Fuel Tax Rebate Form BC – If you own or lease a vehicle in the province of British Columbia, you may qualify for a fuel tax rebate. With the aid of this program, individuals with disabilities or other qualifying circumstances can get their fuel taxes reimbursed. It also offers a program for people with disabilities that helps people get back a portion of the federal excise tax on gasoline.

Fuel Tax Credit for ICBC

For those who live in British Columbia, it may be possible to get an ICBC fuel tax rebate. You will typically need to complete a rebate form and send it to ICBC. The rebate will be sent to you in the form of a cheque or direct deposit. In some cases, you can get the rebate through your credit card. However, you might have to wait until June to get the rebate if you don’t have a credit card.

The rebate is worth up to $110 for individual drivers, and $165 for commercial drivers. Since gas prices have been rising in recent months, it is crucial to lower the costs wherever possible. A rebate can help drivers pay off their gas bills, and B.C. has some of the highest gas prices in the country.

The amount of the rebate is based on the type of fuel you use. However, if you are disabled, you may be able to get up to $500 in annual reimbursement. Be sure to check with the BC as the amount you can receive will depend on the type of fuel you use. Ministry of Finance.

The government has implemented new policies that will increase the number of people who qualify. ICBC is increasing its eligibility criteria for its Disability Discount program. The modifications will enable disabled people to reduce their transportation expenses. Applicants will be notified by mail once the rebate is approved. However, keep in mind that each policy and driver is only eligible for one rebate.

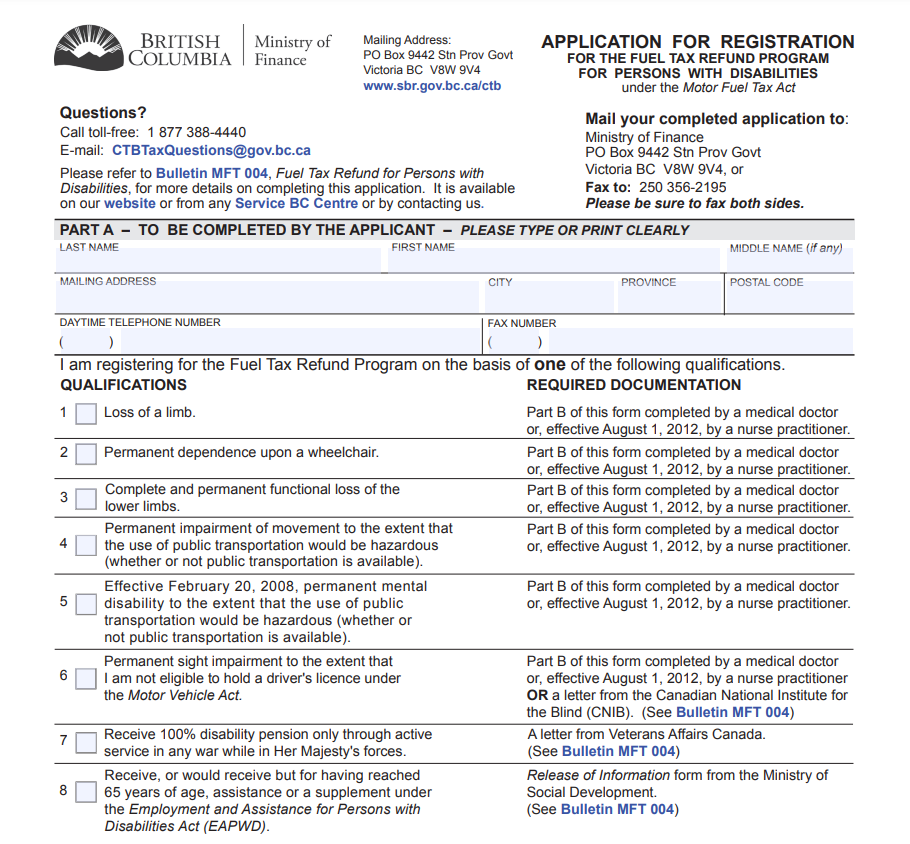

Program for persons with disabilities

In British Columbia, the Ministry of Finance runs a program that enables applicants with disabilities to request a fuel tax rebate. These individuals can request a refund for up to $500 per year, and can have their request backdated up to four years. The amount of the refund depends on the type of fuel that the person uses.

The fuel tax rebate program for persons with disabilities is aimed to help cut transportation costs for those with impairments. To apply, applicants must provide a valid driver’s license number. They must present a government-issued photo ID showing their legal name and date of birth if a driver’s license is unavailable. They must also fill out the vehicle ownership declaration. The vehicle can’t be registered to an incorporated company or association. Even if the vehicle is expired, a person may still be eligible for a fuel tax rebate.

Depending on the type of disability, you may be eligible for a fuel tax rebate of up to $500 a year. A few examples of qualifying impairments are the inability to walk farther than 100 meters, the need for a wheelchair for outside-the-home mobility, and the inability to dress oneself. Caregivers may also be allowed to claim a portion of the disability tax credit on behalf of their dependant or spouse.

refund of the federal gasoline excise tax

If you purchased gasoline from a retailer, you may qualify for a refund. The federal government offers a program that allows you to claim a portion of the gasoline excise tax. The government reimburses up to 1.5 cents per gallon and 0.15 cents every kilometer. You must file your claim within two years of the purchase date. The refund will only be issued to eligible claimants. Charitable organizations, legally recognized non-profits, and people who are permanently disabled from moving around are eligible claimants.

There are a number of exceptions to the federal excise tax on fuel. For example, certain types of farm equipment, some boats, and trains are exempt. If your fuel is used for these types of purposes, you should report these non-taxable expenses on Schedule C of Form 720.

If your firm uses huge amounts of fuel, you may qualify for a hefty rebate. The federal excise tax on gasoline is 18.3 cents per gallon, while the federal excise tax on diesel is 24 cents. Diesel fuel is exempt from the excise tax if it is used for off-road purposes. However, biodiesel manufacturers must file a tax return for over-road use.

You must submit Form MFR-21 in order to request your refund. Within six months of the date of purchase, the form must be submitted. The claim must be submitted separately for each retail location and be accompanied by a valid Sales Tax number.

Download Fuel Tax Rebate Form BC 2025