Consumers Energy Rebate Form 2024 – The conditions for requesting a rebate from Consumers Energy are described in this article. Additionally, it will go over any potential tax obligations brought on by refunds. If you are eligible, you may be able to reduce your tax obligation while also saving money on your heating costs. Here is where you can submit a rebate form.

To ensure a smooth reimbursement process, it is advisable to have your validated heating bills and receipts readily available when submitting the reimbursement form. In case you have any inquiries, don’t hesitate to reach out to Consumers Energy at 1-800-228-3623 or visit their website for further assistance. They are dedicated to providing excellent customer service and will be more than happy to help you with any questions you may have.

Credit for home heating claimed

A tax credit that homeowners can use is called the Home Heating Credit. The credit is determined by adding up all of your household’s heating expenses from November 2020 to October 2021. Ensure that you include this expense in your total if you use bulk fuel. The Treasury might ask for documentation of your heating expenses. But only Michigan homesteads are eligible for this incentive. Tenants are not permitted.

For the 2021 taxation year, the IRS includes modified the Residential Energy Credits form. A credit claim for home heating is impacted by this change. Line 5 of the form is where installers of qualified biomass stoves can claim the credit. This tax credit is accessible in the year when the eligible product was installed. On your 2024 tax return, you can claim it. You cannot deduct a biomass stove, though, if you buy one after the 2021 tax year.

For groups of two or more persons, a home heating credit may be requested. The home must be owned by both claimants or be rented. Each applicant’s eligibility for a certain amount of home heating credit will be determined by the resources available to the household and their share of the standard allowance (amount determined by adding personal exemptions to the standard allowance). The standard allowance is determined by how many claimants reside in the residence.

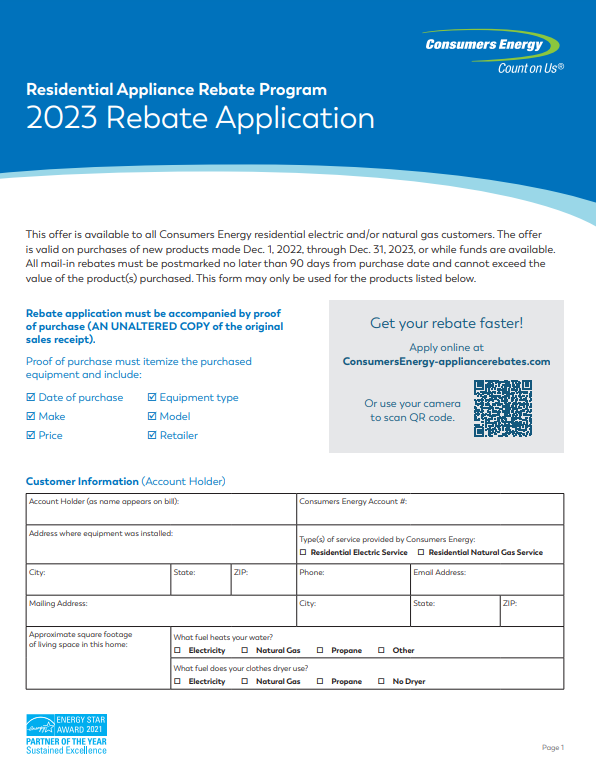

requirements for Consumers Energy rebate applications

If you’re interested in enhancing your home and reducing energy expenses, consider exploring Consumers Energy’s program. They offer a range of incentives that cover certain home remodeling products, making it an excellent opportunity to upgrade your house while saving on energy costs.

The program has a cap on participants, and applications are considered on a first-come, first-served basis. There are several specifications and guidelines to follow. Certain items and systems are not eligible for the rebate program, which is also subject to modification and termination without prior notice.

The conditions and requirements of the program should be understood before installing any energy-efficient products. You must must already be a Consumers Energy customer. You must have a domestic gas or electricity service to be eligible for the reimbursement. Second, the replacement product must be installed within two years. For each HVAC system or Wi-Fi connected thermostat, only one refund application may be submitted. Third, the rebate cannot be for more than the qualified product’s purchase price. You also need to provide evidence of purchase in order to get your rebate.

requirements for consumers to apply for energy in 2024

Taxes due as a result of refunds

Depending on your financial circumstances, you may or may not be able to receive your rebate. The rebate will pay for a certain amount of expenses. Your total credit will be equivalent to 5% of all project costs that are eligible. You have five years to use any remaining credit if you don’t use it all. Any unused credits may also be carried over for a subsequent year. Under this program, you may not claim tax credits for more than 50% of your qualified project expenditures.

You must make sure that the energy-saving measures you implemented adhere to all relevant laws, building codes, and zoning requirements before claiming your rebate. To confirm that the energy-saving measures you installed are legal, you should also contact your local government or utility company. You should confirm that any contractor you use to submit a rebate claim has a quality control post-installation inspection. ICF, the program’s implementer, is in charge of running the program. Additionally, it is crucial to confirm that you have a Material Receipt (MR) for the energy-saving goods and services you bought. The goods and services must have been acquired by you and given to the contractor. The price of those things must also be listed on your return receipts.