Michigan Tax Rebate 2024 – Michigan Tax Rebate 2024 is a program designed to offer financial assistance to eligible taxpayers in Michigan. You may be able to receive part of your hard-earned money back, which you can use for paying off bills, saving for the future, or spending on essential items.

Michigan Tax Rebate 2024 is a program designed to offer financial assistance to eligible taxpayers in Michigan. The purpose of the rebate is to give back some of your hard-earned money, so that you can pay off bills, save for the future or spend on necessities.

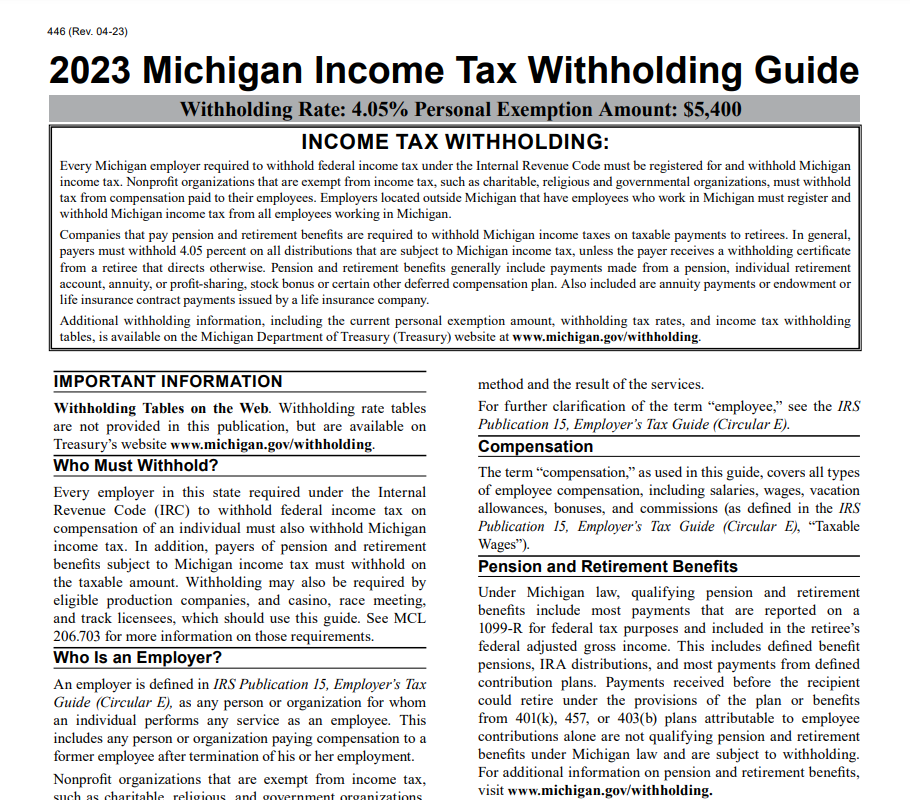

Eligibility for Michigan Tax Rebate 2024

To be eligible for the Michigan Tax Rebate 2024, you must meet certain criteria. These eligibility requirements include:

- Are You Eligible for Michigan Tax Rebates in 2024

- A resident of Michigan with a valid Social Security number

- Taxable income within the specified limit

- Filing a tax return for 2024

Types of Michigan Tax Rebates Available in 2024

Michigan 2024 offers various tax rebates, such as:

- Property Tax Rebate

- Homestead Property Tax Credit

- Michigan Earned Income Tax Credit

- Senior Citizens Property Tax Credit

Each type of tax rebate has its own eligibility criteria and benefits, making it essential to understand these different rebates and their conditions in order to maximize your benefit.

How to Claim Michigan Tax Rebate 2024

Claiming the Michigan Tax Rebate 2024 is a straightforward process. Here are all of the necessary steps:

- Assess if you qualify for the rebate by reviewing the eligibility criteria.

- Collect all necessary documentation, such as tax returns and any other relevant financial info.

- Complete and submit the Michigan Tax Rebate 2024 form to the Michigan Department of Treasury.

- Wait for the Department of Treasury to process your claim and issue you with your rebate.

- Deadlines for Michigan Tax Rebate 2024

The deadline to claim your Michigan Tax Rebate 2024 usually falls around mid-April of the following year. Be aware of this deadline in order to guarantee that you don’t miss out on receiving your rebate.

How to Prepare for Michigan Tax Rebate 2024

To prepare for the Michigan Tax Rebate of 2024, you can take these steps:

- Keep track of your taxable income and expenses throughout the year.

- Review eligibility criteria and types of rebates available to determine which ones you may qualify for.

- Gather all necessary documentation in one place, keeping it organized.

- After the deadline has passed, be sure to complete the Michigan Tax Rebate 2024 form as quickly as possible in order to expedite processing of your claim.

Conclusion

The Michigan Tax Rebate 2024 offers eligible taxpayers the chance to receive financial assistance. By understanding eligibility criteria, types of rebates available, and how to claim them efficiently, you can ensure maximum benefit from this opportunity. Don’t wait – start planning now to take advantage of this offer today.

It is essential to remember that the Michigan Tax Rebate 2024 program is dynamic and subject to change. To stay informed and compliant with their latest policies and guidelines, visit their website or reach out directly to their customer service center.

In addition to the Michigan Tax Rebate 2024, there are other tax credits and deductions available in Michigan that could reduce your taxable income and boost your refund. These include deductions for charitable contributions, education expenses, and medical costs. It’s always wise to consult a tax professional or use tax preparation software beforehand in order to maximize the benefit from all available credits and deductions.

In conclusion, the Michigan Tax Rebate 2024 offers eligible taxpayers a great opportunity to receive financial assistance and reduce their tax liability. By understanding eligibility criteria, types of rebates available, and how to claim them efficiently, you can ensure you maximize your benefit from this opportunity. So don’t wait – start planning now to maximize your money-saving potential and take advantage of this great chance.

Download Michigan Tax Rebate 2024