Leeds Council Tax Rebate Form – The city council of Leeds may be able to reimburse you for your council tax payments. Not all of the over 80,000 households who qualify for this stipend have gotten it. On June 24, at 5 p.m., applications must be submitted. If you’re a student, you can seek an exemption if you’re living in student accommodation in Leeds.

80,000 Leeds families qualified for the PS150 energy bill grant were not given it.

80,000 homes in Leeds that are eligible for the PS150 energy bill incentive have not yet received it, according to a BBC investigation. This is true even though the councils have been granted until the end of September by the government to make the payments. The PS150 payment has been distributed to 97% of households in England and Wales. About half of homes in Northern Ireland do not receive it.

Families who have been waiting to get the grant now have an easy way to lower their energy costs; all they need to do is sign up for the program. The government will give them an application form after they register. The application form must be completed and sent to the appropriate organization. The vouchers will then be sent to them. They will never be asked for their bank account information or any other sensitive information, though. The vouchers will be delivered to you during the first week of the month if you have a conventional prepayment meter.

The application deadline is June 24 at 5 p.m.

To apply for your Leeds Council Tax Rebate, you must keep in mind three crucial dates. First, there is the due date, which is June 24 at 5:00 PM. The sooner you apply, the quicker you will receive your refund because the council will only distribute the funds in September.

The second and third deadlines are July 15 and August 31, respectively. Direct debit council tax payers will immediately receive their PS150 rebate; however, those without direct debit will need to submit a rebate application. If you’re on a direct debit program, the application procedure may take longer and should take about six weeks. In an effort to lower energy costs, the government is providing rebates to homes in council tax bands A through D.

required proof

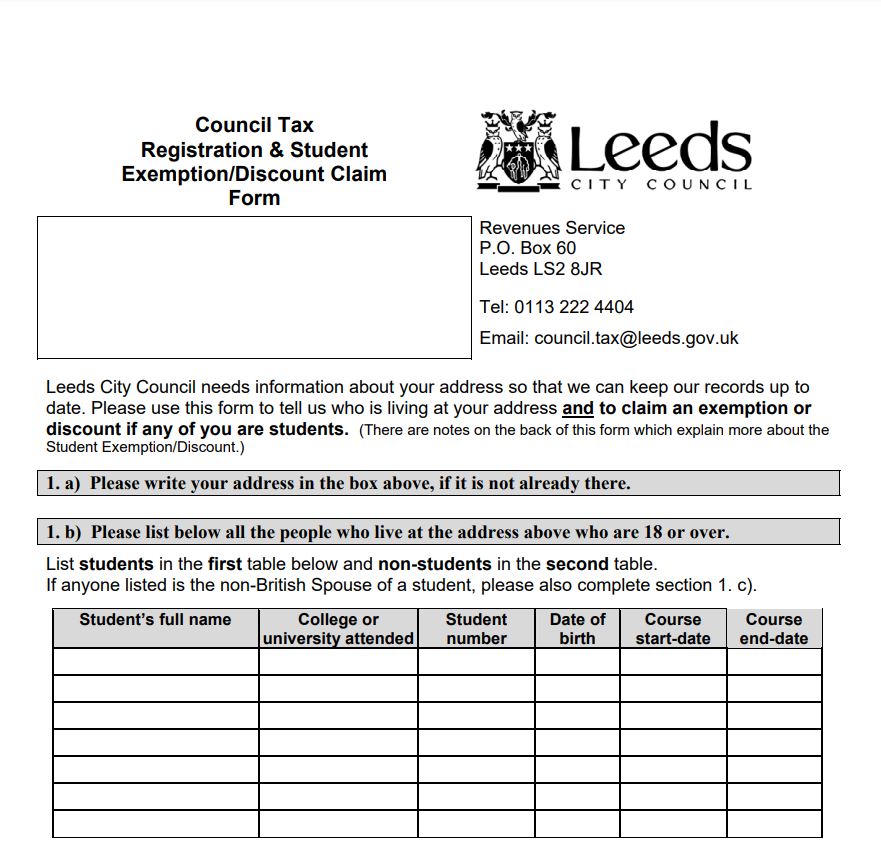

There are a few steps you should do if you live in Leeds and wish to apply for a council tax rebate to make sure your application is accepted. Ensure that you have the necessary proof as a first step. For instance, you’ll require a registration status certificate if you’re a full-time student. Requesting this form from your local council and sending it to them along with your identification documentation is possible. By the end of April, if your application is accepted, your reimbursement will be available in your account.

To find out what kind of proof the council requires, you could visit their website. You can be required to show evidence of your savings and income depending on the council. Put a note on the application form if you need more time to gather these proofs. If you make a mistake, get in touch with the municipality and ask them to modify your application. You should put this in writing so that you have a record of your communications.

software problems

Due to technological difficulties, some Leeds residents are unable to submit their claims for council tax rebates. Numerous residents have experienced difficulties receiving their reimbursement by the deadline. Even some councils have experienced difficulties making payments on time. Fortunately, there is still time for the process to be changed, so there is no reason to give up.

The Leeds council urges locals to submit their refund applications before the cutoff date. Missing the deadline will result in a PS150 credit being applied to their council tax accounts, which may be redeemed at the post office. But if you can, submit your application before the cutoff date so you can get your refund faster.

banking mistake

Leeds council tax rebates were scheduled to be distributed in the summer of 2018, however some homes received PS300 instead of PS150 due to a financial error. The Treasury received the remaining sums. A solution to this issue should have been found as quickly as possible. Two councils, according to Money Saving Expert, are having trouble making the payment by the end of June. The organization stated that some people may not receive their money until September due to the delay caused by IT issues.

Before submitting an online application, it’s crucial to double-check that all the information is correct. Ensure that your first name and last name are typed in accurately to avoid receiving an error message. If so, you can get help by calling the council tax helpline at 01993 861040. You will be asked for more information if the application still does not proceed.

Download Leeds Council Tax Rebate Form 2025