80d Rebate – When it comes to financial planning and saving on taxes, understanding the various deductions and rebates available under the Income Tax Act is essential. One such provision that can significantly benefit individuals and families is the 80D Rebate. In this article, we’ll delve into the details of 80D Rebate, explaining what it is, who is eligible for it, the types of insurance it covers, and much more.

What is 80D Rebate?

The 80D Rebate is a tax benefit provided under the Income Tax Act for the premiums paid on health insurance policies. It allows taxpayers to reduce their taxable income by the amount they spend on health insurance premiums for themselves and their family members.

Eligibility for 80D Rebate

To be eligible for the 80D Rebate, you must be an individual or a Hindu Undivided Family (HUF) that has purchased health insurance for yourself, your spouse, children, and parents. This means that both salaried individuals and self-employed individuals can avail of this tax benefit.

Types of Insurance Covered

The 80D Rebate covers various health insurance policies, including individual health plans, family floater policies, senior citizen health plans, and critical illness plans. This means you have the flexibility to choose the insurance policy that best suits your needs and still enjoy tax benefits.

Maximum Deduction Limits

Under the 80D Rebate, the maximum deduction allowed is based on the age of the insured individuals. For individuals below 60 years, the maximum deduction is ₹25,000, and for senior citizens, it’s ₹50,000. Additionally, an extra ₹25,000 can be claimed for policies covering senior citizen parents.

Premium Payments and Tax Benefits

Premium payments for health insurance not only provide financial security in times of medical emergencies but also offer significant tax benefits. The premium you pay is deducted from your taxable income, reducing the overall tax liability.

The Importance of Health Insurance

Having health insurance is crucial not only for the financial benefits but also for the peace of mind it provides. With rising healthcare costs, a health insurance policy can ensure that you and your loved ones receive the best medical care without straining your finances.

Tax Planning with 80D Rebate

Tax planning is an essential part of financial management. The 80D Rebate allows you to plan your taxes effectively while safeguarding your family’s health.

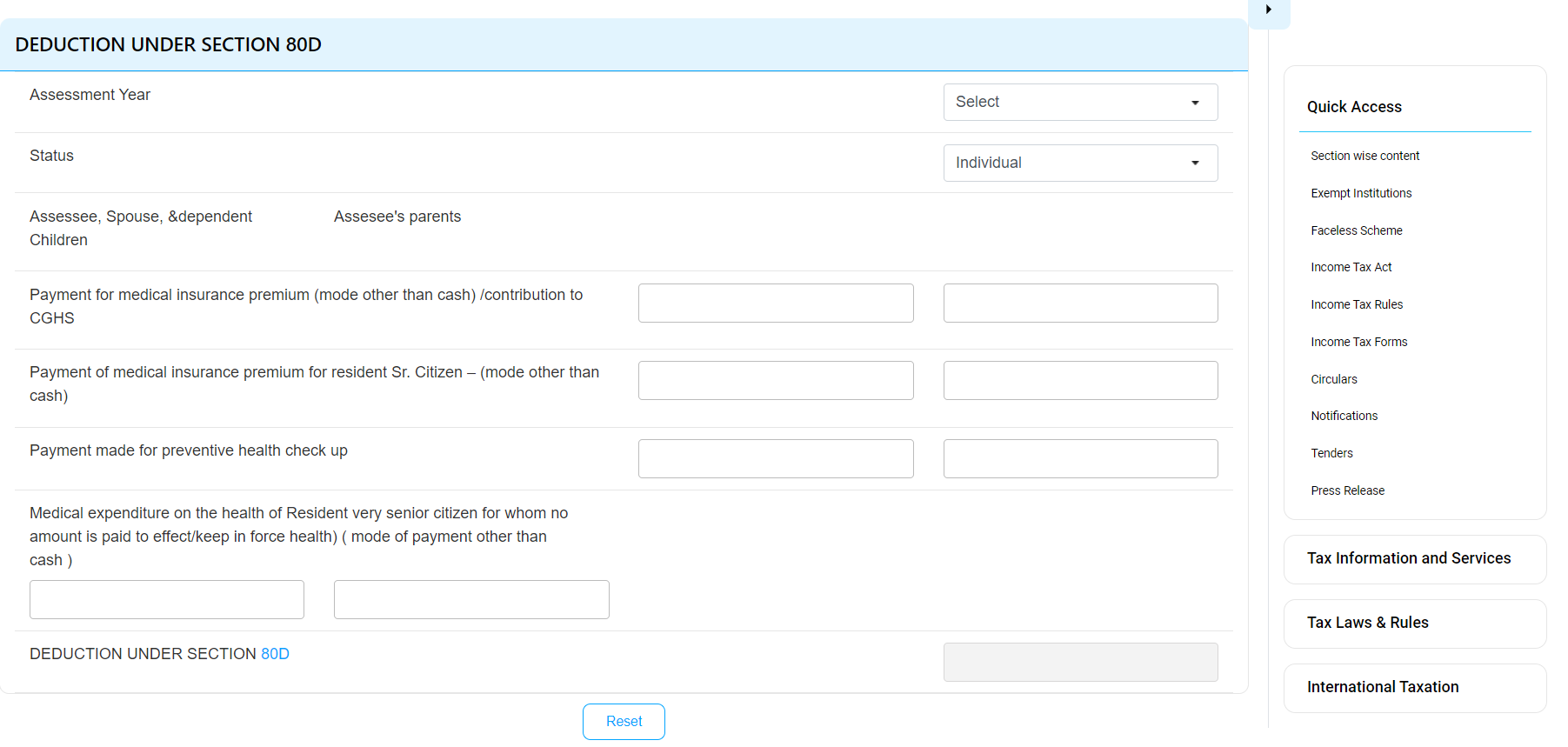

How to Claim 80D Rebate

To claim the 80D Rebate, you need to keep a record of the premium payments and provide the necessary details when filing your tax return. Make sure to retain all the receipts and documents related to your health insurance policy.

Common Misconceptions

There are several misconceptions regarding 80D Rebate. Some individuals believe that health insurance premiums are not tax-deductible, which is far from the truth. This section will address some of these common misconceptions.

80D Rebate vs. 80C Deductions

It’s important to differentiate between the 80D Rebate and 80C deductions. While 80C deductions cover various investments and expenses, the 80D Rebate is specific to health insurance premiums. Understanding this difference is crucial for effective tax planning.

Importance of Regular Premium Payments

To enjoy the tax benefits of 80D Rebate, it’s essential to make regular premium payments. Missing payments can lead to policy lapses and a loss of tax benefits.

Factors Affecting 80D Rebate

Various factors can impact the amount you can claim under the 80D Rebate, including the type of policy, the number of family members covered, and the sum insured. It’s important to consider these factors when choosing a health insurance plan.

Comparing Different Health Insurance Plans

Choosing the right health insurance plan can make a significant difference in your financial security and tax planning. Compare different plans to find the one that suits your needs and budget.

Conclusion

In conclusion, the 80D Rebate is a valuable tax benefit that encourages individuals and families to prioritize their health. By investing in health insurance and making regular premium payments, you not only protect your loved ones but also reduce your tax liability.