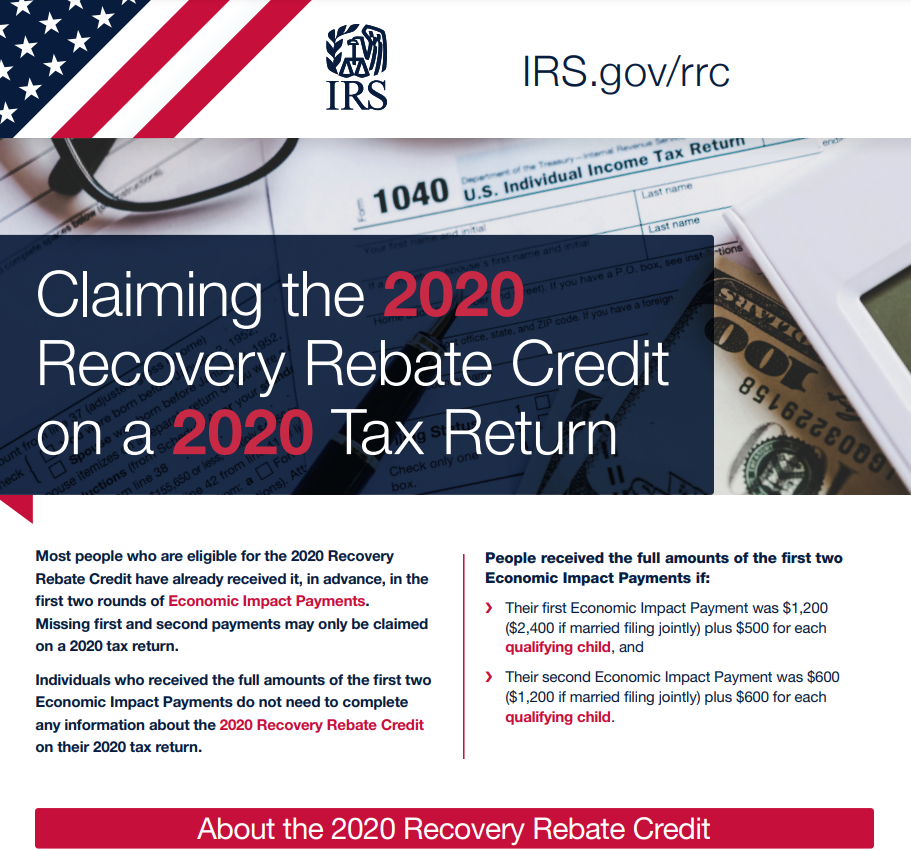

How Do I Apply For The Recovery Rebate Credit – You’ve come to the right place if you want to learn more about the Recovery Rebate Credit. You can learn more about what you can claim, how to apply, and other things here. Also available is more information about the prerequisites. However, you must confirm your eligibility before beginning.

Unqualified claimants

The Recovery Rebate credit program was designed to provide recipients of stimulus payments with additional funds. Not everyone who received a stimulus check, though, is qualified to use it. People who did not get a stimulus check should get in touch with their tax agency to see if they qualify for the credit.

You need to be employed in order to qualify for the credit. For instance, you would not be qualified to get the Recovery Rebate credit if you worked as a nurse in the healthcare sector. You might be qualified for the credit if you provided home health care and worked in the medical field.

The PEUC, a government program that extends regular unemployment benefits, may also be available to those who are qualified for the Recovery Rebate credit. This program is intended to assist those who are unable to work and have used up all of their usual state benefits. There is a phaseout time for this program’s eligibility, though. Before the program expires, claimants have up to six more months to continue receiving the credit.

Unallowable sum

Check to discover if you qualify for the Recovery Rebate Credit if you intend to file your next tax return. The credit is available for a variety of justifications. You can claim the credit for the child, for instance, if the child is under 16 and not using Medicaid.

To eligible taxpayers who did not receive economic impact payments, the Recovery Rebate Credit is paid in advance (EIPs). You must have altered your marital status or claimed a new dependent in 2021 because the credit’s value is based on your most recent return.

The credit is not available to people who have already received their full stimulus payments. To be qualified for the honour, you must include a Social Security number by the 2021 tax filing date. Additionally, you must have a physical notification outlining the entire amount distributed as well as an IRS account.

Requirements

When you submit your taxes, you can claim a tax benefit called the Recovery Rebate Credit. For those who did not receive the entire amount of stimulus cash, this credit may be helpful. You might be eligible to claim this credit if you received a stimulus check in the previous year and intend to submit your taxes in 2020. You must, however, fulfill a few conditions before you can apply for the credit.

Both your SSN and ATIN must be current. Utilizing the data you provided for the tax year 2020, the Recovery Rebate Credit’s value is determined. However, you won’t be qualified for the 2021 Credit if you received a third Economic Impact Payment in the most recent tax year.

You need a current Social Security number in order to qualify for the 2021 recovery rebate credit. Your 2021 adjusted gross income will be used to determine how much of a recovery rebate credit you are eligible for, and if you have any dependents, your eligibility will increase. Additionally, you must have a current IRS online account or a physical notice in the mail with the amount distributed.

Tax deduction

Nominees must fulfill specific needs in order to be eligible for the Recovery Rebate Credit. The third wave of stimulus money that were received are eligible for the credit. People who have two children but did not receive any stimulus money, or who have a child they claim, are not eligible for it. For individuals who fulfilled the other criteria, the credit was still accessible.

You must first satisfy the income requirements in order to be eligible for the Recovery Rebate Credit. Your tax return from the prior year serves as the basis for the amount you get. For instance, you might be qualified for an additional $1,200 in cash if you received a stimulus check in 2009. It is a good idea to get in touch with your tax agency and ask them to look up your payment in order to find out if you qualify.

The Recovery Rebate Credit will result in a larger refund and a smaller balance due. The Recovery Rebate Credit will be in an amount equal to the EIP you were eligible for minus the amount you actually got. For instance, if you received a $500 reward, you would also receive a $500 recovery rebate credit that you wouldn’t be required to pay back.

Download How Do I Apply For The Recovery Rebate Credit 2024