Maryland Tax Rebate 2024 – The Maryland Tax Rebate 2024 is a valuable resource for taxpayers looking to claim tax benefits in the state. This complete guide choice help you navigate the process, determine your eligibility, prepare the required documents, and claim your tax rebate. We’ll also share tips on maximizing your tax benefits and avoiding common pitfalls.

Tax Rebate Eligibility

Before you can claim the Maryland Tax Rebate, you’ll need to determine if you’re eligible. Eligibility criteria include:

- Residency: You must be a resident of Maryland during the tax year.

- Filing status: Your tax filing status impacts your eligibility for certain tax benefits.

- Income: Your adjusted gross income (AGI) may affect your rebate amount.

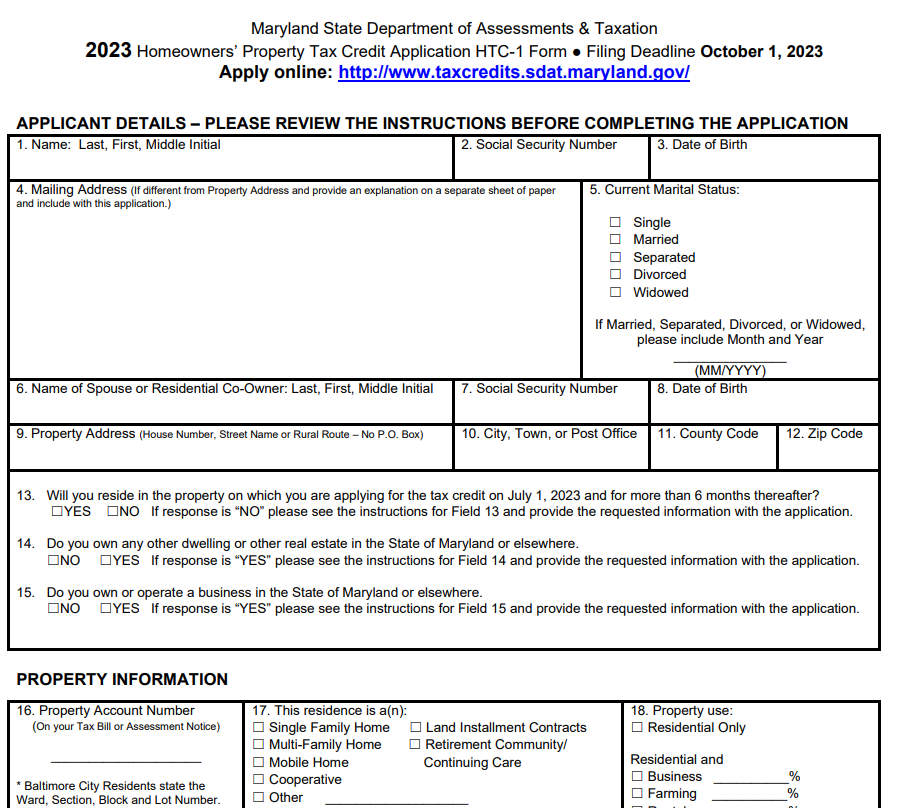

Required Documents for Maryland Tax Rebate

Gather the following documents to claim your tax rebate:

- W-2 forms: These show your earned income and taxes withheld by your employer.

- 1099 forms: These report any additional income from freelancing, investments, or other sources.

- Maryland Tax Forms: Complete the appropriate state tax forms based on your filing status and income.

Steps to Claim Your Tax Rebate

- Determine your eligibility: Review the eligibility criteria and ensure you meet the requirements to claim the tax rebate.

- Gather necessary documents: Compile all required documents, including W-2s, 1099s, and Maryland tax forms.

- Complete your tax return: Fill out the appropriate state tax forms and calculate your rebate amount.

- Submit your tax return: File your tax return electronically or by mail, ensuring all required documents are included.

- Track your rebate: Use the Maryland Comptroller’s website to track the status of your tax rebate claim.

Tips to Maximize Your Maryland Tax Rebate

- File early: Submit your tax return as soon as possible to receive your rebate quickly.

- Double-check your forms: Ensure all information is accurate and complete to avoid delays or errors.

- Claim all applicable deductions and credits: Research available deductions and credits to maximize your rebate amount.

- Consult a tax professional: Seek advice from a tax expert to ensure you’re claiming all eligible benefits.

Conclusion

Understanding the Maryland Tax Rebate 2024 process is crucial for claiming your tax benefits. By determining your eligibility, gathering necessary documents, and following the actions summarized in this guide, you can efficiently claim your tax rebate. Remember to use our tips to maximize your benefits and minimize potential errors.

Download Maryland Tax Rebate 2024