Missouri Tax Rebate 2024 – Missouri Tax Rebate 2024 is a program that offers tax credits and refunds to eligible taxpayers in the state of Missouri, helping them reduce their tax liabilities and gain some relief on their hard-earned funds. In this article, we’ll cover everything you need to know about Missouri Tax Rebate 2024, such as who qualifies, how to claim, filing deadlines, and tax saving tips.

Eligibility for Missouri Tax Rebate 2024

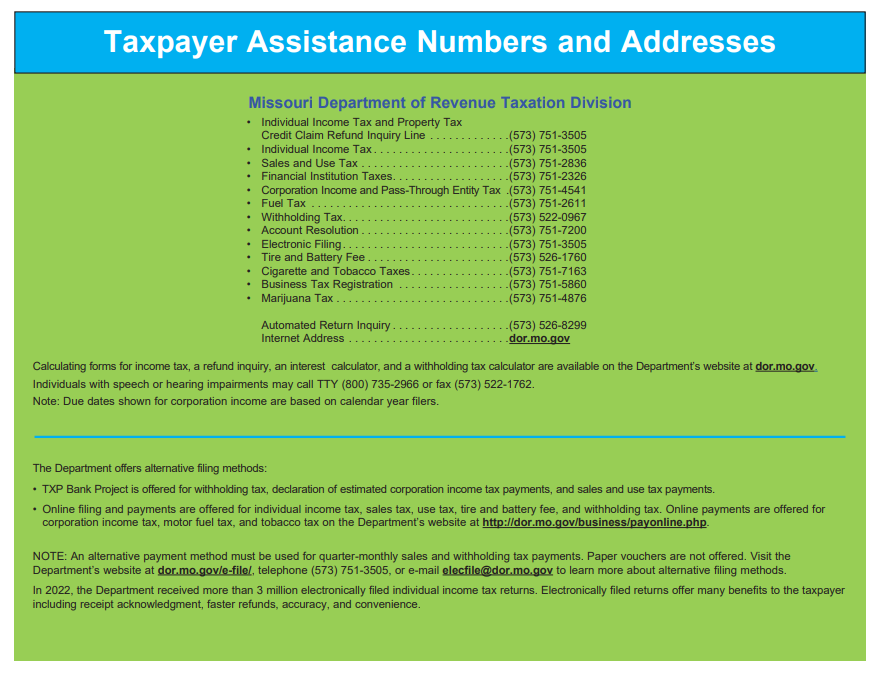

Taxpayers who qualify for the Missouri Tax Rebate must meet certain criteria, such as being a Missouri resident, earning an income level, and meeting other eligibility requirements set out by the Missouri Department of Revenue. They can check their eligibility by visiting either the Missouri Department of Revenue website or speaking with a tax professional.

How to Claim Missouri Tax Rebate 2024

Claiming the Missouri Tax Rebate is a straightforward process that can be completed online or via postal mail. Taxpayers simply need to follow these steps in order to receive their rebate:

- Gather all necessary documentation, such as W-2 forms, 1099 forms and other tax-related documents.

- Complete the Missouri Tax Rebate claim form found on the Missouri Department of Revenue website.

- Submit the completed form and all required documentation to the Missouri Department of Revenue either by post or online.

Filing Deadlines for Missouri Tax Rebate 2024

The filing deadline for Missouri Tax Rebate claims is April 15th, 2024. Taxpayers who miss this deadline may still be eligible to claim their rebate, but may face penalties and interest charges. It’s essential that you file on time in order to avoid any additional fees and receive your rebate quickly.

Tax Saving Tips for Missouri Taxpayers

Missouri taxpayers looking to maximize their tax refunds can benefit by following these tax saving tips:

- Accept advantage of tax assumptions and credits, such as the Missouri Tax Rebate, to reduce their tax liabilities.

- Maintain accurate records for all tax-related expenses, including receipts, invoices, and other documentation.

- Consider hiring a tax professional for assistance in preparing and filing their returns.

- Take advantage of free tax preparation services provided by organizations like Volunteer Income Tax Assistance (VITA) program for free tax preparation assistance.

- Plan ahead for tax season by setting aside money each month to cover any outstanding liabilities.

Conclusion

Missouri Tax Rebate 2024 offers eligible taxpayers the chance to reduce their tax liabilities and receive financial relief. By understanding the eligibility criteria, filing deadlines, and tax saving tips, taxpayers can maximize their refunds and take advantage of this program. It’s essential that you remain knowledgeable on Missouri’s tax laws in order to make sure that you receive all benefits to which you are entitled.

Download Missouri Tax Rebate 2024