processed each day, and millions of pounds will be given to deserving homes. Your account will automatically receive the rebate funds if you pay your council tax via direct debit. You must complete a separate application if you pay your council tax by check or cash. The funds you receive will be transferred to the same bank account as you used to pay your council taxes. This indicates that it won’t be taken out of your payment. It’s critical to keep in mind that council tax rebate monies are simply additional funds to help with family expenses; they are neither loans nor debts.

How to submit a council tax refund request for a person who is seriously mentally handicapped

If you suffer from serious mental disabilities, you can be eligible for a council tax cut or perhaps an exemption. This is applicable to those who have dementia, Alzheimer’s disease, or other serious mental illnesses. You must be at least 18 years old and have a permanent handicap that affects your ability to think critically and interact with others. Additionally, a medical certificate confirming your condition is required. Once you’ve satisfied these requirements, you can download the relevant form and receive your discount.

You should ask for a discount from the Royal Borough of Greenwich if you think you have a serious mental illness. You must be in compliance with the 1983 Naval, Military, or Air Force Service Pensions Order in order to receive a discount. You must also submit proof that you obtain specific benefits in addition to your doctor’s certification.

If you believe you are eligible, complete the appropriate application form and get in touch with the council tax division of your local government. You should be able to submit an application for a council tax rebate after being assessed.

Download Council Tax Rebate Form Kirklees 2025