How To Fill Out Stimulus Rebate Form – You’ve come to the right site if you’re unsure how to complete a stimulus rebate form. You will learn more about this form’s requirements in this post, along with instructions on how to determine your recovery rebate credit. Samantha Hawkins, a certified public accountant and the owner of Hawkins CPA Solutions in Upper Marlboro, Maryland, is the author of this article.

Credit for Recovery Rebates

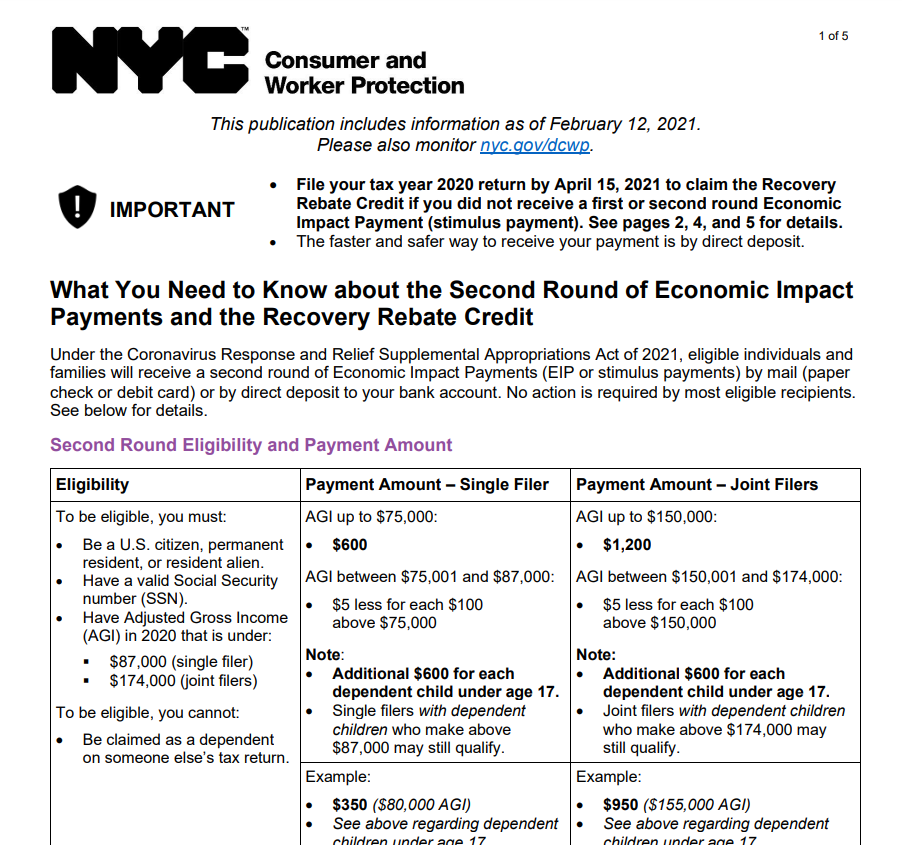

Making sure you are eligible is the first step in obtaining your recovery rebate credit. To claim a credit, you must have submitted a tax return if you are qualified. If not, you will have to wait until your subsequent tax return to make the credit claim.

You can still apply for a credit even if you didn’t qualify for the full credit amount but were nonetheless impacted by the recession. You can accomplish this by using tax preparation software like TurboTax, which fills out the appropriate tax forms and quizzes you on economic effect payments. If you prepare your own taxes, line 30 on Form 1040 should be filled out to claim the credit. Calculate your credit amount using the spreadsheet and the instructions on the form.

If you are a qualifying taxpayer, and your income is less than the phase-out threshold, you could be entitled to claim the Recovery Rebate Credit. The specifics of your tax return for 2020 will determine the credit’s amount, and you must also satisfy all other requirements to be eligible. Check the box on the form that reads, “Taxpayer is not claiming the Recovery Rebate Credit,” if you do not want to receive the credit.

tax filing deadline

Make sure to file your tax return by the deadline when you fill it out. The typical tax filing deadline is April 15. The IRS shifted it to the following business day, though, as April 15 came on a Friday this year. If you file your return early, you can still file it on April 18 even if you missed the deadline.

You are still eligible to claim the recovery rebate credit even if you did not get a stimulus payment. You must either file a new tax return for 2020 or make changes to an older return for a prior year. Even if you got a check in 2018, you might still have to wait a while before you can apply for the stimulus rebate.

You can claim the credit on line 30 of your tax return or Form 1040-SR if you meet the requirements. You can check your bank statements or your IRS online account to find out how much stimulus money you have received. If you were given additional stimulus payments, the extra sum will be deducted from your tax refund, lowering the overall amount of taxes you owe.

Calculating the Credit for Recovery Rebate

You must first determine your eligibility for the Recovery Rebate Credit before you can submit a claim for it. Your last year’s stimulus payment will determine how much you get. For instance, you might still be eligible to collect the credit on your 2020 return if you received a $7,500 stimulus check in the summer of 2010 but did not claim it on your tax return.

If you are single, you may be eligible for the recovery rebate credit of up to $1,200 each year. You may submit up to one additional RRC claim worth $600 if you are married. You may be eligible for up to 75% of the credit’s overall value if you have a qualified child.

You must know your income for the current year and the prior year in order to calculate your recovery rebate credit. Numerous Americans were able to survive the coronavirus outbreak thanks in large part to the stimulus funds. You can be qualified for an additional $1,400 if you have a second kid. The best tax preparation software will compute the credit automatically for you as part of your tax return.

Refunds and Recovery Rebate Credit are compared

Your stimulus payments and refunds can be reconciled using a procedure provided by the IRS. This information is available on notice 1444-C. The Recovery Rebate Credit Worksheet must then be filled out on your federal tax return. Based on your responses to the questions on the stimulus rebate form, this worksheet will automatically populate your refund amount with the amount of your stimulus payout.

You should expect to wait at least six months after filing your tax return before getting your refund. Your recovery rebate numbers may be rechecked by the IRS in the interim. The IRS will get in touch with you if your credits and refunds are inconsistent and require more supporting documents. If the numbers do not match, you will then have to wait a few months to get your money back.

An FAQ on this subject has been published by the IRS. Regarding the reconciliation of refunds and Recovery Rebate Credit on the stimulus rebate form, it offers useful information. Additionally, TurboTax provides particular COVID-19 advice. You can enter your income details to claim different tax credits and deductions in addition to the Recovery Rebate Credit.

Download How To Fill Out Stimulus Rebate Form 2025