2024 Property Tax Rebate Form – If you’re a homeowner in Iowa, you may be eligible for a property tax rebate, which can provide significant relief on your tax burden. The Iowa Property Tax Rebate Form for 2025 is a crucial document for homeowners seeking this financial assistance.

Understanding the Purpose of Property Tax Rebates

Property taxes are charges imposed by local governments on property owners, typically based on the assessed value of their properties. These taxes serve as a significant revenue source for funding various public services and infrastructure projects crucial for the community’s functioning, including schools, roads, police and fire departments, parks, and other essential services.

Property tax rebates are initiatives implemented to alleviate the burden of high property tax bills, particularly for homeowners who may face financial difficulties in meeting these obligations. These rebates aim to maintain fairness and affordability in property taxation, ensuring that residents, especially those with lower incomes or facing economic challenges, can continue to afford their homes without being overly burdened by taxes.

By providing relief through property tax rebates, local governments can mitigate the impact of rising property values or tax rates on homeowners, thus promoting stability and equity within communities. This assistance helps to uphold the principle of property ownership as a fundamental right while ensuring that essential public services are adequately funded for the benefit of all residents.

Eligibility Criteria for Iowa Property Tax Rebate

To be eligible for the Iowa Property Tax Rebate, you must fulfill specific criteria outlined by the state:

- Income Requirements: Your household income must fall within predetermined limits set by the Iowa Department of Revenue. These limits may vary depending on factors such as marital status and age.

- Age Requirements: Besides meeting income criteria, eligibility may also hinge on age. Typically, only homeowners who have reached a certain age are considered eligible for the rebate.

- Disability Criteria: Special provisions may exist for individuals with disabilities under the Iowa Property Tax Rebate program. You may need to provide documentation to support your disability claim when applying for the rebate.

Meeting these eligibility criteria ensures that the rebate program targets those who may face financial challenges in meeting their property tax obligations, particularly individuals with lower incomes, seniors, and individuals with disabilities. These criteria help maintain fairness and equity in distributing assistance while ensuring that those most in need receive support from the program.

How to Obtain the Iowa Property Tax Rebate Form

To obtain the Iowa Property Tax Rebate Form, you have two primary options:

- Online Submission Process: Visit the Iowa Department of Revenue website to download the rebate form. Once downloaded, you can fill it out electronically and submit it online. This method offers convenience and typically results in faster processing of your rebate application.

- Physical Form Pickup Locations: You can also obtain a physical copy of the rebate form by visiting designated locations. These locations may include government offices, libraries, community centers, or other public facilities. Look for signs or inquire at these locations to find out if they offer the Iowa Property Tax Rebate Form.

Choosing the method that suits you best ensures that you have access to the necessary paperwork to apply for the Iowa Property Tax Rebate. Whether you prefer the ease of online submission or the familiarity of filling out a physical form, both options enable you to initiate the rebate application process effectively.

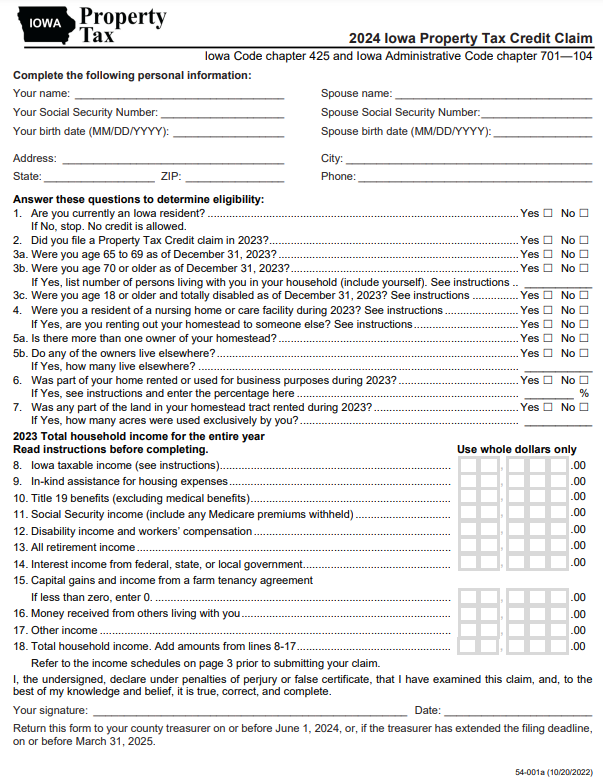

Filling Out the Iowa Property Tax Rebate Form

When completing the Iowa Property Tax Rebate Form, ensure you include the following required information:

- Personal Information: Provide detailed information about yourself, including your full name, address, contact information, and Social Security number.

- Property Details: Include information about the property for which you are seeking a rebate. This may include the property address, parcel number, and details about the property’s ownership.

- Household Income: Disclose your household income as required on the form. This may involve providing information about your employment, investments, pensions, or any other sources of income for all members of your household.

- Special Circumstances: If applicable, indicate any special circumstances that may affect your eligibility for the rebate, such as disability status or senior citizen status.

Document Submission Guidelines

- Proof of Income: Include documentation to support the household income reported on the form. This may include pay stubs, tax returns, bank statements, or any other relevant financial documents.

- Property Ownership Proof: Provide evidence of property ownership, such as a deed or property tax statement, to verify your eligibility for the rebate.

- Special Circumstances Documentation: If claiming eligibility based on disability or senior citizen status, include any required documentation to support your claim.

Ensure all information provided is accurate and complete before submitting the form. Review the form and accompanying documents thoroughly to avoid delays or complications in processing your rebate application.

Deadline for Submission

It’s crucial to submit your Iowa Property Tax Rebate Form before the deadline set by the Iowa Department of Revenue. Failure to meet this deadline could lead to your application being rejected or experiencing delays in processing.

After submitting your rebate application, it will undergo processing by the Iowa Department of Revenue. The processing time can vary, but you should anticipate receiving notification regarding the status of your application within a specific timeframe.

Remaining mindful of the submission deadline and promptly providing any required documentation can help ensure that your rebate application is processed efficiently and that you receive timely updates on its status. If you have any questions or concerns about the processing timeline or deadlines, it’s advisable to contact the Iowa Department of Revenue for clarification and guidance.

Common Mistakes to Avoid

When filling out the Iowa Property Tax Rebate Form, be sure to avoid common mistakes such as:

- Providing inaccurate information

- Forgetting to include required documentation

- Missing the submission deadline

Checking the Status of Your Rebate Application

To check the status of your rebate application, you can reach out to the Iowa Department of Revenue for assistance. When contacting them, be sure to have your application reference number on hand, as this will facilitate faster processing of your inquiry.

It’s vital to emphasize the importance of providing accurate information when applying for the Iowa Property Tax Rebate. Any discrepancies or errors in the information submitted could lead to delays or rejection of your application. Therefore, double-check all details before submission to ensure accuracy and increase the likelihood of a smooth processing experience.

By maintaining accuracy throughout the application process and promptly addressing any inquiries or concerns regarding your rebate application status, you can help expedite the process and ensure that you receive the rebate to which you are entitled.

Conclusion

The 2025 Iowa Property Tax Rebate Form provides homeowners with an opportunity to alleviate their tax burden and ensure that property taxes remain fair and affordable. By understanding the eligibility criteria, submission process, and common pitfalls to avoid, you can increase your chances of a successful rebate application.

Download 2025 Property Tax Rebate Form

FAQs

- Can I apply for the Iowa Property Tax Rebate if I rent my home?

- No, the rebate is only available to homeowners.

- What is the income limit for eligibility?

- Income limits vary depending on factors such as marital status and age. Check the latest guidelines from the Iowa Department of Revenue.

- Is there a fee to submit the rebate form?

- No, there is no fee to submit the form.

- How long does it take to receive the rebate once approved?

- Processing times may vary, but you can expect to receive notification within a few weeks.

- Can I appeal if my rebate application is denied?

- Yes, you can appeal the decision with the Iowa Department of Revenue.