Renters Rebate Vt – An application for Renters Rebate Vt is A form that requires you to provide specific information in order to secure the rental of your property. This Vermont Renters Rebate program is in the process of being changed and is expected to be changed in 2021. In the following article, we’ll review the requirements for eligibility, deadlines for applications, and other modifications. By using the form that comes from US Legal Forms You can swiftly and easily fill in the form. This software allows you to fill in the form quickly and submit the form electronically for legal reasons. Renters Rebate Vt.

Changes to Vermont’s Renters’ Tax Credit Program

The previous year the State of Vermont modified the tax credit for renters program dramatically. The changes took force for the 2021 tax year and will have an impact on the tax season. Even if you’re not legally required to file taxes on income in Vermont, however, you can submit a Renter Credit Claims. It is possible to file electronically via myVTax or tax software or ask to be provided with the paper forms.

The new rules would oblige states to allocate 75 percent of tax credits to renters on families with extremely low incomes. They are those who earn less than 150 percent of the federal poverty line. The remaining credits will be granted to families with incomes of between 60% and $150 percent below the poverty line. This would boost the value of the renters tax credit to families with lower incomes. However, it will oblige states to create a system to transfer the credit from one tenant to the next.

Eligibility For Renters Rebate Vt

This Renters Rebate Vermont program was before known as the renter credit. It required residents to reside in Vermont for the whole tax year or for six months consecutively. This credit is available even if you didn’t complete your income tax returns. The eligibility requirements for this credit are subject to change each year, and it is crucial to consult the Vermont Department of Taxes for the most up-to-date information.

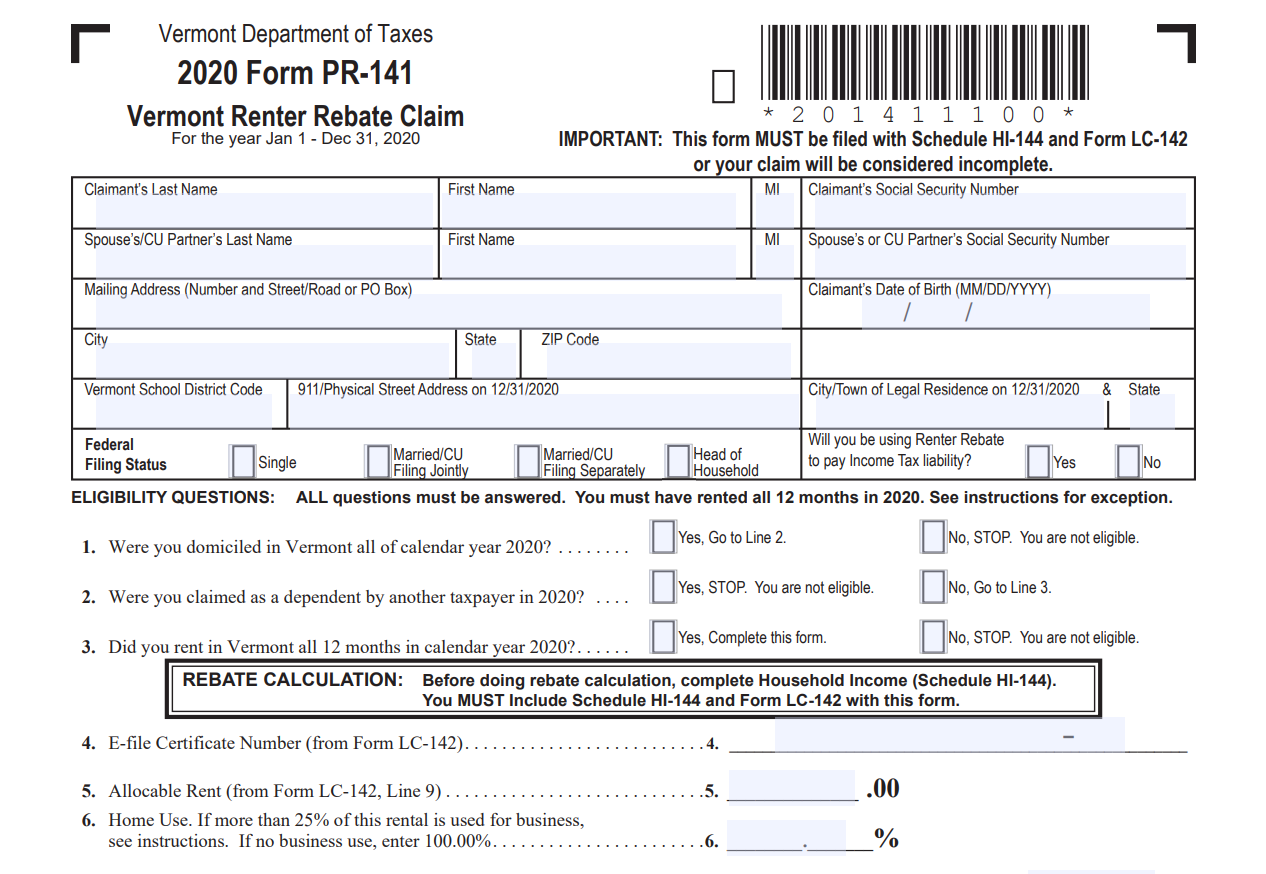

It is necessary to be a resident full-time of Vermont earning less than $47,000 annually and reside in Vermont for at least one calendar year in order to be eligible. For a claim for a renters rebate, complete an application form called PR-141. You must also provide an official landlord’s statement. Also, you must provide information about your family’s income on Schedule HI-144. This will assist the program to determine if you are eligible to receive this award.

Application deadlines

If you’re a resident of Vermont and earn less than $47,000 a year, You may be eligible to participate in the renters rebate program. You can claim as much as 2-5 percent of your prior rent payment. In order to be eligible, you have to reside in Vermont for the whole calendar year. If you’ve had an infection caused by coronavirus then you might not be qualified for the program since the resultant illness can’t be claimed as rent-paid.

The applicant must have at least one child under 18 years old earning less than $20,000 annually. In order to be eligible for the renters ‘ rebate program, renters must be at or above 60 and have at least one child less than 18. In the event that you are the parent of a child who is under 18 years old it is recommended to apply to the Renters Rebate Vermont. If you reside in a retirement facility and you are a resident, you could be eligible under the Renters Rebate Vermont program.

Changes in 2021

The U.S. Department of Housing and Urban Development has announced modifications for the Renters Rebate program for 2021. The law will establish an refundable tax credit for tenants with low income, equivalent to a proportion that is the sum of rent minus 30 percent of the household’s income. New law is expected to assign the credit amount in states to distribute to taxpayers. Additionally, the majority of tenants will not have to provide their landlord with a Landlord Certificate.

The renter’s credit (formerly called”renter rebate) is a tax credit that is available for rent paid by the landlord to an Vermont resident. To be eligible, you need to reside in Vermont throughout the tax year, and at minimum 6 consecutive months. Additionally, there is no requirement to prepare the income tax return in order to take advantage of the tax credit. The changes will affect the tax filing season in 2024. Renter credit for Vermont Vermont rental credit for renters is accessible electronically via tax software or directly within myVTax. If you prefer an actual paper form or a paper copy, you can ask for the form to be sent to you.

Download Renters Rebate Vt Form 2024