Reimbursement Form Of Bajaj Allianz Health Insurance – It’s critical to comprehend your insurance plan when you get one. This kind of insurance policy offers a variety of insured quantities, riders, and daily cash allowance programs, among other advantages. You should pick an insurance policy that addresses your unique requirements and preferences.

Benefits of a diverse range of insurance amounts

The organization provides a range of products with different insured sums. Individuals and families have a choice of lifetime renewable insurance, individual and family floater policies, and other options. These insurance plans pay for hospital stays and other necessary medical costs. Additionally, some insurance plans also cover the price of dietary supplements and assistance tools. The policies also provide coverage for annual physicals. They also offer daily financial benefits for those who accompany an insured youngster. The insurance that is offered for organ donation is a second advantage.

The extensive network of cashless hospitals operated by Bajaj Allianz across India is another advantage of their health insurance plans. By doing this, policyholders can save money by not having to pay for services that aren’t necessary or covered by their main insurance. Additionally, there are no co-payment requirements in the health insurance plans offered by Bajaj Allianz, so you don’t have to worry about covering hospital expenses. Additionally, Bajaj Allianz provides clients in need of assistance with round-the-clock customer service.

advantages of a rider

With the Bajaj Allianz Health Insurance rider, you can choose the doctor who treats you for your medical needs. More than 90,000 doctors around the nation are available to you through this rider. Only current Bajaj Allianz health insurance clients are eligible for this rider.

Health insurance for people has been offered by the insurance provider Bajaj Allianz for many years. It provides a range of health insurance plans to accommodate people of all ages and income brackets. This business is renowned for its quick claim resolution and round-the-clock client service.

If you are given a critical illness diagnosis, a critical illness rider will pay you a lump payment. Most medical costs will be covered by this one-time payment. The accidental death benefit rider is another sort of rider that provides your family with a benefit in the event of your passing. When you require more coverage or want to make your policy more comprehensive, the advantages of these riders are frequently very beneficial.

advantages of a daily cash allowance program

Even if you are in the hospital, you can avoid paying out of pocket for medical expenses by enrolling in a daily cash allowance plan with Bajaj Allaanz Health Insurance. You must get in touch with the firm no later than 48 hours after being hospitalized or 48 hours before your scheduled admission to make a claim. By entering the number from your health ID card online, you can do this. An approval letter will be sent to you after your claim has been accepted.

Your daily cash benefits are provided by the Bajaj Allianz hospital cash daily allowance plan, which also offers fast claim settlement, income tax advantages on premiums, and lifetime renewal. The plan also offers a tempting family discount when you include a second or third insured family member. The long-term policy discount of 4% for two years and 8% for three years is another fantastic benefit.

advantages of a critical illness plan

Critical illness insurance policies are a terrific method to safeguard yourself from unforeseen costs and guarantee that you receive the best care available. The various plans provided by Bajaj Allianz Health Insurance are designed to meet the requirements of individual policyholders, families, and senior persons. For instance, the Women Specific Critical Illness Plan was created to assist women in protecting themselves from the financial burden of life-threatening illnesses, such as cancer. This plan also covers costs associated with schooling and job loss in addition to offering a lump sum reward to plan holders in the event of a serious illness.

Additionally, Bajaj Allianz Health Insurance provides the Criti-Care critical illness plan, which enables customers to tailor the coverage to suit their particular need. Organ transplantation, neuro-immune illness, cardiovascular and kidney treatment, and cancer are all covered under the plan. Additionally, it provides coverage for issues with the mind, including as anxiety and depression.

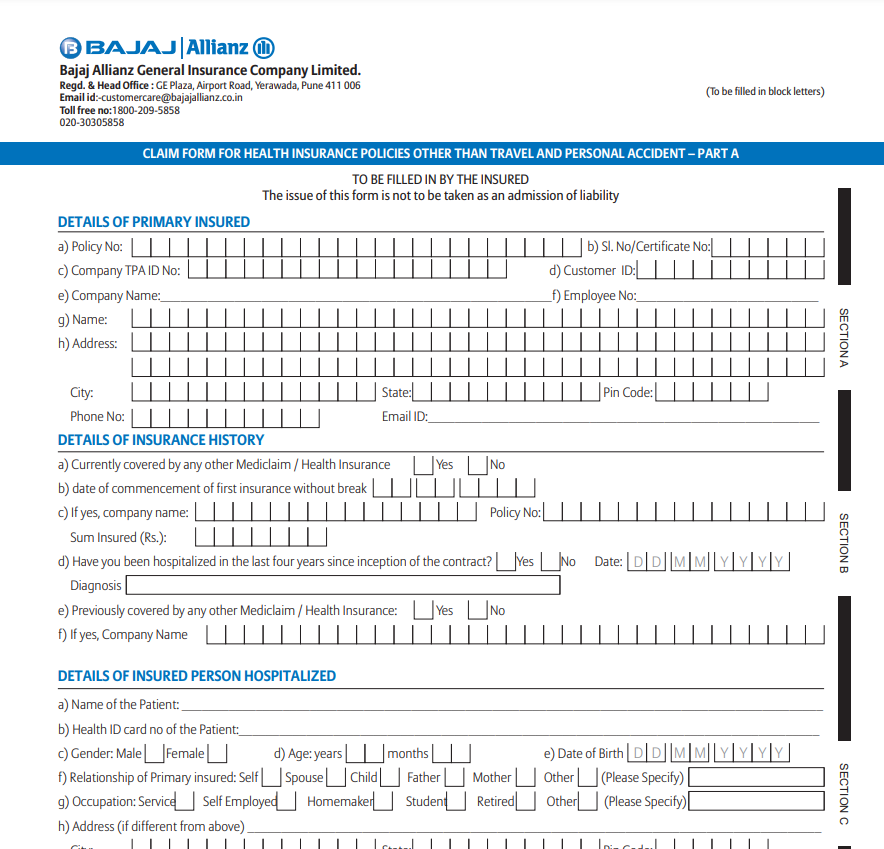

Download Reimbursement Form Of Bajaj Allianz Health Insurance 2024