BBMP Property Tax Rebate – Bruhat Bengaluru Mahanagara Palike (BBMP) is the administrative body responsible for civic and infrastructural amenities in Bangalore. One of BBMP’s functions is the assessment and collection of property taxes. BBMP property tax is a significant source of revenue for the local government, which is used for the city’s development and maintenance.

Importance of Paying Property Tax

Property tax is the financial responsibility of every property owner in Bangalore. It funds crucial services such as waste disposal, street maintenance, and public safety initiatives. Besides, it’s a civic duty that contributes to the prosperity of our city. But did you know that you could get a rebate on your property tax? Well, keep reading to discover more!

The BBMP Tax System

Calculating property tax may initially appear complex, but in reality, it is a straightforward process that can be easily understood. This process takes into account several factors including the total built-up area of the property, its location, property type, and age. By considering these crucial elements, accurate and fair property tax assessments can be made to ensure that homeowners are paying their dues in a just and equitable manner.

Factors Influencing Property Tax

Several factors determine the amount you have to pay as property tax. These include the property’s location, its age, the type of construction, its usage (residential or commercial), and the total built-up area.

Tax Calculation Examples

For instance, a residential property located in Zone A, less than 15 years old with a built-up area of 1000 sq. ft., will have a different tax liability from a commercial property in the same zone, but older and larger.

BBMP Property Tax Rebate

Imagine a world where you can actually enjoy the benefits of a rebate on your property tax. It sounds like something out of a dream, doesn’t it? Well, I’m here to tell you that this dream can become a reality with the innovative BBMP property tax system. This groundbreaking system not only ensures that you pay your fair share of taxes but also rewards responsible property owners with enticing rebates. By implementing this system, the BBMP is revolutionizing the way we think about property tax and making it more accessible and beneficial for everyone. So why wait? Take advantage of this incredible opportunity and start saving money on your property taxes today!

What is a Property Tax Rebate?

A property tax rebate is a reduction or refund of taxes to eligible property owners. It’s an incentive designed to encourage prompt and full tax payment.

BBMP Property Tax Rebate: Eligibility Criteria

The BBMP offers a 5% rebate to property owners who pay the full year’s tax in one installment within the stipulated time.

How to Apply for BBMP Property Tax Rebate

Claiming the BBMP property tax rebate is a breeze. All you need to do is pay your property tax in full, in one installment, within the specified due date.

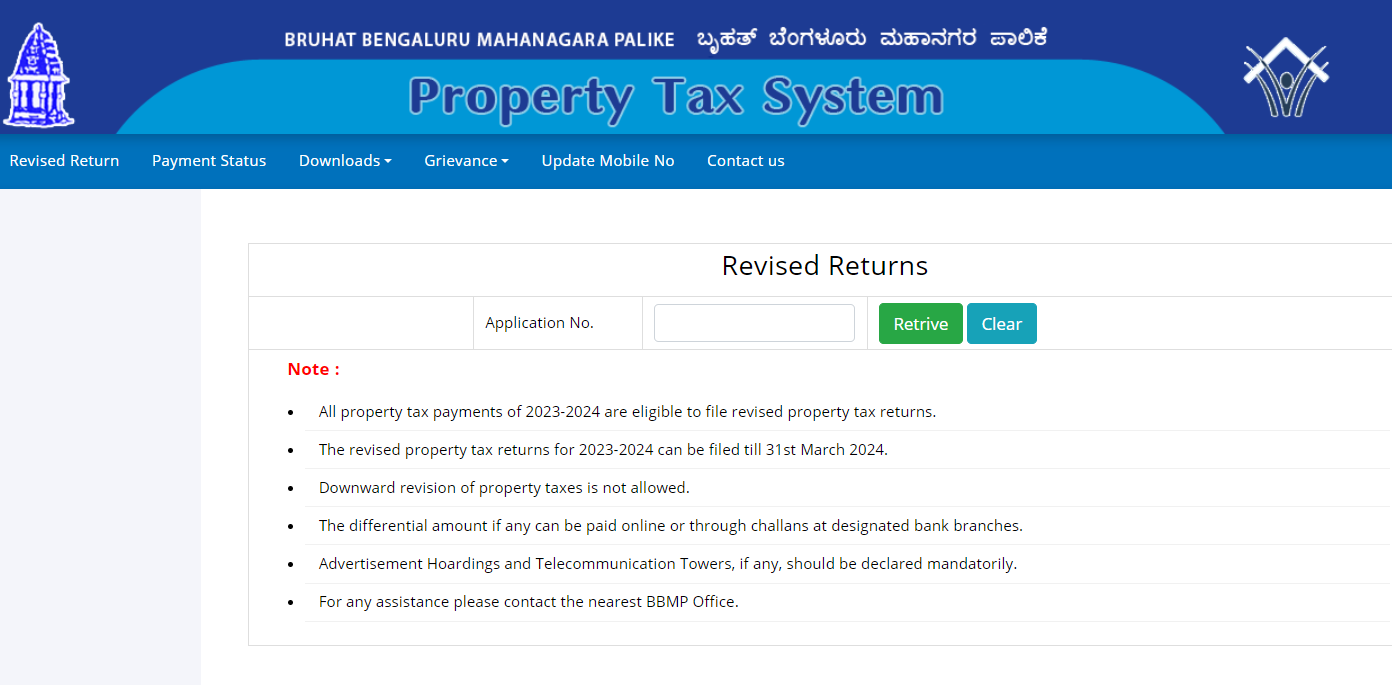

Step-by-step Application Procedure

- Visit the BBMP property tax payment portal.

- Input your Property Identification Number (PID).

- The system will calculate your annual property tax.

- Pay the full amount before the due date to automatically qualify for the 5% rebate.

Consequences of not Claiming the Rebate

It is of utmost importance to promptly claim your rebate within the specified period to avoid the onerous consequences of having to pay the full property tax without any discounts. By neglecting to do so, you may inadvertently subject yourself to an unnecessary financial burden that could have been easily avoided. Additionally, it is worth noting that maintaining a consistent record of regular tax payments and diligently claiming rebates when eligible not only showcases your responsible civic behavior but also serves as a valuable asset in potential future legal or financial situations. By proactively adhering to these practices, you are positioning yourself for favorable outcomes and ensuring a strong foundation for your continued financial well-being.

Conclusion

Understanding the BBMP property tax system, including the rebate mechanism, is crucial for every property owner in Bangalore. Claiming your property tax rebate not only helps in saving money but also contributes to your responsibility as a citizen. So, don’t miss out on your rebate the next time you’re paying your property tax!