How To Fill Out HST Rebate Form – A portion of any GST/HST paid on the purchase and other renovations done to convert the building is eligible for a rebate on new housing.

In Ontario, first-time homeowners who buy or remodel a building are eligible for a GST/HST rebate of up to $36,300. A portion of the GST/HST paid on the acquisition and improvements, including building and land costs, is eligible for a rebate.

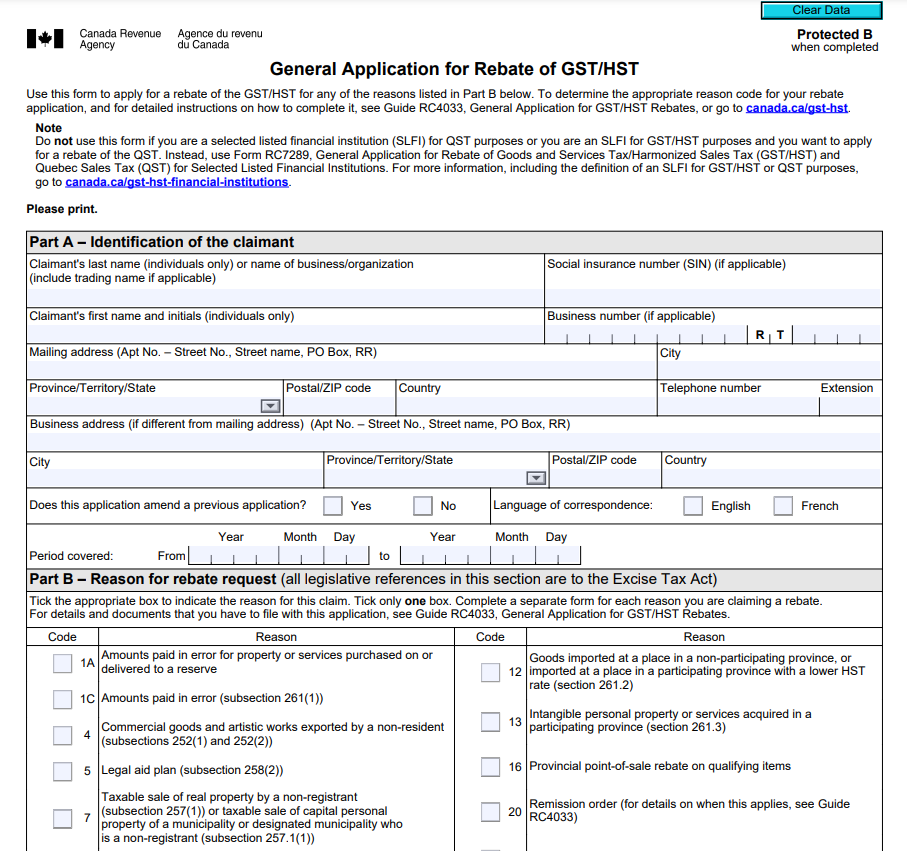

To request the reimbursement, an eligible applicant must submit two forms. The application form is the first form, and the calculation form is the second. You must also submit an additional form if you reside in a jurisdiction that deducts provincial taxes from your purchase. The tax center must receive the forms via mail.

You must be a genuine person to submit a rebate application. The reimbursement is not available to corporations. The property has to be the applicant’s principal residence in order to be eligible for the reimbursement. The person’s principal residence must be a place where they expect to stay for the foreseeable future. A person is only permitted to have one primary residence at a time.

eligibility criteria

You must meet certain eligibility requirements in order to request a HST rebate. At least one of the following must be present. List each item in turn if you have more than one. You can’t make both claims at once. This might cause problems. To ensure you receive the largest reimbursement, there are a few actions you may do.

You must first ascertain whether your home is eligible for the rebate. If you make additions to the building, you might still be eligible depending on the sort of building you own. But the alterations must be so significant as to give the impression that the property is brand-new. Porches, sunrooms, and family rooms are not included.

GST191-WS Form

You must be aware of the appropriate amounts to enter on each line of the GST191-WS HST refund form. The top line represents the 12% federal HST payment, whereas the remaining lines represent HST payments of 14% or greater. Put all invoices from the same vendor that you have on the same line if you have more than one.

You must put the HST paid on the property in Box 8 if you purchased a new home in 2008 or earlier. You must supply a power of attorney for the person signing the GST/191-WS in order to complete the form. After establishing the power of attorney, you must complete the direct deposit section of the form. A tick and a signature are needed for the direct deposit section.

Submission

In order to be eligible for a HST rebate, you must complete the appropriate form for your province. A form on the government website details the amount of the rebate you’ll receive. If you reside in a province that deducts provincial taxes, you will also need to submit an additional form. You and your agent must sign both documents. Additionally, you must mail the forms to the relevant tax offices.

You must gather all of your receipts in order to complete the rebate form. These receipts have to be issued in the applicant’s name. A bill or other supporting materials must be submitted as well. Additionally, you have six years to maintain all of your rebate documentation.

Benefits

You can be qualified for a HST rebate if you’re buying a new house or condominium. You might save hundreds of dollars with this tax break. Additionally, you can utilize it to lower the price of your new apartment or house. If you want to buy a new home, you might wish to apply for a HST rebate before making the final payment.

Calculate your qualified expenses and list them on the invoice if you are eligible for the rebate. You won’t lose out on any refund sums at the end of the year thanks to it. Additionally, you must include your rebate percentages on the invoice and deduct them from the invoice’s overall cost. The net amount should then be entered into the proper expenditure account.

Download How To Fill Out HST Rebate Form 2025