VT Renters Rebate Form 2025 – If you’re a renter in Vermont, you may want to take advantage of the Renters Rebate program. The state has recently made some major changes to the program, including a simplified application process and income requirements. The changes will also affect the 2025 income tax filing season. Even if you don’t owe income taxes, you can still file a Renter Credit Claim. You can file electronically with your tax software, directly through myVTax, or you can mail the RCC-146 paper form.

Streamlined application process

The Vermont legislature recently passed legislation to simplify the process of filing for Vermont renters’ rebates. The new law, Act 160 of 2020, will go into effect in the 2021 tax year. As a result, renters will be eligible to file a Renter Credit Claim even if they are not required to file an income tax. To submit a claim, renters can use tax software or myVTax to file the form electronically. Otherwise, they can request a paper form and request that it be mailed.

Income requirements

If you’re thinking about filing a Vermont renters rebate claim, you need to be aware of the income requirements. You can make up to $47,000 per year and you must live in Vermont for the entire calendar year. Depending on your circumstances, you may qualify for the full rebate amount.

Depending on your income, you may be able to qualify for the full rebate amount or partial rebate. Generally, the income requirements are based on the amount of rent you pay each month. If your income is under $10,000 per year, you’ll receive a credit of about $1,200. If you’re earning between $25k and $47,000 per year, you may be able to get a full credit of up to $3,000, which means you could potentially receive up to $8000.

For more information, visit the Vermont Department of Taxes. The Vermont Renters Rebate Program was revised last year to simplify the process. To make the process more user-friendly, the Vermont Department of Taxes has made it easier to file and receive a refund. The new program is titled the Vermont Renter Credit Program and is intended to assist Vermont renters with their rental costs.

Applicant’s eligibility

Before completing the application for the Vermont Renters Rebate, it is necessary to determine whether an applicant is eligible. Applicants must be at least 18 years of age and able to sign a legal binding document. They must also possess a government issued photo identification. The application will be reviewed individually and each applicant is responsible for paying any necessary fees before the application can be processed. Applications that do not meet all of the necessary requirements may be denied or delayed.

To determine whether a person can qualify for the Vermont Renters Rebate, they should first determine their income and rent arrangement. If they rent through a landlord, they must identify the landlord as the primary payer of their utilities. They will also need to identify the type of fuel used.

Pre-application meetings

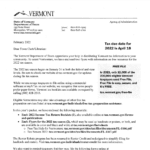

Vermont renters should prepare for a sweeping change to the state’s renters rebate program. The Vermont legislature has just passed Act 160 of 2020, which makes a number of changes to the program, which will go into effect in the 2021 tax year. The new program will have a significant impact on the upcoming 2025 income tax filing season. If you live in Vermont and are currently renting an apartment or a home, you should file a Renter Credit Claim by April 18. You can file the form electronically using tax software or directly through myVTax. You can also fill out the paper form and request it be mailed to you, if you prefer.