Alabama Tax Rebate 2024 – Tax Rebate is a program offered by the state of Alabama to promote economic development by offering tax incentives to individuals and businesses alike. It seeks to attract new businesses into the area, retain existing ones, and foster job creation.

Tax incentives: Essential Aid for Economic Development

Tax incentives are an invaluable tool for encouraging economic growth and development. Not only do they stimulate investment, create jobs, and boost tax revenue for the state of Alabama, but they also attract new businesses and motivate existing ones to expand, leading to a thriving economy.

What is Alabama Tax Rebate?

Eligibility Criteria for Individuals and Businesses

A. Establishes eligibility criteria for both individuals and businesses alike.

Alabama Tax Rebate eligibility requires individuals and businesses to complete specific criteria, such as living located in Alabama, creating new jobs or investing in eligible projects. The eligibility requirements vary depending on the type of tax incentive being offered.

B. Tax credits and incentives provided by the state

Alabama provides a range of tax credits and incentives to promote economic development, such as:

- Job Creation Tax Credit: Provides a credit of up to $1,250 for each new job created

- Investment Credit: Assigns a tax credit of up to 1.5% on eligible investment in qualified projects.

- Small Business and Agribusiness Jobs Act: Provides tax incentives for small businesses and agribusinesses that create jobs or make capital investments, while New

- Markets Tax Credit provides tax credits to investors in low-income communities.

- Alabama Jobs Act: Provides tax credits to companies that create 50 new jobs and invest a minimum of $2 million into the state.

C. Calculating Tax Rebudge Amount Calculations

The amount of the tax rebate depends on the type of incentive and eligibility criteria. For instance, the Job Creation Tax Credit provides up to $1,250 per new job created while the Investment Credit offers a credit of up to 1.5% of eligible investment in qualified projects. Businesses should consult with a tax professional in order to determine their eligibility and calculate the rebate amount accordingly.

How to apply for Alabama Tax Rebate in 2024?

A. Gathering Required Documents and Information

Businesses and individuals interested in applying for Alabama Tax Rebate must gather certain documents and information, such as tax returns, financial statements, and employment records. It is essential to thoroughly review each tax incentive’s eligibility criteria before submitting your application; make sure all required documents and details are included.

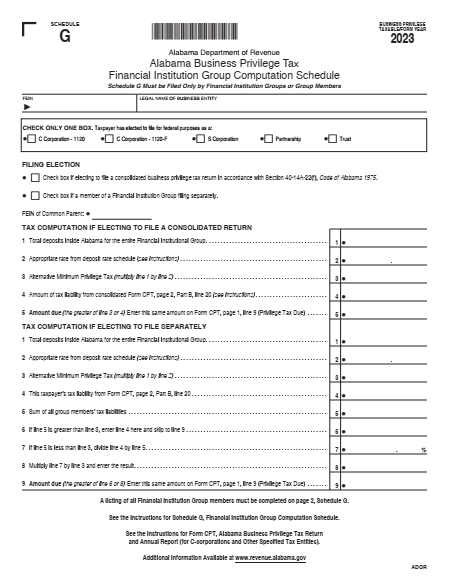

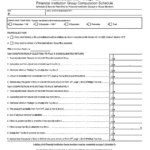

B. Filling Out the Tax Rebate Application Form

The tax rebate application form can be obtained from the Alabama Department of Revenue or online. Ensure that all information provided on the form is accurate and complete, along with any necessary attachments or supporting documentation. Once submitted, please ensure any required approvals have been granted.

C. Submitting the application and maintaining contact

Once your application is complete, submit it to the Alabama Department of Revenue. Be sure to keep a copy of both your completed application and any supporting documentation for your records. Businesses and individuals should follow up with the Department of Revenue to confirm their submission has been received and to inquire about its status.

Tips for Achieving Maximum Alabama Tax Rebate Benefits for Your Business

A. Acquaint yourself with the various tax deductions that may be available to you

Businesses should carefully assess the various tax incentives available and determine which ones they qualify for. It is essential to comprehend the eligibility criteria, rebate amount, as well as any other conditions or limitations.

B. Keeping Track of Eligible Expenses and Deductions

To maximize your tax rebate, it is essential to keep track of eligible expenses and deductions. This could include costs related to new job creation, capital investments, or other eligible projects. Accurate records are essential in guaranteeing all eligible costs are claimed.

C. Reaching Out to a Tax Professional

Companies should confer with a tax professional to maximize the use of available incentives and rebates. A tax specialist can assist in determining eligibility, calculating rebate amounts, and making sure all necessary documentation and information is included in the application.

Conclusion

A. Recap of Key Points in Alabama

Tax Rebate is a program offered by the state of Alabama to promote economic development by offering tax incentives to individuals and businesses alike. It offers various tax credits and incentives such as Job Creation Tax Credit, Investment Credit, and New Markets Tax Credit. In order to apply for Alabama Tax Rebate assistance, businesses and individuals must meet eligibility criteria and submit an application in full to the Alabama Department of Revenue.

B. Importance of Utilizing Tax Incentives<extra_id_-2> Tax incentives provide significant financial advantages that should not be overlooked, so it’s important to take advantage of them whenever possible.

Tax incentives can help businesses save money on taxes, create jobs and invest in their communities. By offering incentives to businesses in Alabama, the state of Alabama hopes to attract new ventures, retain existing ones and promote economic development.

C. Inspiring You to Apply for Alabama

Tax Rebate If you are a business owner or individual in Alabama, we urge you to explore the tax incentives available and apply for Alabama Tax Rebate. By doing so, you can help fuel growth in your business, create jobs, and contribute to the economic development of your community.

Download Alabama Tax Rebate 2024