Low Income Rebate – Low income rebate programs have become a vital lifeline for many individuals and families facing financial constraints. In this article, we will explore the various facets of low income rebate, from its definition to the impact it has on local economies. Let’s dive into the world of financial assistance, uncovering the benefits, challenges, and success stories that define this crucial aspect of social support.

Definition of Low Income Rebate

Low income rebate refers to financial assistance programs designed to provide relief to individuals or families with limited financial resources. These programs aim to alleviate the financial burden by offering rebates or credits on essential expenses.

Importance of Low Income Rebate

The importance of low income rebate extends beyond individual financial relief. It plays a key role in stimulating economic growth, fostering social well-being, and creating a safety net for vulnerable populations.

Understanding Low Income Rebate Programs

Eligibility Criteria

To qualify for low income rebate programs, individuals typically need to meet specific eligibility criteria, such as income thresholds and household size. Understanding these criteria is crucial for those seeking financial assistance.

Types of Expenses Covered

Low income rebate programs often cover a range of expenses, including housing, utilities, healthcare, and education. Knowing which expenses are eligible for rebates can help individuals make informed decisions regarding their financial needs.

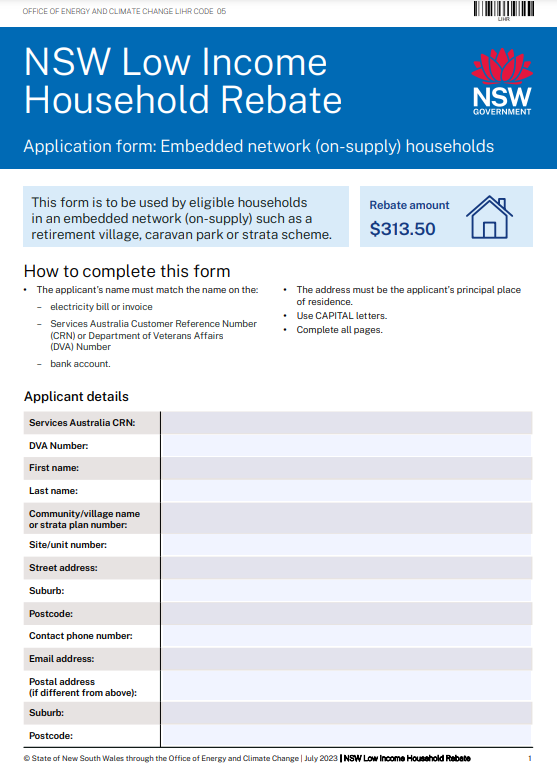

Application Process

Navigating the application process is a critical step in accessing low income rebate benefits. This section will provide a step-by-step guide, highlighting common pitfalls to avoid during the application process.

Benefits of Low Income Rebate

Financial Relief for Individuals and Families

The primary benefit of low income rebate is evident in the financial relief it provides. By reducing the economic strain on individuals and families, these programs contribute to overall well-being.

Stimulating Economic Growth

Beyond individual benefits, low income rebate programs play a role in stimulating local economies. Increased spending power in communities can have a positive ripple effect on businesses and services.

Social Impact

Low income rebate programs contribute to social welfare by addressing inequalities and promoting inclusivity. This section will delve into the broader impact on community well-being.

Challenges and Criticisms

Limited Funding

One of the challenges facing low income rebate programs is limited funding. As demand for financial assistance rises, securing adequate funding becomes a critical issue.

Administrative Challenges

Administrative hurdles can hinder the efficient implementation of rebate programs. Addressing these challenges is essential for ensuring that assistance reaches those who need it most.

Perceived Inequities

Critics often point to perceived inequities in the distribution of rebates. Examining these concerns and potential solutions is crucial for creating fair and accessible programs.

Success Stories

Real-life Examples

Highlighting real-life success stories provides a human perspective on the impact of low income rebate programs. Personal narratives showcase the positive outcomes and transformative effects on individuals and communities.

Positive Impact on Communities

Beyond individual success stories, low income rebate programs can have a positive impact on the broader community. This section will explore how financial relief contributes to community development.

How to Apply for Low Income Rebate

Step-by-step Guide

This detailed guide will walk readers through the application process, offering practical tips to streamline their experience. A well-informed application process increases the likelihood of success.

Common Mistakes to Avoid

Understanding common mistakes during the application process is essential. This section will provide insights into pitfalls to avoid, ensuring a smoother application experience.

Impact on Local Economies

Case Studies

Examining specific case studies will shed light on the tangible impact of low income rebate programs on local economies. These studies will showcase success stories and areas for improvement.

Long-term Effects

Understanding the long-term effects of financial assistance on local economies is crucial for policymakers and advocates. This section will explore the lasting impact of rebate programs.

Future Prospects and Policy Changes

Trends in Low Income Rebate Programs

Analyzing current trends in low income rebate programs can provide insights into future prospects. This section will explore evolving policies and potential changes on the horizon.

Potential Improvements

Identifying areas for improvement is essential for the continued effectiveness of rebate programs. This section will discuss potential enhancements and innovations in low income rebate policies.

Public Perception and Awareness

Importance of Education

Educating the public about low income rebate programs is crucial for dispelling misconceptions and fostering support. This section will explore the role of education in shaping public perception.

Addressing Misconceptions

Examining common misconceptions surrounding low income rebate programs and providing accurate information is essential for building trust and support.

Legislative Support

Government Initiatives

Exploring current government initiatives supporting low income rebate programs highlights the importance of legislative backing. This section will showcase the role of policymakers in creating a robust support system.

Advocacy Efforts

The efforts of advocacy groups and organizations in promoting and expanding low income rebate programs will be highlighted, emphasizing the collective push for positive change.

Comparisons with Other Social Assistance Programs

Contrasts with Welfare Programs

Drawing comparisons between low income rebate programs and traditional welfare programs will provide insights into their unique features and respective benefits.

Unique Features of Low Income Rebate

This section will delve into the distinctive features that set low income rebate programs apart from other social assistance initiatives.

Navigating the Tax Implications

Impact on Tax Returns

Understanding the implications of low income rebate on tax returns is crucial for recipients. This section will provide insights into potential tax benefits and reporting requirements.

Reporting Requirements

Highlighting reporting requirements ensures that individuals receiving rebates are aware of their responsibilities, fostering transparency and compliance.

Analyzing the Economic Data

Statistical Insights

Examining economic data related to low income rebate programs will provide a data-driven perspective on their impact. Statistical insights will contribute to a comprehensive understanding of the program’s effectiveness.

Trends Over the Years

Tracking trends over the years will offer valuable insights into the evolution of low income rebate programs, helping to identify areas of improvement and success.

Community Engagement and Collaboration

Involvement of Nonprofit Organizations

Exploring the role of nonprofit organizations in supporting low income rebate programs emphasizes the importance of community engagement. Collaborative efforts can enhance the effectiveness of these programs.

Corporate Social Responsibility

Highlighting corporate social responsibility initiatives related to low income rebate programs underscores the broader community impact and encourages businesses to contribute to social welfare.

Conclusion

Summarizing the Key Points

In conclusion, low income rebate programs play a crucial role in providing financial relief, stimulating economic growth, and fostering social well-being. The multifaceted impact on individuals and communities highlights the significance of continued support and improvement.

Encouragement for Further Research and Understanding

Encouraging further research and understanding is essential for policymakers, advocates, and the public. Continued efforts to refine and expand low income rebate programs can lead to a more inclusive and supportive society.