Maryland Renters Rebate 2024 – You could be eligible for a little-known tax credit that will help you cut your monthly rent if you reside in Maryland. The Maryland Renters Rebate is what it is called, and it can help you save money.

This program, modeled after the Homeowners Property Tax Credit, assists qualifying renters who pay high monthly rent in relation to their income.Every resident of Maryland who is 60 years of age or older, who is completely incapacitated, and who rents a home and has at least one dependent child is eligible.

What is Maryland Renters Rebate?

For tenants who satisfy specific criteria, the Maryland Renters Rebate program offers an income tax benefit. The Circuit Breaker Program, which is similar to the Homeowners’ Tax Credit Program in concept, differs in its qualifying conditions.

Renters should have some protection, just like homeowners do, because they indirectly pay property taxes as part of their monthly rent. According to acting agency director Owen Charles, the amount of rent paid, the renter’s income, and compliance with other particular program conditions are all taken into account when determining program participation.

Renters who are 60 years of age or older, who are completely incapacitated, or who dwell with a minor underneath the period of 18 are also eligible (click here for more information). The actual refund is determined by the renter’s monthly rent payment and income.

The executive director of Economic Action Maryland, Marceline White, expresses her hope that elderly tenants will utilize this little-known tax benefit that has been available for many years. She claims that it can help you save up to $1,000 per year for your household.

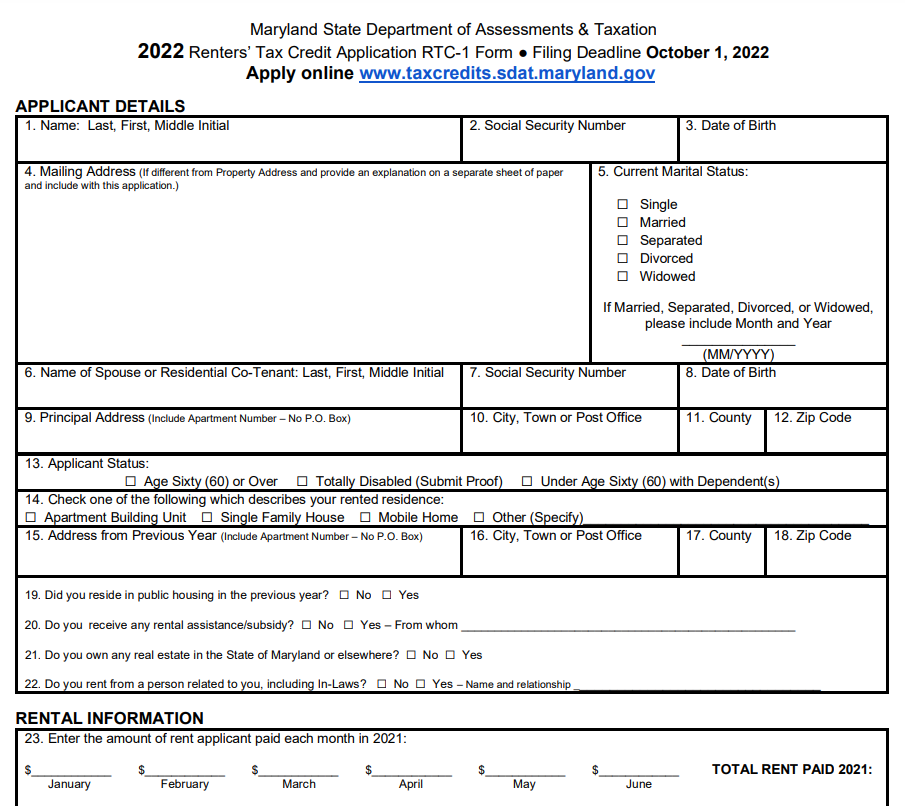

How to Get Maryland Renters Rebate

In Maryland, low-income renters who satisfy specific requirements can apply for a tenants’ rebate. It is a direct check payout from the state for up to $1,000 each year.

Additionally, it encourages elderly people to age in place and saves tax payers money by cutting down on the number of homes that need costly home repairs, which in turn lowers property taxes. Even though this program has been around for a while, many individuals are still somewhat confused by it.

You must stand 60 years of years or older (or completely incapacitated) and house at least one dependent child who is under the age of 18 in order to be eligible. You may submit an application online or print one off and mail it in.

You may quickly and easily find out if you qualify for this credit by completing the short application. Your monthly rent payment and your income will determine the precise refund you get.

A little-known tax benefit called the Maryland Renters Rebate can assist you in paying for home improvements like a new furnace or roof. It is worth checking into since it may help you save hundreds of dollars a year on property taxes.

How to Track Maryland Renters Rebate

The Maryland Renters Rebate is a direct payment from the state to Maryland residents, up to $1,000 a year, to assist with housing costs. It is open to those who are 60 years of age or older, completely disabled, or younger than 60 and have at least one dependent child residing in a leased home. Please see the Maryland Department of Assessments and Taxation website for further details on this program and to complete the application. We encourage qualified applicants to submit their applications as early as possible so they may obtain the most benefit from the program. This new tax credit application system improves the Department of Assessments and Taxation’s capacity to handle tax credits accurately and promptly.

Download Maryland Renters Rebate 2024