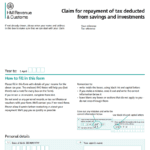

HMRC Tax Rebate Form – HMRC issues checks to the taxpayer as payment for tax rebates. These checks cover the entire amount of taxes you owe. You may still claim even if you cease working in the middle of the tax year. Within 45 days of obtaining your P800 form from HMRC, you can submit a claim online.

You receive a check from HMRC for the full amount you are owed.

The procedure will be explained to you by your HMRC advisor, who will also inform you of the papers you must submit. The majority of people have their refunds automatically deducted from their earnings or pensions, however if you are receiving a pension or have a lesser income, you might need to submit a direct claim.

You are entitled to a tax refund if you have previously overpaid taxes. You must, however, make the payment within four years after the day you overpaid. To demonstrate that you overpaid, you will require a Statement of Liability from the Revenue.

Within three to five business days, you will get your HMRC tax rebate check in the mail. This period is shortened to three days for payments received using direct debit or bacs. However, for payments made on account, the due date can coincide with a weekend or a holiday.

You might be entitled to a tax refund if, among other things, your employment status changes or you relocate inside the UK. To be eligible for the refund, you must present a P45 or starter checklist to the HR department at your new position. Additionally, the HR team can speak with HMRC on your behalf.

Another frequent tax rebate claim is underpayment of tax. If you underpaid your tax, you had to pay the difference. Your tax credits may be reduced by unpaid taxes, so HMRC gives you a check for the full amount listed on your HMRC tax rebate form. You can even have to pay fines or interest if you owe more money than you should.

When you receive your P800, you have 45 days to submit an online claim.

If you match the criteria, you can submit a claim for a tax refund online in the UK. Typically, you have 45 days from the date you receive your HMRC tax rebate form to do this. However, you should speak with an accountant if your situation is complicated. Within six to seven weeks of receiving your claim, you ought to receive a check in the mail if it has been granted.

Once you obtain your HMRC tax rebate form, you must accurately complete it. You will be required to offer some details on your identity and your company. You have the option to include specifics about your spending. You may submit a claim for one or more tax years. You should be aware that you can only backdate your claim for a maximum of four years, though. This implies that you can apply your tax rebate to the year in which you paid more tax than the subsequent year if you did.

You might choose to contact HMRC to file a complaint if your tax return contains an error. You can submit a claim using VAT method 2 if the error is minor. The sole limitation is that you are not permitted to make the same adjustment on a subsequent VAT return. If not, you should speak with the VAT helpdesk to further discuss the situation. To seek guidance on your specific situation, you can also get in touch with your neighborhood HMRC office.

If you work from home, you are eligible to file a tax relief claim for those days. The amount of tax relief you get from the government will depend on how much of your expenses you actually paid compared to how much you actually received. You can’t make a claim for any job you undertake outside of regular working hours because this relief is only eligible on the days when you truly work from home.

If you cease working halfway through the tax year, you can file a claim.

You are eligible to receive a refund from HMRC if you leave your job in the UK midway through the tax year. This reimbursement, which is given to you throughout the tax year, is referred to as a “in-year tax repayment.” To make this claim, you are not need to submit a P45 form or another tax return, but HMRC will frequently ask you to do so.

There are more grounds for which you might be qualified to get a PAYE refund. Because you held numerous part-time jobs over a given year, for instance, you might have had unused personal allowance. You may have overpaid your taxes in the prior tax year, which is another possible explanation.

You can use form P50 to get a reimbursement from HMRC if you are unemployed for longer than four weeks. You must, however, be able to demonstrate that you were unemployed for a minimum of four weeks prior to the end of the tax year. Try contacting HMRC’s online tax checker if you’re unsure.

Download HMRC Tax Rebate Form 2024