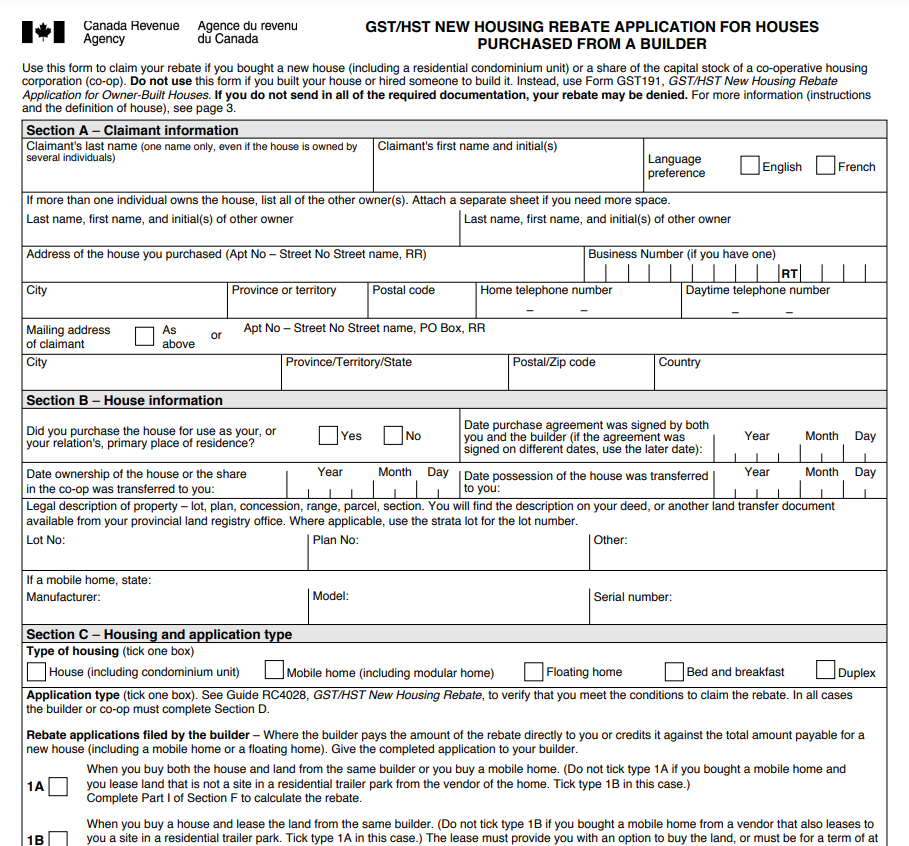

GST New Housing Rebate Form – You must complete the necessary form in order to request a GST New Housing Rebate. You must be aware of a few things before completing the form. These include the type of application, the maximum price for a home, and the specified interest rate. Don’t forget to add the applicant’s name.

Type 5 of Application

You might be qualified for a GST/HST new housing rebate if you recently bought a new home in Ontario. The house must have a fair market value between $350,001 and $449,999 in order to be eligible. The expansion also needs to be substantial enough to qualify as a new construction. Therefore, a family room, sunroom, or porch will not be considered.

Two years following the ownership transfer date, you have up to apply for the reimbursement. You must take care to finish the application form, though. Applications that are not complete may be rejected. Additionally, you may only submit a rebate application once for each home you own. You must submit a different form for each property if you want to claim your rebate more than once.

Minimum interest rates

You might be qualified for the GST/HST new housing refund if you’re looking to buy a new house. You must complete and submit two forms on the government website in order to request this reimbursement. The second form is the actual application, while the first form demonstrates how to compute your rebate. You’ll also need to complete another form if you reside in a province that deducts provincial taxes. Within two years after the home’s purchase, both documents must be delivered to tax centers.

Price cap on new homes

You might be qualified for a GST/QST/HST rebate if you’re looking to buy a new house in Ontario. Up to a federal cap of $400,000, the rebate amount is based on 6% of the home’s sale price. The reimbursement amount is $24,000 for the first two years, then it steadily reduces.

New homeowners are eligible for the new housing rebate. If you’re searching for a new house in Ontario, you can complete the application to receive a rebate of up to $24,000. The amount of your claim will depend on the home’s fair market value and whether any improvements have been made.

Candidate’s name

Filling out an application form is required when requesting the GST/HST new house rebate. You could also have to present evidence of your occupancy. A single rebate application is allowed per home. Two years following the new home’s base date is when applications must be submitted.

Two forms must be submitted: one demonstrates how your rebate was calculated, and the other is your application. If you subtracted provincial taxes from the transaction, you might additionally need to complete a separate form for your province. You should mail both forms to your neighborhood tax office.

purchase of a mobile home or floating home by two or more people

A new housing rebate can be available to you if you recently purchased a mobile or floating house. However, you must be certain that the home serves as your principal dwelling. In other words, it needed to have at least a 90% renovation. There are several ways to tell if a house has been remodeled. Comparing the number of bedrooms and square footage is one of them. Only one person may submit the form for the new housing refund, and you must be the registered owner of the mobile home or floating home.

To claim the federal and provincial components of HST on a mobile or floating home, utilize the new housing rebate form. The house’s FMV must be in the range of $350,001 and $449,999. When filling out the form, you must account for the value of the land and any additions done to the house.

Download GST New Housing Rebate Form 2024