Vermont Renters Rebate Form 2025 – Whether or not you live in Vermont, you may be eligible for the Vermont Renters Rebate Form.People can use this form to claim a tax credit based on how much rent they have paid over the course of a year. Adults who are not married may use their own name to claim the credit. You can receive a tax credit for renting your house, whether you’re a single person or a family. The rebate claim process has just been simplified, making it simpler than before.

The basis for VERAP renter credit is actual rent paid.

The Vermont Emergency Rental Aid Program, or VERAP, is a program that offers rent assistance to Vermonters who qualify based on their income. VERAP can aid with paying back rent and upcoming rent payments in addition to offering utility assistance. Additionally, it might offer a statement of intent to tenants who are still looking for housing.

The manner in which VERAP distributes benefits has changed. The rent can now be paid for a maximum of 18 months, but not the entire back rent. For instance, it might be used to settle any past rent that was owed as of April 1, 2020. Applicants may also be eligible for a letter of intent, but they must disclose any outstanding rent.

The Vermont Emergency Rental Assistance Program also features an online application in addition to the letter of intent. On a computer or a smartphone, applicants can complete the application. They also have to upload court documents. For instance, VERAP might be able to speed up the eviction process for a renter.

Adults who are not married may independently claim credit thanks to the VERAP renter credit.

The Vermont Emergency Rental Assistance Program, or VERAP, is intended to assist tenants who have lived in their rental unit for at least six months. You must submit an online or mobile application to be considered for VERAP.

If your income has dropped or you have been unable to make rent payments for some other reason, VERAP will reimburse you for the missed rent payments. VERAP can provide you with a letter of intent if you are still searching for a rental. Additionally, VERAP will cover the next three months’ worth of rent. Additionally, you can apply for the program’s additional 15 months.

Those who are requesting more than three months of back rent might need to provide more documentation. Participants who recertify more than 90 days after their previous recertification must also provide proof of their household’s income in addition to the foregoing paperwork.

Renter credit through VERAP has been streamlined.

Renter credit eligibility has been simplified by VERAP. It features a new application procedure, is valid for 18 months, and allows rent repayment. After April 1, 2020, the program will pay accumulated rent arrears. If your income changes while you are still eligible for a subsidized rental house, you must notify the housing program. You also need to sign a new lease or rental contract.

The benefits that the Vermont Emergency Rental Assistance Program provides have also changed. Rent arrears and other housing expenses will be covered by the program, but only until its funds are depleted. The program’s eligibility requirements have also been modified. Everyone who lives in a mobile home may now be eligible for federal rental subsidies, whereas before the program was only open to Vermonters who qualified according to their income.

Anyone who has rented a home for less than a full year is eligible for the VERAP renter credit.

The advantages of VERAP, or the Vermont Emergency Rental Assistance Program, have altered. Only Vermonters with qualifying incomes are now eligible for this program. You may be qualified for the new program even if you’re homeless right now, but you’ll still need to fill out a rental application. If you are approved, you will receive a letter of intent and could be able to temporarily get some rent paid.

Even though you might not be able to receive all of your missing rent back, the VERAP program will reimburse it to you. The program only lasts for a short time and will expire in 2025. If you qualify, you might want to start organizing your housing costs right away to avoid losing your VERAP payments.

filing in bulk for Vermont tenants

You have the choice to file the Vermont renter’s rebate form in bulk, whether you are a landlord with a lot of rental units or just one. The Vermont Tax Office can give instructions on how to fill out this form.

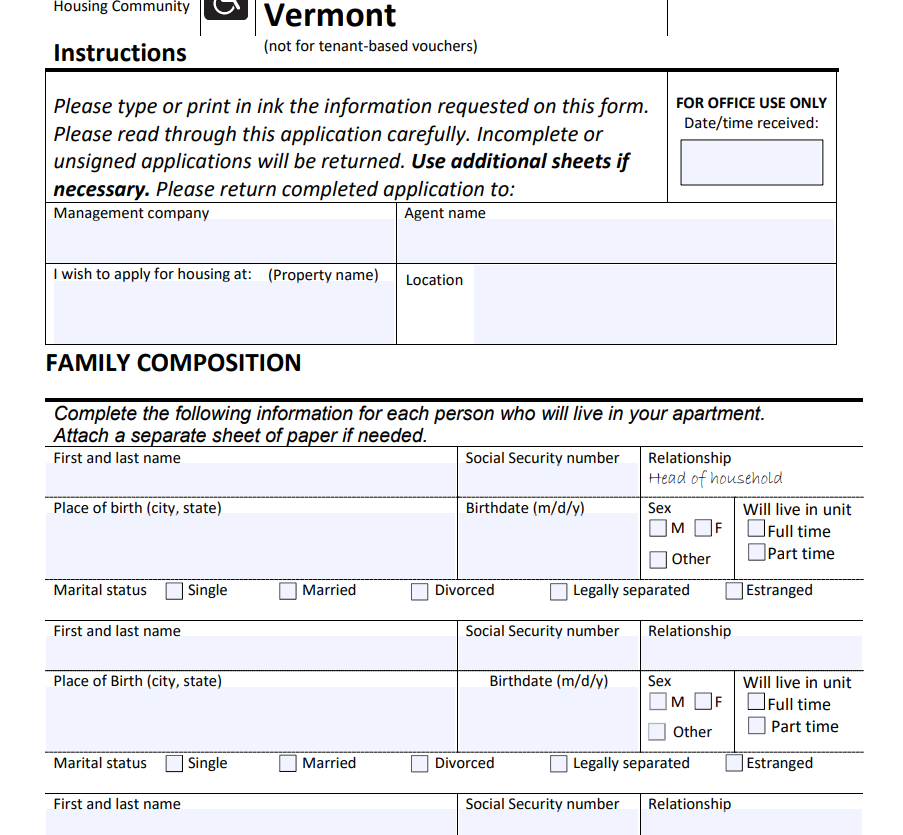

You must have accurate details regarding your rental property in order to submit the Vermont renter’s rebate form in bulk. You will require details such as the owner’s name, the number of rental units, and the address of the rental property. Additionally, you must include the property’s school parcel account number (SPAN) and postal address. You must specify how many lots you own if you are a landlord who owns a mobile home park.

Download Vermont Renters Rebate Form 2025