Get Carbon Tax Rebate when you pay taxes. This tax rebate is part of Climate Action Incentive Payment (CAIP). The Carbon Tax Rebate will now become a quarterly benefit. You will receive your Carbon Tax Rebate automatically four times per year if you are eligible, beginning in July 2024.

The Carbon Tax Rebate is an amount that is exempt from tax and used to offset the costs of federal pollution pricing for individuals and their families. It is available for residents of Alberta and Saskatchewan as well as Manitoba, Ontario, and Ontario. It includes a basic amount as well as a supplement for rural and small-sized residents.

Who is eligible to participate in the Carbon Tax Rebate?

You must be a resident in Alberta, Saskatchewan or Manitoba on the first and last days of each payment month to be eligible. These conditions must be met during the same time period.

- You must be 19 years old or older

- You are a spouse, common-law partner or have had one in the past

- You are or were a parent.

Are you a parent of an eligible child?

If all of the following conditions are met, you have an eligible child.

- Your child is less than 19 years old

- Your child lives with you

- You are the primary responsible for raising your child.

- Your child is eligible for Canada’s child benefit

A credit will be added to the Carbon Tax Rebate if you are eligible for Canada child benefits. Register your child for Canada child benefits if you haven’t done so. If you and your spouse share custody of your child/children (if you are entitled), you will be paid 50% of what you would receive if you had the child live with you full-time.

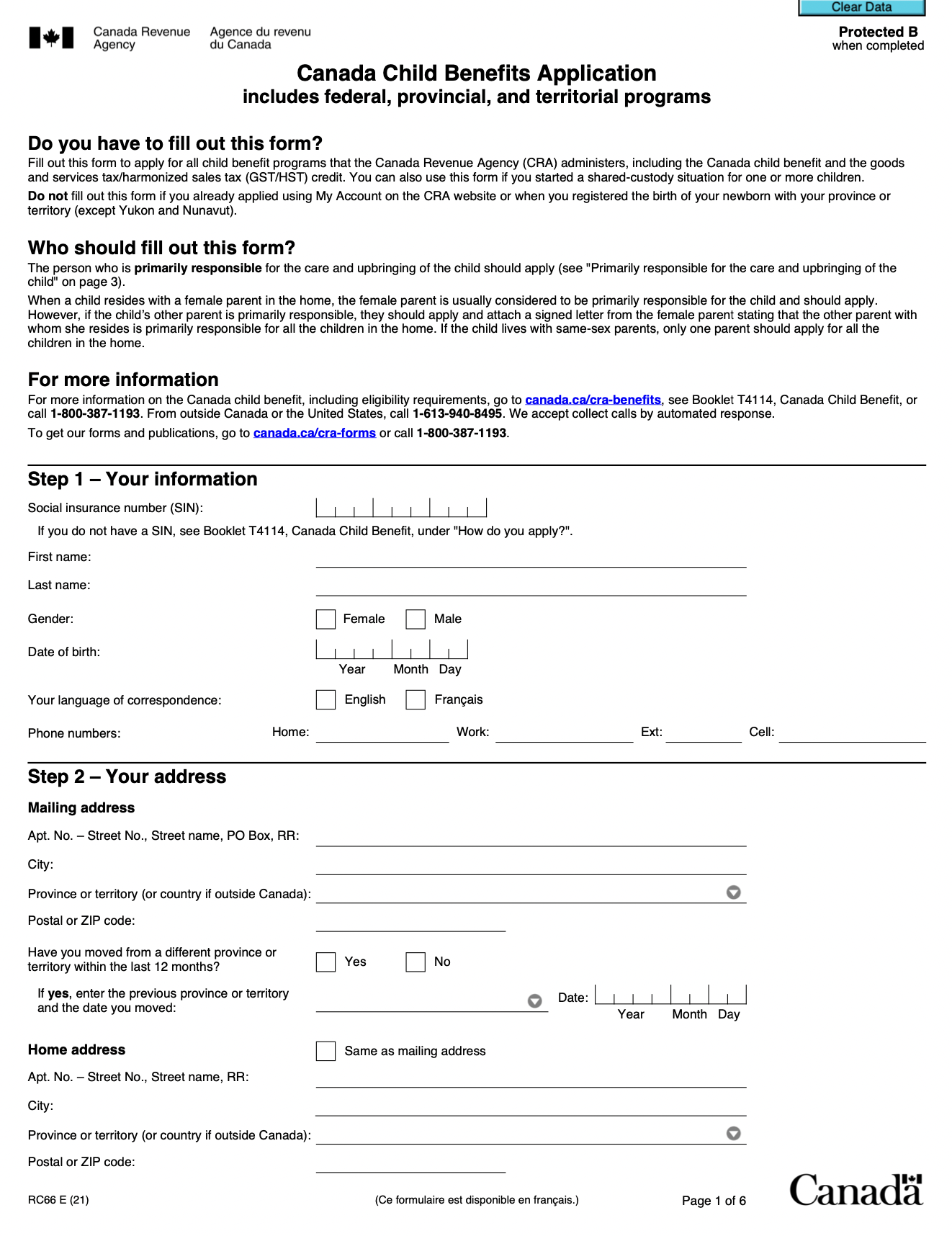

Download Carbon Tax Rebate Form