Kohl’s Corporation Rebate – The 1901-founded, family-owned Kohl’s Corporation is well-known for its inexpensive apparel, home goods, and food offerings. In actuality, the company’s proprietary brands account for about half of its yearly sales. However, activist investors have started calling for changes in the business’s management, which has put the shares of the company under examination.

Investor activists want new leadership in place.Activist investors are putting more and more pressure on Kohl’s Corporation, a well-known network of department stores. These shareholders want the company’s leadership to change. Additionally, they are promoting the company’s sale.

Hedge fund investors have targeted Kohl’s on several occasions. The business turned down an offer from Acacia Research in June. The company made a $64 per share purchase offer for the shares. At that cost, the firm would be valued at $9 billion.

Kohl’s largest shareholder, Ancora Holdings Group, LLC, holds 2.5 percent of the company’s stock. It is advocating the removal of the CEO and board chairman. Macellum Advisors, another activist investor, has a 5% investment in the store.

Recently, Kohl’s has brought up the idea of selling the business to private equity groups. However, the board voted against it due to the unstable state of the stock market.

Kohl’s includes existed under stress from activist investors to take significant action to compete with rivals. This has included the company’s sale or the spinoff of its online store.

The corporation is surrounded by activist investors.

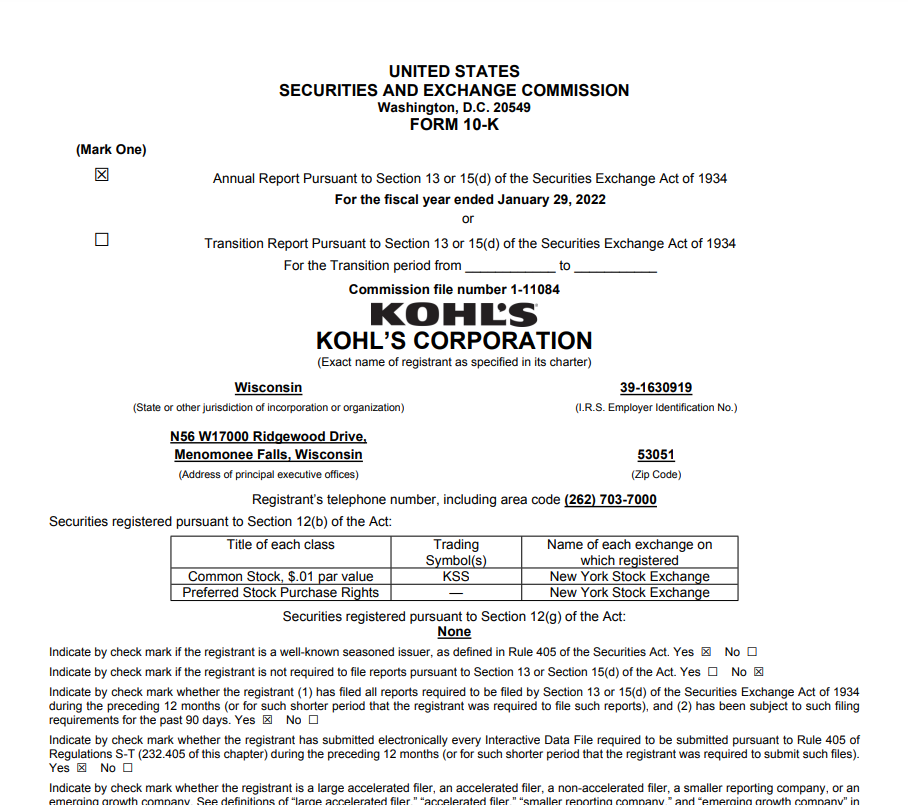

A sizable department store chain with locations in more than a dozen states is called Kohl’s Corporation. Activist investors have been putting pressure on it for the past year. A few of the activist investors have been urging management changes at the corporation.

Jonathan Duskin established the hedge fund Macellum Capital Management in 2009, and it is one of the activists. For months, the hedge fund has openly criticized the corporation.

The business revealed its intentions to increase its share repurchase program to $2 billion earlier this month. The bottom line, however, has not been much impacted by the initiatives. As a result, the business is currently starting over.

This is Kohl’s management’s most recent action to counteract pressure from activist investors. Margaret Jenkins, a former Denny’s CMO, was just added to Kohl’s board, according to Bloomberg.

A $9 billion deal from activist hedge fund Starboard Value LP was turned down by Kohl’s in January. However, Sycamore Partners’ counteroffer was also taken into account.

Nearly half of the company’s yearly revenues are from private brands.

A successful private labeling strategy can result in significant sales. A high-quality product may boost a retailer’s attractiveness to customers, whether it’s a new brand or a carefully selected one that’s already on the market. Additionally, it might improve a retailer’s rapport with well-known producers.

Over the past 20 years, private labels have expanded in popularity in the US. Additionally, they’re being accepted into more categories. This covers alcohol, soft drinks, and medication. It’s interesting that the food sector is experiencing the biggest increase. Retailers have started to profit from their popularity, so they are no longer merely a commodity.

Some merchants have enthusiastically embraced the idea. As an illustration, Wal-Mart Stores is now among the top 10 food retailers in the United States. As a result, brand-name goods producers can’t help but worry about their adversary.

Not every store benefits the most from private labels. For instance, some customers have high standards and expect a business to have the greatest and most well-known national brands in their niche. Unfortunately, if a business doesn’t carry these brands, customers will probably go to a different one.

The business’s approach won’t alter how customers see it.

Sales at Kohl’s Corporation (KSS) fell 7% in the third quarter. Despite a little improvement over the prior year, this is a significant fall. As a result, the business has lowered its outlook. According to the revised projection, normalized profits per share would decline by 59% in FY 2021.

The corporation also mentioned that inflation is slowing down sales growth when it announced the cut. The effects are severe for a retail business that serves middle-class customers. For the balance of the year, client demand is also weak.

The management of Kohl’s is engaged in a proxy battle with Macellum Capital Management, an activist investment company. As the third-largest stakeholder in Kohl, Macellum has redoubled efforts to influence the company’s course.

Macellum has been advocating for significant reforms at Kohl’s through an investment fund. They think that the business’s strategy has to be altered since it isn’t working.

Download Kohl’s Corporation Rebate Form 2025