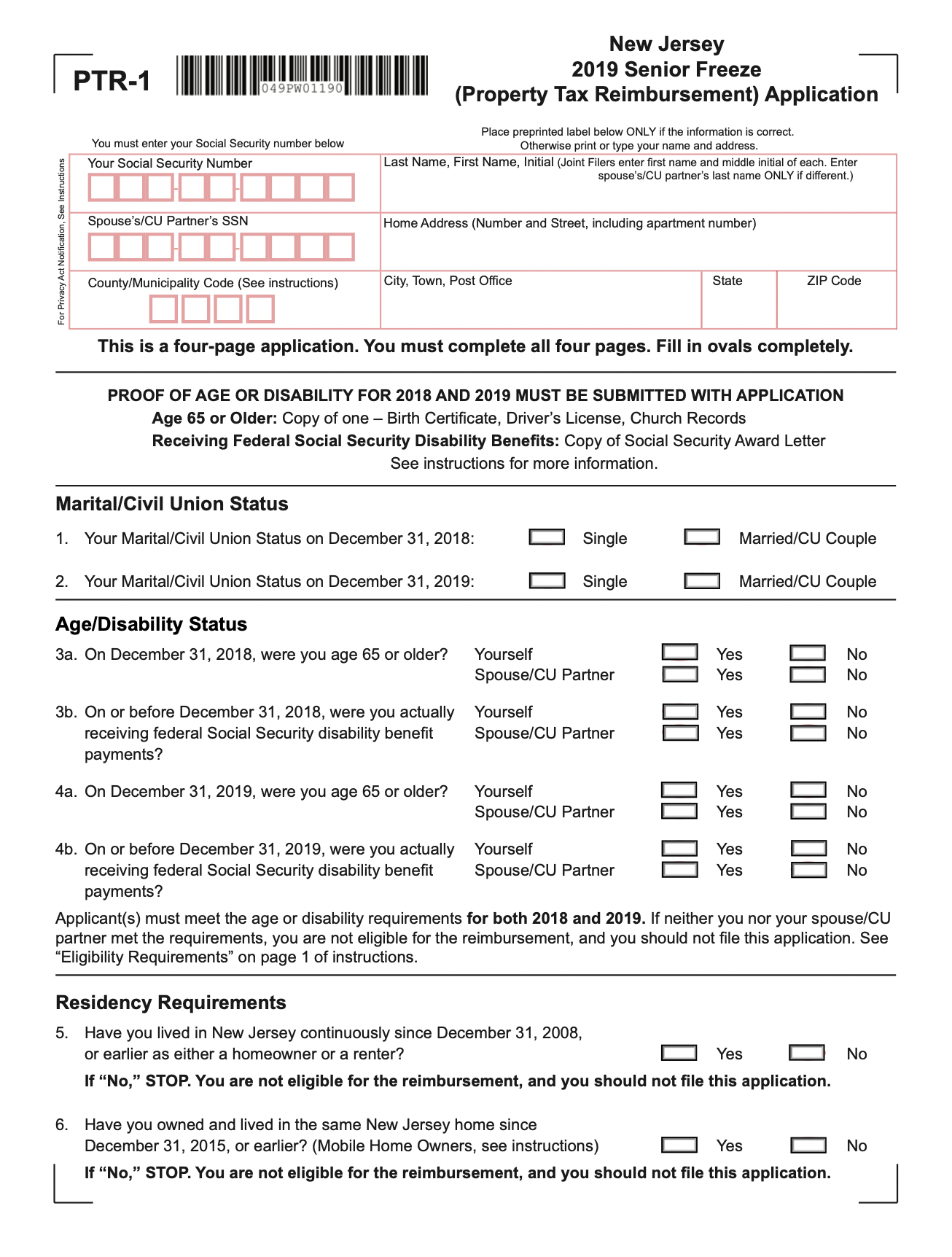

Use the NJ Tax Rebate Form below to earn tax rebate if you are living or working under State of New Jersey.

FYI, The state Department of Treasury reported Tuesday that New Jersey has sent more than 200,000 income-tax rebates since it started issuing them at the beginning of each month.

There are more than 760,000 New Jersey households that qualify for a rebate check up to $500. This includes couples earning less than $150,000 and at least one child. Individuals with income below $75,000 can also be eligible.

Who can receive an NJ Tax Rebate?

New Jersey couples who have a marital income of less than $150,000 and no children under the age of 18 are eligible for a rebate check. Individuals earning less than $75,000 and having at least one dependent child are eligible.

How much will you get?

Maximum rebate amount is $500 The maximum rebate is $500, but lower income taxpayers may receive less. This rebate is non-refundable. Your state income tax liability must be at least $500 in order to qualify for the $500 rebate. A $300 rebate will be given if your state income tax liability exceeds $300. You’ll get a $100 rebate if it exceeds $100

According to the Department of Treasury, the average amount for couples who file jointly is $425. The average amount for single filers, which amounts to nearly 48,000, will be $297.