Christchurch City Rates Rebate – The Christchurch City Rates Rebate can be a chance for ratepayers to receive some money back. What you get from the refund is dependent on the situation. The evaluations are conducted every three years, and penalty fees are assessed on a case-by case basis. If you want to apply for an assessment, complete your application form and submit it to the council before the 30th of June. The process for applying takes approximately 10 minutes and is available on the internet.

The evaluations are conducted every three years.

The revaluation of the value of property is conducted at least every 3 years Christchurch. Alongside the value of the property the rates are also determined by the usage by the owner of the house. The values are determined by Option an independent appraiser that is a professional both on an annual and a long-term basis. Christchurch City Council expects to conduct the next revaluation in March 2014 or sooner. If you’re wondering what valuation means, keep reading.

Revaluations are mandatory for all municipalities in New Zealand, including Christchurch City. The revaluation represents market values at a particular moment in time. In contrast to market values councils have the power to decide whether or not to implement this Order in Council. Christchurch City Council may decide not to apply this Order in Council or opt not to implement it. In any event, the new value will serve as the basis for determining rates starting on July 1, 2020.

The average rise of all properties with a rateable value was 49% the last time the most notable increase was for lifestyle blocks, which gained the most. Commercial properties however were up by 30%, and industrial properties saw an improvement of 70% percent. The percentages are different from suburb to suburb like the prices. A map that is interactive shows average price increases for each suburb and a discussion of trends in the region. The map also provides details about each property.

The refund of penalties is handled on a case-by-case basis.

The Department of Internal Affairs has created an Regulatory Impact Statement. It is the most important document that explains rates and the policies of Christchurch. It also clarifies the penalties will be dealt with on a case-by-case basis. Furthermore, it is possible to receive an amount back if your rate is in arrears. The Department will look into the matter on a case-by-case basis.

Act is a modification of the Rating Act is a change to the Rating Act which must be in effect by the 1st of July 2012. This Order is not apprehensive to allow retrospective taxation. Therefore, the Council can decide whether or not to apply it in specific situations. The Order also outlines the goals of the scheme. This will make it easier for the public to understand why the demand was made and whether it’s the right decision to pursue it. Should the Council decides to not apply to the order, they will explain the reasons for the decision.

The Council will have to take into consideration the impacts on property owners from the earthquake, as well as the impact on ratepayers. Ratepayers are advised to consult an expert property attorney prior to making any modifications. The Christchurch The City Council’s Annual Plan 2011 includes the plan, which was rejected in the Land Valuation Tribunal. The Department, however, has modified the plan to include the views of LINZ regarding the matter.

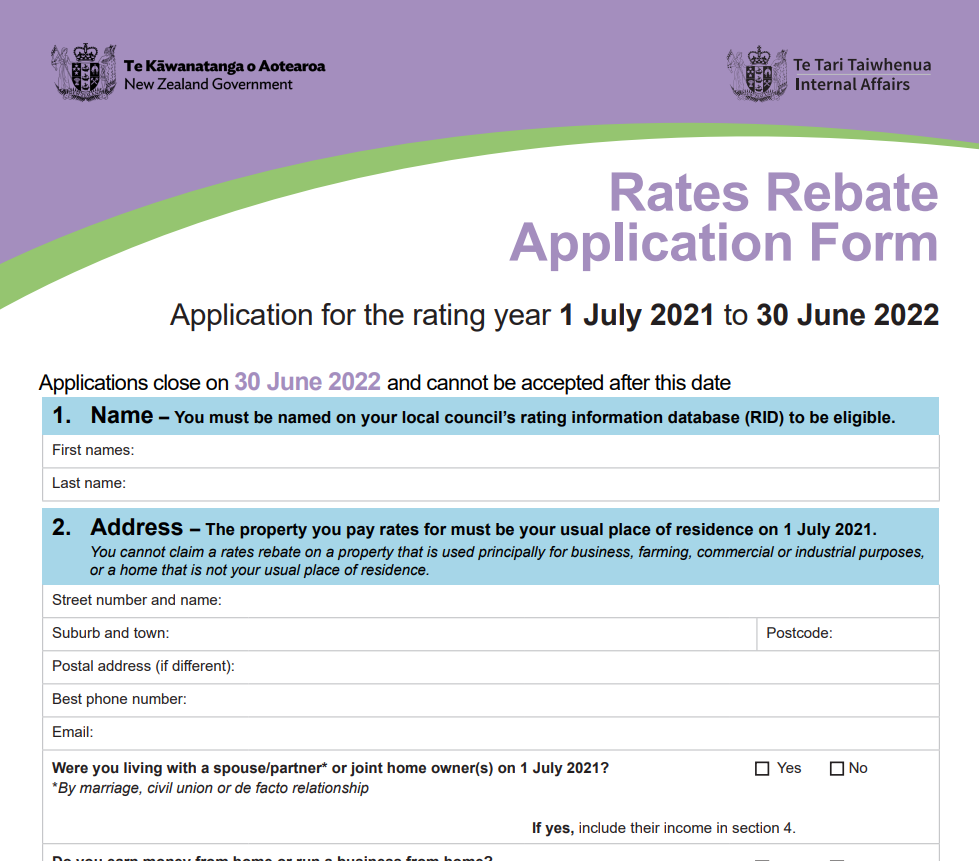

Application guidelines for the Christchurch City Rates Rebate

The guidelines to apply for the Christchurch City Rate s Rebate are designed to facilitate the process for homeowners with low incomes. If you have to pay rates for an unaffordable property and you have an income that is low for your household then you could be qualified to receive an amount of rebate. The maximum amount of subsidy available to an applicant is $655 and the threshold for income is $26,150. The amount of rebate is based on your income level as well as your number of dependents who reside in your house. If you’re one person with a spouse, the additional $500 per person is generally enough to qualify for an amount of rebate.

You may apply for a rebate when you have received your rate bills in July. The government will then send the applicant a form which you need to complete and submit to the council by the end of June. If you’re unsure of your income You can consult this Department of Internal Affairs’ rebate calculator. Contact the office of the council directly or make use of a rate calculator available on the Department of Internal Affairs website.

Download Christchurch City Rates Rebate Form 2024