Kemp Property Tax Rebate – Are you a homeowner looking for ways to reduce your property tax burden? If so, the Kemp Property Tax Rebate could be the answer you’ve been searching for. In this comprehensive guide, we will explore the intricacies of the Kemp Property Tax Rebate, its benefits, eligibility criteria, and how to apply for it. By the end of this article, you’ll have a clear understanding of how this rebate can help you save money and make homeownership more affordable.

Property taxes are a significant expense for homeowners, and they can sometimes become a financial burden. The Kemp Property Tax Rebate is a government initiative designed to alleviate this burden by providing financial relief to eligible homeowners.

What is a Property Tax Rebate?

A property tax rebate is a refund or reduction in property taxes provided by the government. It’s a way to give back to homeowners and ease the financial strain associated with property ownership. The Kemp Property Tax Rebate is named after its proponent, Governor John Kemp, who recognized the need to support homeowners in the face of rising property taxes.

The Benefits of the Kemp Property Tax Rebate

The benefits of the Kemp Property Tax Rebate are manifold. Not only does it provide direct financial relief to homeowners, but it also stimulates local economies by increasing disposable income. By reducing the financial stress of property taxes, homeowners can allocate those funds to other essential needs, such as home improvements, education, or healthcare.

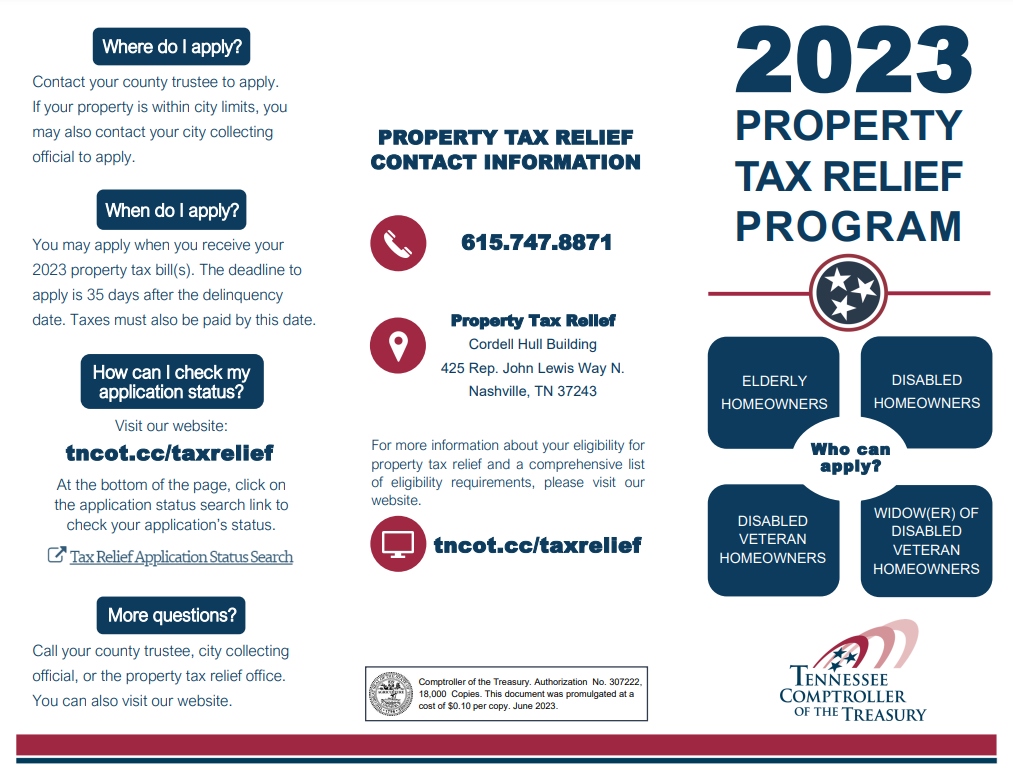

Eligibility Criteria for the Rebate

To qualify for the Kemp Property Tax Rebate, homeowners must meet certain criteria. These criteria typically include property value, residency, and income thresholds. It’s essential to understand these criteria before applying to ensure you meet the requirements.

How to Apply for the Kemp Property Tax Rebate

Applying for the rebate is a straightforward process, but it’s crucial to gather all necessary documents and information before starting your application. We’ll guide you through the application process, ensuring you have everything you need to complete it successfully.

Understanding the Application Process

The application process involves submitting your property and financial details to the relevant government agency. Once your application is approved, you can expect to receive the rebate, which will directly reduce your property tax burden.

How the Rebate Impacts Homeowners

The Kemp Property Tax Rebate has a substantial impact on homeowners’ financial well-being. It helps to secure their homes, improve their quality of life, and encourages responsible property ownership.

The Economic Impact of Property Tax Rebates

Property tax rebates, such as the Kemp Property Tax Rebate, have a broader economic impact. They stimulate local economies by injecting funds into communities, creating a positive cycle of growth and prosperity.

Successful Case Studies

Real-life examples of homeowners benefiting from the Kemp Property Tax Rebate serve as inspiration for others. We will delve into some success stories and how the rebate transformed their lives.

The Future of Property Tax Rebates

As property taxes continue to be a concern for homeowners, the future of property tax rebates becomes increasingly significant. We’ll explore potential developments and improvements in property tax relief programs.

Tips for Maximizing Your Rebate

To make the most of the Kemp Property Tax Rebate, we provide some practical tips and strategies for homeowners. These tips can help you maximize your savings and improve your financial well-being.

Conclusion

In conclusion, the Kemp Property Tax Rebate is a valuable resource for homeowners looking to reduce their property tax burden and improve their financial stability. By taking advantage of this rebate, you can enjoy the benefits of property ownership without the excessive financial strain.