Reimbursement Form Bajaj Allianz – You must submit the pre-authorization request form and the reimbursement form to the insurance company in order to be reimbursed. You will be able to better navigate the claims settlement process if you comprehend these forms and their associated procedures. Here are some pointers to help you through the claims process, whether you’re a new member or have been with the firm for a long time.

Form for pre-authorization requests

With Bajaj Allianz, submitting a claim is as simple as filling out a short form. Using the number on your health ID card, you can fill it out online. Within 60 minutes of reviewing your claim, the health insurance will respond. In some circumstances, they might need more proof before approving your claim.

A top-notch provider of health insurance is Bajaj Allianz. It provides a number of advantages, such as cashless treatment and a 24-hour helpline. Whether you require surgery, a trip to the emergency department, or both, Bajaj Allianz can assist.

You must get pre-authorization before utilizing your Bajaj Allianz medical insurance coverage. This entails delivering a pre-authorization document to your insurance provider before beginning treatment. Once approved, you’ll be allowed to use your insurance at a hospital without having to pay out of pocket. However, if your request is turned down, you will be in charge of covering all expenses up until the date of discharge. Additionally, maintain all hospital records for the insurer to review. Your claim can be dismissed within 45 days if you don’t submit these supporting papers.

Additionally, Bajaj Allianz might let you acquire an extra care policy. These products are excellent for those who require additional protection over and beyond existing health insurance. These policies are available individually or in a floater format. Depending on how many members you add to your plan, the premiums will change.

Form for reimbursement

Before your insurance company would pay your hospital fees, you must first acquire pre-authorization. This request must be addressed to the insurer in writing. The insurance provider will issue you an authorisation letter if your request is granted. If their other qualifying requirements are met even if your request is rejected, you will still be covered. You can get assistance from Bajaj Allianz’s Helpline with the claim process. They can provide you with information on how to lodge a claim as well as answer any concerns you have regarding the plan.

For emergency care at a hospital in its network, reimbursement from Bajaj Allianz will pay. Additionally, the insurer will discuss your claim’s resolution with the hospital. Reimbursement is a simple and quick process. Just make sure you are aware of and have your policy number with you when you visit the hospital.

For inpatient and post-hospital treatment, there is coverage under the Bajaj Allianz Health Insurance plan. It also covers costs associated with child daycare. The coverage also offers lump sum payouts and weekly benefits. One, two, or three years are your options for the length of the plan. If you add two or more family members to your plan, you can also take advantage of a family discount.

An established provider of general insurance in India is Bajaj Allianz. It offers affordable health insurance with the best possible coverage. It has received many accolades and is renowned for its quick claim resolution. Every family member is covered by plans from Bajaj Allianz.

Process for settling claims

One of the most crucial elements of your health insurance coverage is the Bajaj Allianz claims settlement procedure. It is quick, easy, and hassle-free. The business has a high ratio of claim settlements. You receive all the necessary information during the claims process. You will typically receive your claim within 30 days. The company’s website allows you to look up the status of your claim.

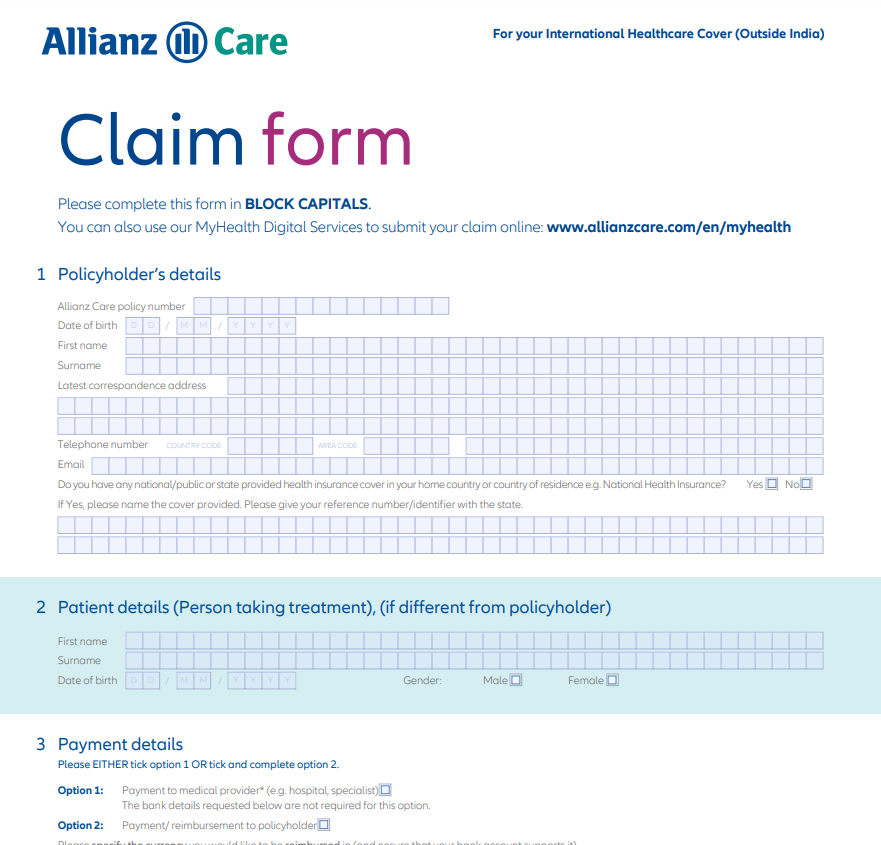

Filling out the Bajaj Allianz-provided Reimbursement form is the first step in the claims settlement procedure. You must provide information about your claim, including all supporting documentation. When the form is finished, send it to the insurance company along with the required paperwork. The insurance provider will examine the papers and decide whether they are legitimate. Bajaj Allianz reserves the right to ask for additional documentation if there are any inconsistencies in the information you have provided. You will be given the benefit sum after they have assessed the claim.

If you have a current Bajaj Allianz insurance coverage, you can complete the form on the website of the insurance provider. The claim can also be filed in person or at a branch office.

Download Reimbursement Form Bajaj Allianz 2025