Property Tax Rebate Form 2024 – In the realm of property ownership, taxes are an inevitable part of the equation. However, for many property owners, there exists the possibility of receiving a welcome relief in the form of property tax rebates. As we delve into the specifics of the Property Tax Rebate Form 2024, it’s essential to grasp the significance of this document and how it can potentially alleviate financial burdens for eligible individuals.

Understanding Property Tax Rebates

What are Property Tax Rebates?

Property tax rebates are refunds or reductions in property taxes that certain homeowners may qualify for based on specific criteria. These rebates serve as a means of providing relief to property owners, particularly those who may be experiencing financial strain.

Importance of Property Tax Rebates

Property tax rebates play a crucial role in easing the financial obligations of homeowners, particularly during times of economic uncertainty or hardship. By offering potential refunds or reductions, these rebates can significantly impact the financial well-being of eligible individuals and families.

How to Qualify for a Property Tax Rebate

Eligibility Criteria

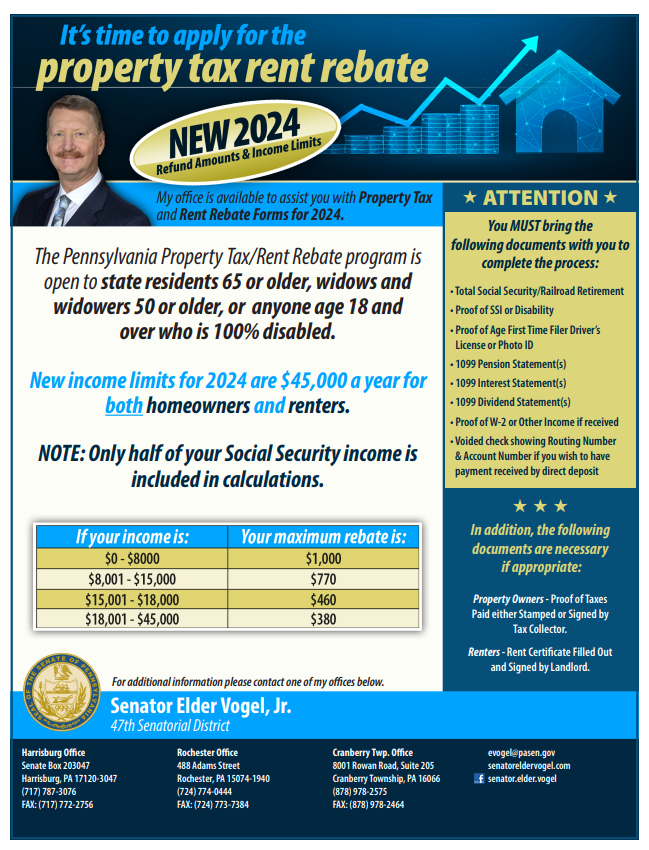

To qualify for a property tax rebate, individuals must typically meet specific eligibility criteria outlined by local tax authorities. These criteria may include factors such as income level, property value, and residency status.

Documentation Required

In addition to meeting eligibility criteria, applicants are often required to provide supporting documentation to substantiate their claims. This documentation may include proof of income, property ownership documents, and other relevant paperwork.

Steps to Fill Out the Property Tax Rebate Form 2024

Gathering Necessary Information

Before filling out the Property Tax Rebate Form 2024, it’s essential to gather all necessary information and documentation to ensure accuracy and completeness. This may include recent tax statements, income documents, and property assessment details.

Completing the Form Correctly

When filling out the form, it’s crucial to pay close attention to instructions and provide accurate information. Any errors or omissions could result in delays or potential rejection of the rebate application.

Common Mistakes to Avoid When Filling Out the Form

When filling out the Property Tax Rebate Form 2024, here are some common mistakes to avoid:

- Inaccurate Income Reporting: Ensure that you report your income accurately. Mistakes such as misreporting income figures or failing to include all sources of income can lead to delays or even denial of your rebate.

- Missing Documentation: Be sure to include all required documentation with your form. This may include proof of income, property ownership documents, or any other supporting materials requested. Missing documentation can result in your application being deemed incomplete.

- Overlooking Eligibility Criteria: Review the eligibility criteria carefully before filling out the form. Ensure that you meet all requirements, such as income thresholds, property ownership status, and residency requirements. Failing to meet eligibility criteria can disqualify you from receiving the rebate.

- Incomplete Form Submission: Fill out the form completely and accurately. Missing information or leaving sections blank can lead to processing delays or rejection of your application. Double-check your form before submission to ensure all fields are filled out properly.

- Incorrect Contact Information: Provide accurate contact information so that the authorities can reach you if they have any questions or need additional information regarding your application. Incorrect contact information can lead to communication issues and delays in processing your rebate.

- Not Reviewing Before Submission: Take the time to review your completed form before submitting it. Look for any errors or inconsistencies and make corrections as needed. A thorough review can help prevent mistakes that could impact the processing of your rebate application.

By avoiding these common mistakes, you can increase the likelihood of a smooth and successful application process for the Property Tax Rebate Form 2024.

Benefits of Claiming a Property Tax Rebate

Claiming a property tax rebate offers numerous benefits for eligible homeowners:

- Financial Relief: Perhaps the most obvious benefit is the financial relief it provides. Property taxes can be a significant expense for homeowners, especially those on fixed incomes or with limited resources. A rebate reduces the overall burden of property taxes, freeing up funds for other essential expenses or savings.

- Improved Budgeting: By lowering property tax expenses through a rebate, homeowners can better budget their finances. Knowing that they have a rebate to offset a portion of their property taxes allows for more accurate financial planning and reduces the risk of unexpected financial strain.

- Reduced Financial Stress: Property taxes can sometimes create financial stress, particularly for homeowners facing economic challenges. Claiming a rebate eases this stress by providing a form of financial assistance, making it easier for homeowners to meet their tax obligations without sacrificing other necessities or dipping into savings.

- Encourages Homeownership: Property tax rebates can serve as an incentive for homeownership, especially for individuals or families considering purchasing a home. Knowing that they may be eligible for a rebate can make homeownership more financially feasible and attractive, encouraging individuals to invest in real estate.

- Supports Local Economy: In some cases, property tax rebates may come with stipulations requiring homeowners to spend the rebate money within the local community. This can have a positive impact on the local economy by stimulating spending at local businesses and supporting job growth.

- Social Equity: Property tax rebates can promote social equity by providing relief to homeowners who may be struggling financially or facing disproportionate tax burdens. Rebates help ensure that property taxes remain fair and equitable for all homeowners, regardless of their income level or financial circumstances.

Overall, claiming a property tax rebate offers significant benefits for eligible homeowners, ranging from financial relief and improved budgeting to reduced stress and support for homeownership.

Deadline and Submission Process

Understanding the deadline and submission process is crucial when applying for the Property Tax Rebate Form 2024:

- Deadline Awareness: Familiarize yourself with the deadline for submitting the rebate form. Missing the deadline could result in forfeiture of eligibility for the rebate, so it’s important to mark the date on your calendar and ensure you submit your application on time.

- Adhering to Guidelines: Follow any specified guidelines for submission provided by the relevant authorities. These guidelines may include instructions on how to complete the form, what documents to include, and where to submit the application. Adhering to these guidelines will help ensure that your application is processed correctly and efficiently.

- Submission Methods: Determine the accepted methods of submission for the rebate form. This could include submitting the form online through a designated website, mailing it to a specific address, or delivering it in person to a designated office. Choose the method that is most convenient for you but ensure that you follow any instructions provided for that submission method.

- Confirmation of Receipt: If possible, request confirmation of receipt for your application. This could be in the form of a confirmation email, a stamped receipt if submitting in person, or a tracking number if mailing the application. Having confirmation of receipt provides peace of mind and serves as evidence that your application was submitted on time.

- Proactive Approach: Take a proactive approach to ensure you meet the deadline and follow the submission process accurately. Start gathering necessary documents and information well in advance of the deadline to avoid any last-minute rush or potential issues.

By being aware of the deadline, adhering to submission guidelines, choosing the appropriate submission method, seeking confirmation of receipt, and taking a proactive approach, you can ensure a smooth and successful submission process for the Property Tax Rebate Form 2024.

Conclusion

In conclusion, the Property Tax Rebate Form 2024 serves as a valuable resource for eligible homeowners seeking relief from property tax burdens. By understanding the eligibility criteria, filling out the form accurately, and adhering to submission deadlines, individuals can potentially benefit from rebates that alleviate financial strain.

Download Property Tax Rebate Form 2024

Frequently Asked Questions (FAQs)

- What is a property tax rebate form?

- A property tax rebate form is a document provided by tax authorities that allows eligible homeowners to apply for refunds or reductions in property taxes based on specific criteria.

- Who is eligible to claim a property tax rebate?

- Eligibility for a property tax rebate varies depending on factors such as income level, property value, and residency status. It’s essential to review eligibility criteria outlined by local tax authorities.

- How can I obtain a property tax rebate form?

- Property tax rebate forms are typically available through local tax offices or government websites. Alternatively, individuals may contact their local tax authorities for assistance in obtaining the necessary forms.

- When is the deadline to submit the property tax rebate form?

- The deadline for submitting the property tax rebate form may vary depending on location and specific guidelines set forth by local tax authorities. It’s crucial to adhere to any specified deadlines to ensure eligibility for the rebate.

- What happens if I make a mistake on my property tax rebate form?

- Making errors on the property tax rebate form could result in delays or potential rejection of the application. It’s essential to carefully review the form and provide accurate information to avoid any issues during the processing.