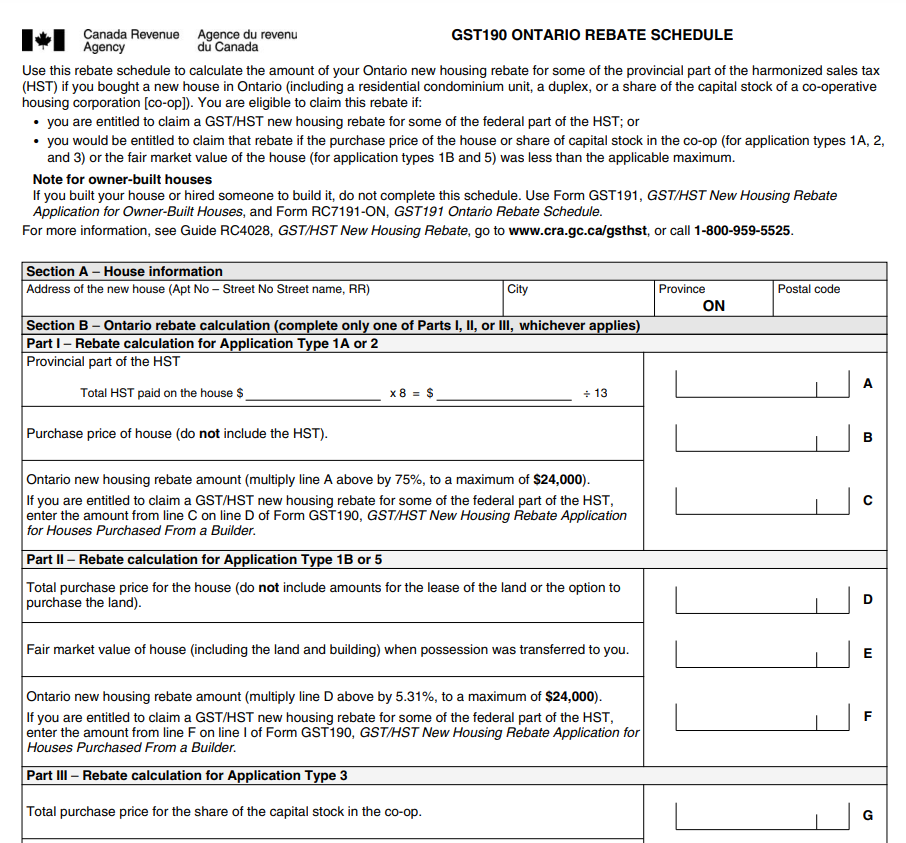

Ontario New Housing Rebate Form – The owner of a newly constructed home in Ontario is required to fill out and submit the one-page Ontario New Housing Rebate Form. The refund amount will be paid to the person who filed the form; this form is only meant for one person. In order to qualify for the rebate, the claimant must also satisfy the requirements of the application type.

Part C

It is required to complete and submit the Part C of Ontario New Housing Rebate Form with the application. The fair market value of the property, as well as any applicable province land transfer taxes, must be included. The paperwork should also have the name and signature of the power of attorney holder. Additionally, the direct deposit section of the rebate application must be completed with a signature and a checkbox.

The cost of the land and the labor required to build the house determine the maximum amount of the Ontario new housing rebate. To be eligible for the reimbursement, a home that the homeowner built must be brand-new or significantly modified. The rebate will be equal to 75% of the purchase price if the land was acquired using HST. Depending on the style of building, the reimbursement can be between $16,080 and $24,000.

The majority of the time, just half of the home may be used as a primary residence. For instance, only half of a home can be claimed as a principal residence if it is 50% bed and breakfast. However, the entire property may be eligible for the new housing incentive if more than 50% of it is used for vacation rentals.

determination of the rebate amount

You should understand how to compute your refund if you intend to buy a new house in Ontario. Whether or not you bought your land using the HST will affect how much you can claim. You’ll also need to be aware of the extent of the building work done on your new house. Owner-built homes that satisfy specific requirements are also acceptable. Significantly restored homes are typically treated the same as newly constructed homes.

You might be eligible for the new housing refund if you purchased a brand-new home in Ontario within the previous three years. You will receive a refund for the HST you paid on behalf of the province. To avoid having to submit an application to the CRA, some builders will offer to pay the rebate straight to you. The builder will carry out that action and deduct the rebate sum from their net tax computation.

The GST191-WS form can be used to figure out your rebate. This form, which is necessary for your application, calculates the amount of GST/HST that was paid when building your home. Fill out this form even if you’re just requesting a refund for new housing in Ontario.

The ITC claim deadline

Claiming ITCs from your builders can be quite beneficial when buying a new house. The Ontario new home rebate is given to you once the house is constructed and applied as a credit to the overall cost of the house. By doing this, you can avoid worrying about completing a CRA application or waiting for the rebate to be processed.

For supplies you bought for construction, you can claim ITCs on your GST/HST returns. There are certain regulations, but they are the same as those for other refund schemes. Your new home’s purchase price must equal at least its fair market value, including any applicable provincial land transfer taxes, in order to be eligible. The maximum amount can then be calculated by multiplying this amount by 5.31%. The most you may receive is $24,000.

Only new or significantly renovated homes are eligible for Ontario’s new housing subsidy. Your home must be your principal residence in order to be eligible for the reimbursement. You might be qualified for a transitional new housing rebate if it isn’t. In these situations, you want to get expert advice from a rebate company.

Conditions for requesting a rebate

If you want to apply for the Ontario new housing rebate, you need be aware of the requirements. These are the guidelines that all applicants must adhere to. Application deadline is April 1, 2017. To be eligible for the rebate, you must satisfy certain requirements. There are two different rebate types available.

You must possess a power of attorney, if necessary, in addition to the fundamental criteria. The power of attorney must be attached to the application and signed by a third party who is not the property’s owner. You must also complete the direct deposit section of the application, which includes a check box and a place for your signature.

Along with the rebate application, the GST191-WS Construction Summary Worksheet must be submitted. This form must be filled out and submitted by the deadline specified in the schedule for provincial rebates. If you don’t send in all the necessary paperwork, your claim can be delayed or denied. Make sure to fill out every field on the form, including the fair market value and construction dates.

Download Ontario New Housing Rebate Form 2025