CVS Caremark Corporation Rebate – You power be curious to learn that the CVS Caremark Corporation has developed a new pricing model that is intended to provide you with a guaranteed net cost for all of your prescriptions. The recent Medicaid scandals, which have created a national discussion about how to address the high costs of prescription medications, have prompted the development of this new strategy.

In 2018, CVS Health expects to profit $300 million from prescription refunds.

It was reported by CVS Health, a business that specializes in pharmacy benefits management, that it anticipates making $300 million in prescription rebates in 2018. It will keep 2% and provide the remaining 98.8% to customers. This is a component of the latest health care reform plan presented by CVS CEO Jeffrey Smith.

Pharma companies offer rebates to PBMs. These businesses then pass the savings on to customers and insurers, sparking heated discussion. The Office of Management and Budget recently proposed altering the legal exemptions for refunds.

The discussion concerning escalating prescription prices has now turned to the topic of refunds. The argument that rebates raise prices has been refuted by CVS. The PBM is still a significant source of income for the business, though.

PBMs are coming under more and more pressure as the price of generic medications rises. Additionally, they are up against more opposition from online merchants like Amazon. Profit margins have decreased as a result.

Medicaid was not compensated by CVS Caremark for the cost of prescription drugs.

One of the biggest retail pharmacy chains in the US, owned by the CVS Caremark Corporation, has agreed to pay $4.2 million to resolve allegations of wrongdoing. The business will start by, among other things, giving members’ individual drug expenses real-time visibility, making it easier to dispense medication, and improving patient outcomes. Along with that, it recently disclosed that it would shortly begin processing prescriptions for Medicaid programs.

Along with the typical suspects, the business is currently settling a lawsuit with the federal government, as part of which it will pay $1.9 million to five states and another $1.02 million to a number of other organizations. The business will also offer a ton of other advantages, like a program to lessen fraud. It is undoubtedly the correct thing to do, even though it is difficult to estimate how many lives will be spared or how many more individuals will be in a better position.

The new “guaranteed net cost” pricing structure from CVS Caremark

The debut of CVS Caremark Corporation’s new “Guaranteed Net Cost” pricing model was recently announced. For insurance plan sponsors, this model’s emphasis on the net cost per claim offers certainty. Clients should save money overall thanks to the new paradigm for pharmacy benefits.

The majority of healthcare service costs are currently concealed from consumers. Health plans find it challenging to compare the prices of various PBMs as a result. In the long run, CVS wants to provide this pricing structure to all of its customers.

Under this system, CVS will transfer all rebates in full. It will also be accountable for adjustments to the drug combination. The projected changes in the prescription mix, wholesale price inflation, and plan utilization are used to determine the assured net cost model.

The new methodology will also assist plan sponsors in delivering savings through PBM cost management techniques. According to CVS, this will bring in an extra $750 million in revenue.

The new approach gives investors a great chance to generate outstanding returns. Over the next five years, EPS stands anticipated to develop at a synthesized annual pace of 7.2%.

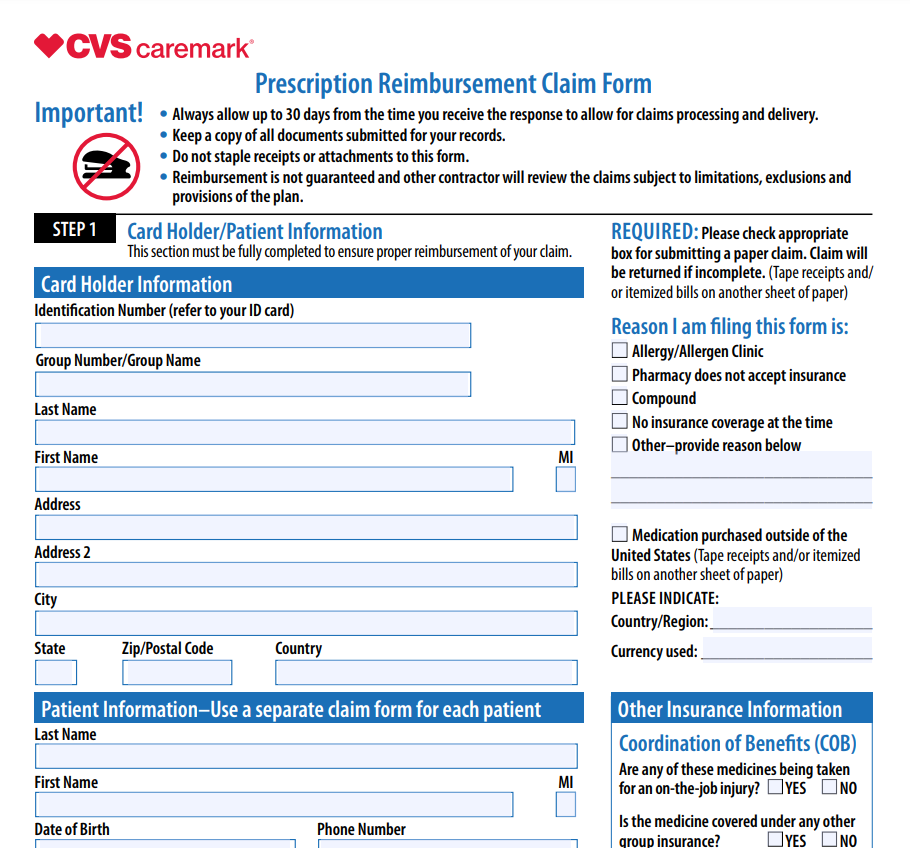

Download CVS Caremark Corporation Rebate Form 2024