Minnesota Renters Rebate 2025 – Discover the benefits of the Minnesota Renters Rebate, a fantastic opportunity for tenants to enjoy some financial relief. By qualifying for this program, not only can you experience a more manageable life with reduced rent, but you can also put some extra money in your pocket. It’s an excellent way to lighten the financial burden and enhance your overall quality of living.

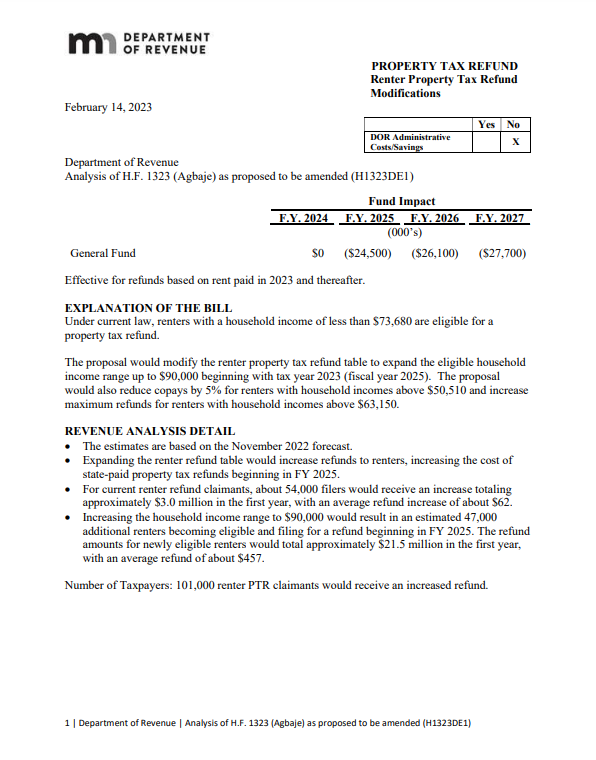

Your potential refund depends on your income and the rent you paid throughout the year. To claim this credit, simply complete the M1PR form alongside your Certificate of Rent Paid (CRP) and submit them to the Minnesota Department of Revenue. Don’t miss out on this opportunity to potentially receive some well-deserved money back in your pocket!

What is Minnesota Renters Rebate?

The Minnesota Renters Rebate gives tenants a partial reimbursement for the property taxes they indirectly pay via their rent, based on their income and the amount of rent paid. Anyone who leases a property tax-paying unit and resides in Minnesota or is in the state for at least 183 days during the tax year is eligible for this reimbursement. The refund is not given to the government, a private college, or any other organization that is exempt from paying real estate taxes or making payments in lieu of taxes. Please get in touch with the building owner if you include any queries regarding your eligibility.

Many of the 314,000 families who qualify for the Renters Credit are made up of elderly or disabled individuals who require additional assistance to satisfy their basic necessities. Strengthening the renter’s credit is a crucial step toward advancing racial justice and easing the financial strain on disadvantaged populations.

How to Track Minnesota Renters Rebate

One of the biggest initiatives for reducing property taxes in the state is the Minnesota Renters Rebate. It is intended to assist tenants who are having a difficult time paying their property taxes, many of whom are elderly or disabled. You must submit a tax return and settle any past-due property taxes in order to be eligible for the reimbursement. The Department of Revenue website can help you determine your eligibility. For free assistance, go to AARP Foundation Property Tax Aide. The Renters Rebate and all of our other well-liked property tax relief programs are still open for applications.