2024 PA Property Tax Rebate Form – Property taxes are a significant financial responsibility for homeowners, making any opportunity for relief a welcome one. The 2024 PA Property Tax Rebate Form is a crucial document that can provide financial assistance to eligible individuals. In this article, we will guide you through the entire process, from understanding the purpose of the form to maximizing your rebate amount.

Understanding the 2024 PA Property Tax Rebate Form

The 2024 PA Property Tax Rebate Form stands as a lifeline for numerous homeowners, providing a valuable opportunity to ease the weight of property taxes. In this section, we will delve into the specifics of the form, exploring its purpose and shedding light on any noteworthy updates for the year 2024.

Eligibility Criteria

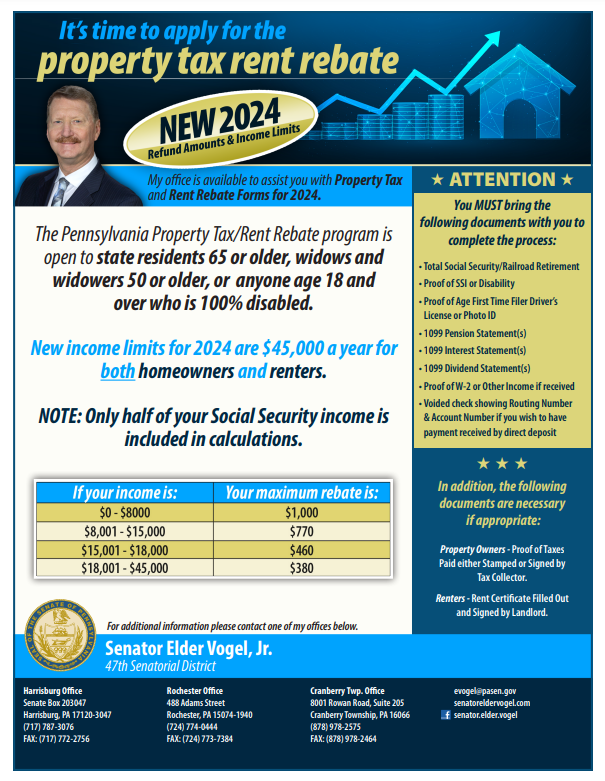

To unlock the benefits of the rebate program, it is imperative to meet specific eligibility criteria. In this segment, we will furnish you with an in-depth breakdown of individuals who qualify for the rebate, emphasizing any novel criteria introduced for the current year. Understanding these eligibility requirements is crucial for a successful application process.

Stay tuned as we navigate through the intricacies of the 2024 PA Property Tax Rebate Form, guiding you toward a comprehensive understanding of its purpose and ensuring you are well-informed about the eligibility criteria essential for securing this valuable financial relief.

How to Obtain the Form

The initial step in the property tax rebate process is gaining access to the required form. Whether you opt for online convenience or prefer obtaining a physical copy, we’re here to guide you on the locations and methods to secure the necessary documents.

Step-by-Step Guide to Fill Out the Form

Once you have the form in hand, the next crucial step is completing it accurately. A successful application hinges on providing precise information. Our comprehensive step-by-step guide will lead you through each section of the form, ensuring you navigate the process seamlessly and avoid common mistakes during submission.

From understanding the purpose of each field to offering insights on potential pitfalls, our guide is designed to enhance your understanding of the form-filling process, increasing the likelihood of a successful application.

Submission Deadlines

Submitting the completed form on time is paramount. Missing deadlines can result in severe consequences, impacting the success of your rebate application. In this section, we’ll underscore the significance of adhering to submission timelines. We’ll also discuss the potential repercussions of late submissions, emphasizing why it’s crucial to meet the specified deadlines.

Stay informed to safeguard your eligibility and maximize your chances of a successful property tax rebate application. Follow our guidance on obtaining the form, filling it out accurately, and adhering to submission deadlines to ensure a smooth and successful process.

Tracking Your Rebate Application

After submitting your property tax rebate form, it’s crucial to stay informed about the progress of your application. In this section, we’ll equip you with valuable information on various online tools and resources designed to help you monitor the status of your rebate application.

Online Tools and Resources

The advancement of technology has simplified the tracking process for rebate applications. We’ll introduce you to user-friendly online tools specifically designed for monitoring the status of your application. These tools provide real-time updates, ensuring you are well-informed about the progress of your rebate.

Contact Details for Assistance

In case you encounter any issues or have queries regarding your rebate application, having the right contact details is essential. We’ll provide you with the necessary information to reach out for assistance, ensuring that any concerns or inquiries are addressed promptly and effectively.

Stay tuned to this section for insights on how to utilize online tools and resources to track your rebate application effortlessly. Additionally, have peace of mind knowing that we’ll equip you with the contact details you need for any further assistance or clarification throughout the process.

Tips for Maximizing Rebate Amount

Appeals Process

your property tax rebate application is denied, all is not lost. In this section, we’ll be your guide through the appeals process, offering insights into the necessary steps to overturn the decision.

Navigating the Appeals Journey

Discover the essential steps involved in appealing a denied application. From understanding the grounds for appeal to gathering supporting documentation, our article will provide you with a comprehensive roadmap to increase your chances of a successful appeal.

Insights into Overturning the Decision

Delve into insights and tips on how to present a compelling case during the appeals process. Understanding the nuances of the appeals system is crucial, and our guidance aims to empower you with the knowledge needed to navigate this phase effectively.

Community Impact

Property tax rebates go beyond individual benefits, creating a positive ripple effect in the community. In this section, explore how these rebates contribute to community development, backed by real-life examples illustrating their profound impact.

Real-Life Examples of Positive Impact

Discover inspiring stories of how property tax rebates have played a vital role in community development. From supporting local initiatives to fostering a sense of collective well-being, our article will showcase tangible examples that highlight the broader positive impact of the rebate program.

Community Development Initiatives

Learn about specific community development initiatives supported by property tax rebates. Whether it’s funding local projects or bolstering essential services, these initiatives underscore the far-reaching benefits of the program beyond individual households.

Stay tuned for valuable insights into the appeals process, equipping you with the knowledge to navigate challenges effectively. Additionally, explore the community impact of property tax rebates, where the positive effects extend well beyond individual financial relief, fostering a stronger and more vibrant community.

Government Initiatives for 2024

As we move forward into 2024, it’s crucial to stay informed about any additional government initiatives related to property taxes. In this section, we will explore whether there are new support programs or initiatives introduced to assist citizens further in managing their property tax obligations.

Exploring Government Support

Our article will delve into any updates or new programs initiated by the government in 2024. Whether it involves additional financial assistance or innovative solutions to alleviate the burden of property taxes, we aim to keep you abreast of the latest developments.

Testimonials and Success Stories

Real-life experiences can offer valuable insights into the effectiveness of the property tax rebate process. In this section, we bring you testimonials and success stories from individuals who have successfully navigated the rebate process, shedding light on the positive impact on their lives and communities.

Inspiring Narratives

Read firsthand accounts of individuals who have benefited from the property tax rebate program. These testimonials will provide a personal perspective on the application process, the impact of the rebate, and how it has positively influenced their lives and the communities they reside in.

Key Takeaways from Success Stories

Gain key takeaways from success stories that may inspire and guide you in your own property tax rebate journey. These narratives showcase the tangible benefits and underscore the importance of participating in programs designed to provide financial relief to homeowners.

Stay tuned for an exploration of government initiatives in 2024 related to property taxes, as well as heartfelt testimonials and success stories that highlight the positive transformations experienced by individuals and communities through the property tax rebate program.

Conclusion

In summary, the 2024 PA Property Tax Rebate Form serves as a valuable tool for homeowners looking to alleviate their financial burdens. Our detailed guide aims to streamline the application process, enabling you to navigate it effortlessly and capitalize on the available benefits. By utilizing this resource effectively, you can potentially enhance your financial situation and take advantage of the relief offered through the property tax rebate program.

Download 2024 PA Property Tax Rebate Form

FAQs (Frequently Asked Questions)

- Can I apply for the property tax rebate online?

- Yes, the online application option is available for added convenience. Visit the official website for details.

- What happens if I miss the submission deadline?

- Missing the deadline may result in consequences such as reduced rebate amounts or even ineligibility. It’s crucial to submit on time.

- Are there any changes to the eligibility criteria for 2024?

- The article covers any new eligibility criteria introduced for the current year, ensuring you have the latest information.

- How can I track the status of my rebate application?

- Online tools and resources are available for tracking. The article provides details on monitoring the progress of your application.

- Is there an appeals process if my application is denied?

- Yes, the article outlines the steps involved in the appeals process if your application is denied.