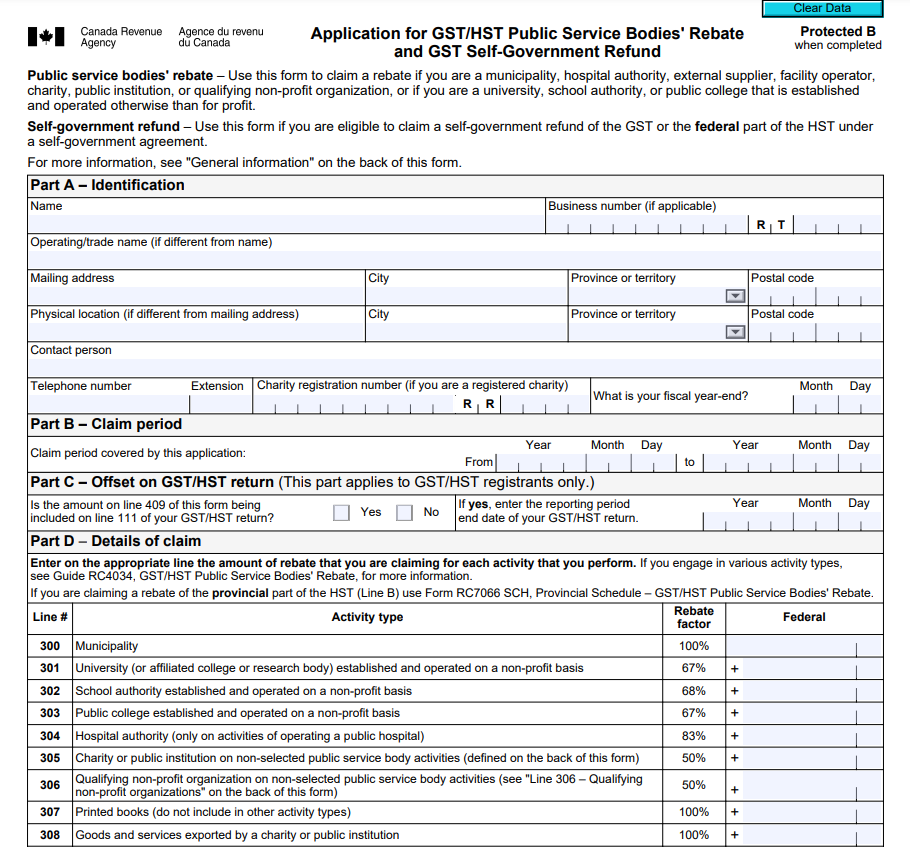

GST Rebate Form For Charities – You might be able to submit a GST/HST rebate claim for some of the costs you pay when operating a church. The government permits you to deduct a specific proportion of the taxes you pay, but you must be very cautious to save all original receipts and records. To file a claim, you have six years, although you can submit two claims in a calendar year.

Supplies made between branches are exempt from GST/HST.

A consumption tax known as GST/HST is assessed on both goods and services. A product’s value addition at each stage of manufacture, distribution, and sale is considered. On supplies between branches of a single organization, however, GST is not charged.

But there are some exceptions. For instance, the sale of medical supplies is GST-free. Medical equipment, educational services, and domestic financial services are exempt from this tax. Similarly, GST is not applied to purchases conducted between a government agency and a non-governmental entity.

Financial services are additionally typically exempt from GST/HST. Financial service providers are not permitted to claim input tax credits for the materials they use to provide the services.

Supplies made between divisions of a single legal organization are exempt.

You might be able to receive a GST rebate on supplies if you’re a NPO or charity. As much as 83% of the total GST paid may be refunded. You might even be able to get a refund on materials bought between divisions of the same legal company in specific circumstances.

A charity may qualify as a small supplier if it satisfies both the $250,000 gross revenue requirement and the $50,000 taxable supply standard. Even though it’s crucial to keep in mind that a charity might surpass these limits, it will still be regarded as a small provider.

The sale of lottery tickets is exempt.

The GST rebate for charitable purposes occasionally does not apply to the sale of lottery tickets. For instance, because the earnings are seen as input taxed sales, a charity that sells raffle tickets to support a nearby homeless shelter will not be qualified to receive a GST rebate. A charity that offers lottery tickets for sale at its door is another such. Because the home lottery is a distinct event from the fundraiser dinner in this instance, the sale of lottery tickets does not meet the criteria for an input taxable sale.

Rent is not included in this.

A GST refund form for charity is a terrific way to get a tax discount on large purchases and construction projects if you are running a nonprofit organization. Don’t worry if you’re unsure whether your company is eligible for the program. If you don’t rent out your space, you can still be eligible. To qualify for the rebate, you must only be listed as a charity.

You are qualified for the provincial HST rebate through the PSB if you are a Canadian charity with a registered status. Your charity must generate at least $250,000 in gross sales each fiscal year or $50,000 in taxable supplies over the previous four quarters in order to qualify.

Donations are not included in this.

For gifts made to charities, GST rebates are available. Donations, however, vary from gifts in that they are not tax deductible. A gift is a willing transfer of money or property made without the donor expecting anything in return. A donation with no monetary value might not be taxed, but if it comes with higher-value goods or services, the donation will be subject to GST.

To qualify for the GST rebate, a charity must fulfill specific requirements. It has to be a charity with a charitable status, an amateur sports group with a charitable status, or a registered charity. An official donation receipt must be provided by the organization for tax purposes. The guidelines for charitable groups to apply for this reimbursement are laid out in a government publication.

Download GST Rebate Form For Charities 2024