The Government of Canada’s introduction of the Grocery Rebate as part of Budget 2024 is a significant step towards providing financial aid to eligible Canadians. This timely initiative aims to alleviate the financial burden faced by many individuals and families, particularly in these challenging times. With the Rebate set to be issued on July 5, 2024, alongside the next quarterly GST/HST credit payment, it promises to provide much-needed relief and support for purchasing essential groceries. Let us delve deeper into the details of this program and explore how it will benefit eligible Canadians across the country.

The Grocery Rebate, an exciting opportunity for individuals, will be a generous offering that is equivalent to double the GST/HST credit amount you received for January 2024. This extraordinary initiative aims to provide you with even more financial support and alleviate the burden of grocery expenses. By availing this rebate, you can enjoy an enhanced purchasing power, making your grocery shopping experience not only convenient but also cost-effective. Don’t miss out on this fantastic chance to stretch your budget and make every dollar count!

Who can get the payment

As the recipient of the GST/HST credit for January 2024, you will also be eligible to receive the Grocery Rebate. This additional benefit ensures that you can enjoy extra savings on your grocery purchases.

Make sure to file your 2021 tax return, even if you didn’t earn any income, in order to claim the Grocery Rebate. This requirement ensures that everyone has an equal opportunity to receive this valuable benefit.

Please take note that you might be eligible for the Grocery Rebate, but not necessarily for the July GST/HST credit or vice versa. The Grocery Rebate is determined using the information from your 2021 tax return, while the next quarterly GST/HST credit payment in July 2024 will be calculated based on your 2024 tax return. To find out more details, please refer to your Notice of (Re)determination.

Eligibility criteria

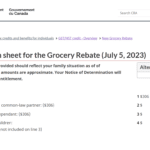

The eligibility criteria for the 2021 base year rebate is an important consideration for individuals and their spouses or common-law partners. By meeting these criteria, you can qualify for this valuable rebate and enjoy the financial benefits it offers. This introduction will outline the eligibility requirements and emphasize the importance of meeting them to take advantage of this opportunity.

Payment details

Are you looking for a way to stretch your budget and save more on your groceries? Look no further! Starting from January 2024, the Grocery Rebate program will be doubling the amount of your GST/HST credit payment. This means that you’ll receive even more financial assistance to help cover the cost of your groceries. The best part? The amount you receive is based on your family situation in January 2024 and your 2021 adjusted family net income, ensuring that it’s tailored to meet your specific needs. In this introduction, we’ll explore how this exciting initiative can help you save money and make grocery shopping more affordable than ever before.

You have the opportunity to receive a generous maximum payment of up to:

If you are single

- $234 (no children)

- $387 (with 1 child)

- $467 (with 2 children)

- $548 (with 3 children)

- $628 (with 4 children)

If you’re in a committed relationship or living together as a couple

- $306 (no children)

- $387 (with 1 child)

- $467 (with 2 children)

- $548 (with 3 children)

- $628 (with 4 children)

Simple steps to accurately calculate your Grocery Rebate payment

By following these guidelines, you can ensure that you receive the maximum amount of money back from your grocery purchases.

The Grocery Rebate program is a valuable initiative aimed at helping individuals and families save money on their grocery expenses. If you received your GST/HST credit payment as a lump sum in July 2024, rest assured that you are still eligible to benefit from this program. By taking advantage of the Grocery Rebate, you can stretch your budget further and ensure that your grocery shopping remains affordable without compromising on quality or nutrition. In this introduction, we will explore the details of the Grocery Rebate program and highlight how it can provide significant savings for those who received their GST/HST credit payment as a lump sum in July 2024.

By applying tax refunds, benefit, and credit payments towards outstanding balances, you can effectively manage your financial obligations. To stay informed about the status of your benefits, simply log into your CRA My Account for real-time updates. Contact the CRA if debt repayment causes you financial hardship. Call 1-888-863-8662 for benefit debt or 1-888-863-8657 for tax return debt. Learn more at Canada.ca/balance-owing.

Payment Date

The Grocery Rebate will be issued on July 5, 2024.

If you do not receive the Grocery Rebate on the expected date, please wait 10 business days before you Canadian government.

We also encourage you to review your Notice of Redetermination for more information about how much you are entitled to receive and when, and any changes to your payments. If you are signed up for My Account, you can find your Notice by clicking on the “Mail” link.