Ontario New Housing Rebate Form 2025 – For owner-built homes, the Ontario New Housing Rebate Form 2025 offers refunds on the cost of building. The reimbursement is only available to those who fulfill a few requirements. They are covered in this article.

eligibility requirements

A tax credit known as the “new housing rebate” enables homeowners to recoup a portion of the cost of a property. It also permits a partial recovery of the HST paid by the federal government. There are several sorts of rebates. You must, however, adhere to specific requirements in order to qualify.

The essential requirement is that the dwelling serve as your place of abode. This implies that in order to be eligible for the refund, you must use it as your primary residence.

You can be qualified for many refund types, depending on your province. For instance, there are many rebate possibilities in Ontario. Similar to this, Nova Scotians who buy their first home inside the province are eligible for the Nova Scotia First-Time Home Buyers Rebate.

You might be wondering if you qualify for the new housing rebate if you are looking to buy a new house. Yes, it is the solution. If you buy a newly constructed home or a remodeled home that satisfies certain requirements, you may be eligible for the refund.

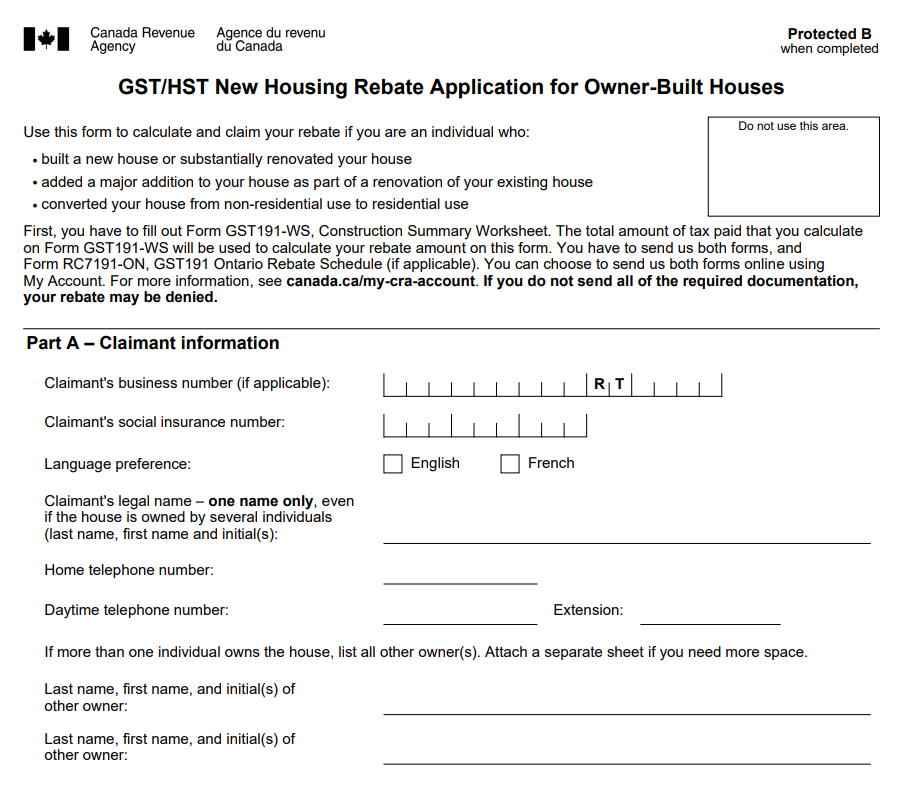

You must finish Form GST190 in order to be eligible for the new housing refund. Part A of the form contains a list of admissible building costs. You need to enter information from estimates and construction bills in the other section, the computation worksheet.

GST/HST refund for privately constructed homes

The new housing rebate program in Ontario gives prospective homeowners the chance to recover part of the money they spent on building, hiring professionals, and purchasing supplies. However, the reimbursement is only available to individuals who are eligible. You’ll need to be aware of a few things in order to apply for the reimbursement.

You must decide if the home is your principal residence, for instance. If so, you must maintain proof of occupation for a minimum of six years.

The amount of HST paid on the residence is another crucial consideration. This must be multiplied by 13.

The entire cost of the house is an additional consideration. Your payment to the builder and assignors is also included in this. There is a partial discount available for properties under $450,000.

Keep copies of your receipts, invoices, and construction spreadsheets as you get ready to submit your refund application. With this information, you may compute the rebateruction spreadsheets as you get ready to submit your refund application. With this information, you may compute the rebate. A full application and calculation worksheet must also be kept for a minimum of six years. Your reimbursement might be rejected if you don’t preserve these records.

You may start filling out your rebate as soon as you’ve decided whether your new house qualifies. You must complete and submit the necessary forms in order to file. The majority of paperwork may be submitted electronically, speeding up the procedure significantly.

Worksheet for calculating GST 190

You could qualify for a refund if you purchased a home in Ontario. This lives due to the particular that a portion of the HST’s federal component may be claimed. Form GST191 must be completed and submitted along with a GST/HST return for the reporting period in order to be eligible for the rebate. Applications for rebates come in five different varieties, and each has its own eligibility criteria. At a later time, you could also be required to show documentation of your occupancy.

By dividing the HST you paid on the home by its fair market value, you may determine the entire amount of the federal portion of the HST you had to pay for it. The land, the building, and any additional buildings are all included in this fair market value. You could also have to pay provincial land transfer taxes.

By completing Form GST191, a taxpayer can submit a claim for a refund. Builders or individuals can utilize the form. You must fulfill the requirements of the application before you can claim a refund, and each type of application has a different deadline for submitting.

Both owner-built homes and those acquired from a builder are eligible for the incentive. Only residences in Ontario are covered by it.

Download Ontario New Housing Rebate Form 2025