Iowa Rent Rebate Form 2025 – You qualify for rent reimbursement through the Iowa IRS if you have resided in an apartment for more than six months. Although the procedure is a little challenging, it is worthwhile. Three months is not out of the question. Keep in mind that Community Action has no influence over the repayment procedure.

Credit for Recovery Rebates

If you meet the eligibility requirements, there is a tax benefit known as the Recovery Rebate Credit that you should definitely take advantage of. This credit is based on factors such as the number of dependents you have, your income, and your 2025 tax return. If your income falls within a lower bracket, there’s a possibility for you to claim extra stimulus funds. Don’t miss out on this opportunity to potentially boost your financial situation!

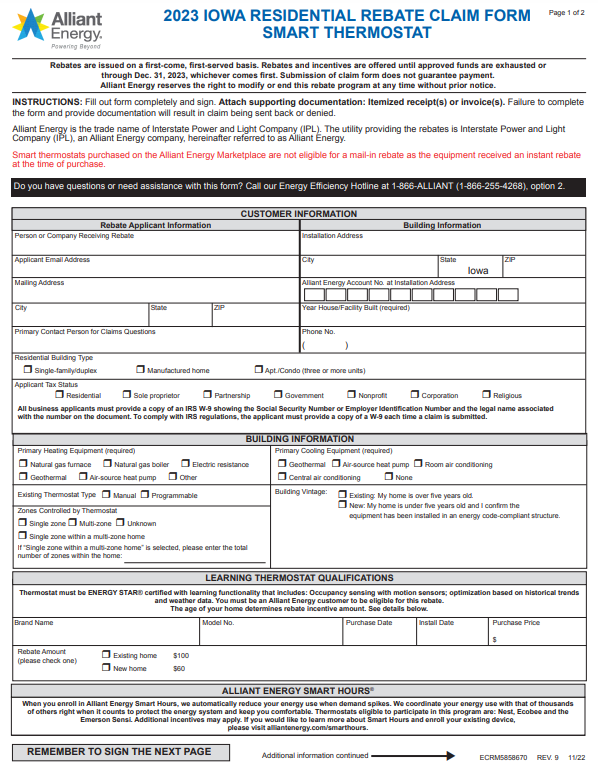

The Rent Rebate Form 2025 must be completed in order to request this tax relief. The IRS is in charge of approving or rejecting the reimbursement. The processing of the refund could take up to three months. The rent reimbursement will be emailed right to you once it has been approved.

Compensation claims

You can claim up to $1,000 for rent that qualifies if you are eligible to apply for Iowa rent reimbursement. Low-income folks, pensioners, and those with disabilities who reside in appropriate housing are all eligible for the program. To be eligible, you must also pay property taxes and be an Iowa resident.

You can submit reimbursement claims online or download the relevant paperwork from the Where’s My Rent Rebate? website. You must be at least 65 years old, at least 18 years old, or disabled to be eligible to apply for rent reimbursement. Additionally, you can be qualified for lower tax rates or a property tax credit if you reside in a mobile home on a rented land.

Payment procedure

You might be qualified for rent assistance if you reside in a qualifying apartment or house. Low-income individuals, elderly, and people with disabilities who pay property taxes and reside in an apartment that qualifies for affordable housing are eligible for this program. You must complete a rent rebate form in order to be eligible for the program.

There are various required fields on the claim form. In order for the refund to be directly paid into your account, you must fill out the form with information about your bank account. The form also requires your signature and phone number for information verification. You can start the refund process after you have signed and returned the paperwork.

If you live in Iowa, you might be eligible for a rent credit or a property tax credit. Both initiatives will lower your upcoming property tax obligations. To qualify, you must be at least 65 years old or have a disability. If your mobile home is on a rented lot, you might be able to qualify for a reduced tax rate for it.

Submission cutoff

You must submit an Iowa rent rebate form if you require rent assistance in order to be reimbursed. You must submit this form together with documentation of your income sources and rent payments. It’s crucial to include your entire name and disability documentation. You must also submit your spouse’s information if you’re married.

You must submit your paperwork between January 1 and June 1 of 2025 if you reside in a care facility. In order to be eligible for rent assistance, you must be 65 years of age or older or have a disability. Additionally, you can be eligible for a property tax benefit if you own a mobile home. Your mortgage payments may be partially or entirely offset by this credit.