Hawaii Tax Rebate 2024 – The Hawaii Tax Rebate 2024 is a financial incentive designed to help eligible taxpayers save money on their state taxes. This manual will deliver a complete overview of the tax benefits available in Hawaii, including the eligibility criteria and how to claim your tax rebate. By understanding these key aspects, you can unlock your financial savings and maximize your tax benefits.

Eligibility Criteria for Hawaii Tax Rebate

To be eligible for the Hawaii Tax Rebate, you must meet certain criteria, such as being a resident of Hawaii, having a valid Social Security Number, and meeting specific income thresholds. Additionally, some tax credits may have additional eligibility requirements.

Tax Credits and Benefits in Hawaii

Several tax credits and benefits are available for eligible taxpayers in Hawaii. Some of the most popular ones include:

- Energy Efficiency Tax Credit This tax credit incentivizes homeowners and businesses to invest in energy-efficient appliances, equipment, and renovations. Qualifying purchases and improvements may be eligible for a credit of up to 35% of the cost.

- Low-Income Household Renters’ Credit Low-income renters in Hawaii may allow for a tax credit of up to $50 per exemption if their household income falls below certain thresholds.

- Child and Dependent Care Expenses Credit Taxpayers who incur expenses for child or dependent care while working or looking for work may be eligible for this tax credit. The credit is a percentage of the allowable federal credit, ranging from 25% to 50% based on adjusted gross income.

How to Claim Your Hawaii Tax Rebate

- Claiming your Hawaii tax rebate involves a step-by-step process to ensure you receive the maximum benefits available:

- Gather Required Documents Collect documents such as your W-2s, 1099s, receipts for eligible expenses, and any other supporting documentation.

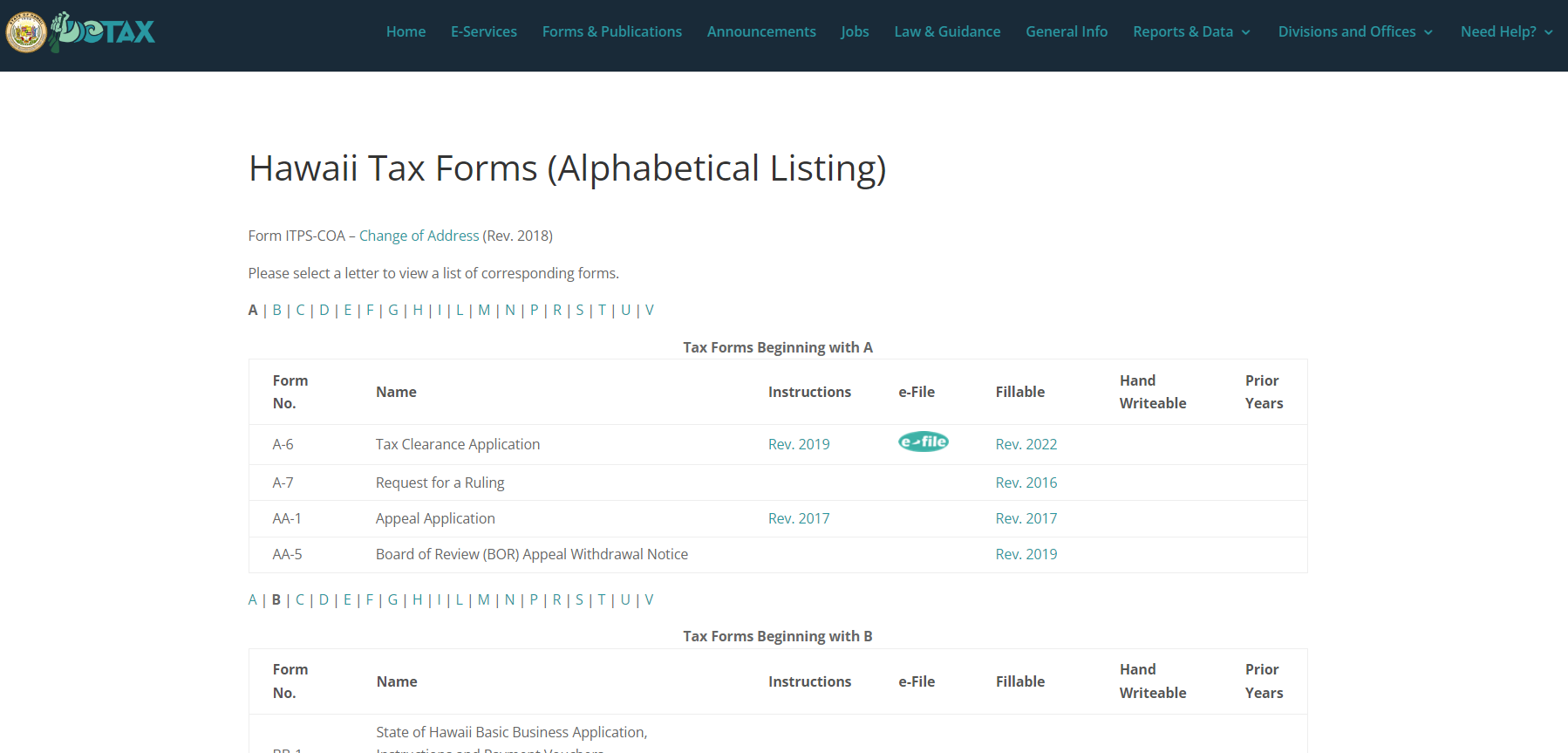

- Complete the Appropriate Tax Forms Fill out the necessary Hawaii state tax forms, including Form N-11 or Form N-15 for individual income tax, and any additional forms or schedules specific to the tax credits you’re claiming.

- Submit Your Tax Forms and Documents Submit your completed tax forms and supporting documents to the Hawaii Department of Taxation either by mail or electronically through their online filing system.

- Track Your Tax Rebate Status After submitting your tax forms, you can track the status of your tax rebate through the Hawaii Department of Taxation’s website or by contacting them directly.

Conclusion

Understanding and claiming the Hawaii Tax Rebate 2024 can lead to significant financial savings. By familiarizing yourself with the eligibility criteria, various tax credits, and following the step-by-step process to claim your rebate, you can ensure you’re maximizing your tax benefits. Stay informed and take advantage of the tax savings opportunities available to you in Hawaii.

Download Hawaii Tax Rebate 2024