The Commercial and Industrial Program Manual explains the application process, eligibility requirements, and technical guidelines. The manual also includes program tools, forms, and technical guidelines. Read this document carefully before you apply for the Trep Rebate. Here are the essential steps to get started:

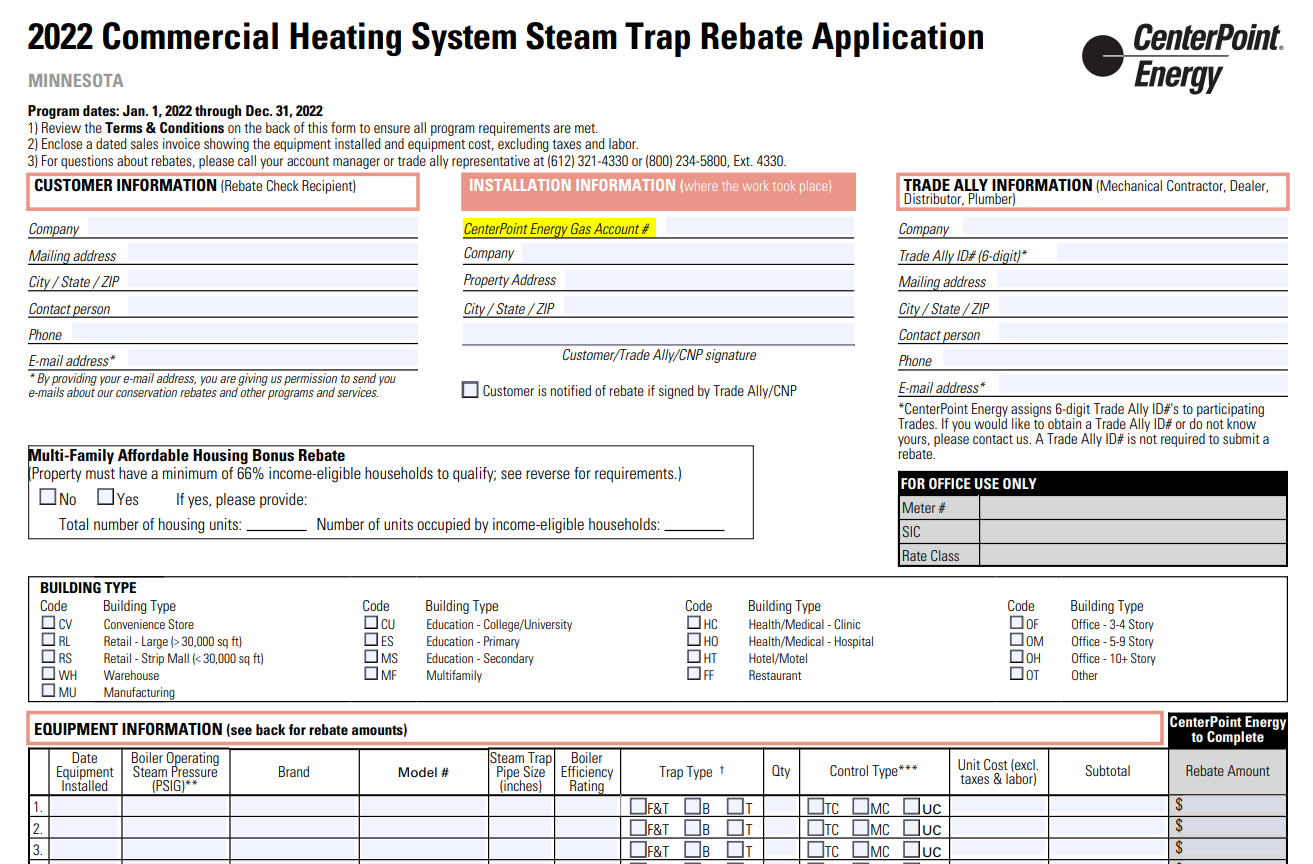

Application requirements

Before you apply for the Trep Rebate, make sure that your equipment meets the eligibility requirements. The Rebate applies only to new or upgraded equipment. You must purchase and install the qualifying items within one year of when you purchased them. You must also buy and install the equipment before you submit an application. The rebate period may vary depending on your equipment and the program. To learn more about the eligibility requirements, visit the Commercial and Industrial Program Manual.

Reporting requirements on IRS Form 1099

There are specific reporting requirements on IRS Form 1099 for Trep rebates. These include the amount that you must enter in box 2 and the qualified stated interest amount in box 8. You must also report deflation adjustment for the year if the security was issued by the U.S. Treasury. The total portion of your OID must be at least $10 daily. The amount of this payment must not be less than 1/4 of one percent of the stated redemption price at maturity.

In addition to reporting requirements on IRS Form 1099, the tax-exempt covered security must also be reported. This type of income is taxable, but the taxpayer must report the gross amount in box 11.

Download Trep Rebate Form 2024