Missouri Rent Rebate Form 2025 – The Missouri Rent Rebate Program is a vital initiative aimed at providing financial assistance to eligible residents facing challenges in meeting their rental obligations. As we dive into the details of the Missouri Rent Rebate Form for the year 2025, it’s essential to understand the intricacies of this program to maximize its benefits.

The Missouri Rent Rebate Program serves as a lifeline for individuals and families grappling with the financial strain of renting a home. In 2025, this program continues its mission of alleviating the burden on eligible residents through targeted financial assistance.

Eligibility Criteria

Before proceeding with the application process, it is essential to understand the eligibility criteria. The program takes into account factors such as income, residential status, and other qualifications. Familiarizing yourself with these requirements is crucial for a seamless application process.

Application Process

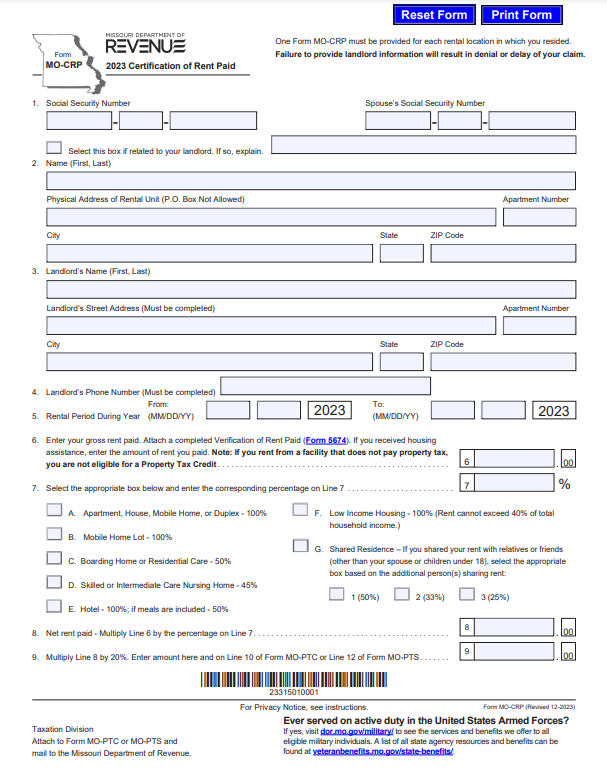

Here’s a step-by-step guide on how to locate and fill out the Missouri Rent Rebate Form 2025 for financial relief:

- Step 1: Access the Form Visit the official website of the Missouri Department of Revenue or the relevant state agency responsible for rent rebate programs. Look for a section related to tax credits or property tax relief. You can also try searching for “Missouri Rent Rebate Form 2025” in your preferred search engine.

- Step 2: Download the Form Once you’ve located the appropriate section, find the 2025 Rent Rebate Form. Download it in PDF format to ensure you have the correct and official version.

- Step 3: Read Instructions Before you start filling out the form, carefully read the accompanying instructions. These guidelines will provide essential information on eligibility criteria, required documentation, and specific details needed for accurate completion.

- Step 4: Gather Necessary Information Collect all the required information and documents before you begin filling out the form. This may include details about your rental agreement, income statements, and any other supporting documents mentioned in the instructions.

- Step 5: Fill Out the Form Complete the form accurately and legibly. Ensure that all required fields are filled in, and double-check your entries to avoid errors. If a section does not apply to your situation, mark it appropriately or write “N/A” (not applicable).

- Step 6: Attach Supporting Documents As per the instructions, attach any necessary supporting documents. This may include proof of income, rental agreements, or other documentation that validates the information provided on the form.

- Step 7: Review the Form Before submitting the form, carefully review all the information you’ve entered. Make sure there are no typos, missing details, or inconsistencies. A thorough review will help prevent processing delays.

- Step 8: Submit the Form Follow the submission instructions provided on the form or the agency’s website. This may involve mailing the form and documents to a specific address or submitting them electronically through an online portal.

- Step 9: Record Confirmation If available, make note of any confirmation number or acknowledgment provided upon submission. This will be useful for tracking the status of your application.

- Step 10: Keep Copies Make copies of the completed form and all supporting documents for your records. This documentation will be valuable in case of any inquiries or if you need to reference the information later.

Documentation Requirements

Determining Rebate Amounts: Unveiling the Calculation Process

Have you ever questioned how the state arrives at the rebate amount you receive? In this exploration, we will delve into the factors that influence the calculation process, shedding light on how the system strives to ensure fair and accurate rebates.

- Income Levels: One of the primary factors in rebate calculations is your income. States often adopt a progressive approach, providing higher rebates to individuals with lower income levels. This ensures that those who may face financial challenges receive more substantial assistance.

- Family Size: Rebate amounts frequently consider the size of your household. Larger families may qualify for higher rebates as they often have more financial responsibilities. This factor reflects the state’s commitment to addressing the diverse needs of households.

- Tax Liability: The amount of taxes you owe or have paid is a crucial determinant. States may set a threshold for tax liability, ensuring that those who have contributed more in taxes receive a more significant rebate. This approach aims to direct assistance where it is most needed.

- Deductions and Credits: Rebate calculations often consider various deductions and credits that individuals may qualify for. This can include education credits, childcare expenses, or other tax incentives. These deductions can reduce your taxable income, ultimately influencing the rebate amount.

- Cost of Living: Some states factor in the cost of living when determining rebate amounts. This acknowledges that living expenses vary across regions, and individuals facing higher costs may be eligible for a more substantial rebate to cope with financial challenges specific to their location.

- Special Circumstances: Certain individuals or households with unique circumstances, such as disabilities or extraordinary medical expenses, may qualify for additional rebates. States may have specific provisions to address these situations and provide tailored assistance where needed.

- Legislative Changes: Rebate calculation methods can be subject to legislative changes. Governments may periodically review and adjust rebate programs to align with evolving economic conditions, tax policies, or social priorities. Staying informed about these changes is crucial for understanding how rebates are determined.

- Application of a Formula: In many cases, states employ a formula that incorporates these various factors to arrive at a specific rebate amount. This formula aims to balance the need for targeted assistance with the goal of equitable distribution.

Understanding the intricate web of factors influencing rebate calculations highlights the complexity of creating a fair and accurate system. As citizens, it’s essential to stay informed about these factors to comprehend how rebates are determined and advocate for policies that align with principles of fairness and economic justice.

Tracking Your Application

Tracking the progress of your application is a crucial step in ensuring that you stay informed about its status. Here are some general guidelines and tools you can use for tracking your application:

- Online Application Portals: Many organizations provide online portals where applicants can log in to check their application status. Upon submission, you might receive login credentials or a confirmation email with a link to the portal. Log in regularly to see if there are any updates.

- Application Confirmation Email: After submitting your application, you should receive a confirmation email. This email often contains important details, including a confirmation number or a link to check the application status. Keep this email safe and refer back to it.

- Application Tracking Numbers: Some organizations assign tracking or reference numbers to applications. This number can be used to check the status of your application. It might be mentioned in the confirmation email or on the application submission page.

- Contacting the HR or Recruitment Team: If there’s no online tracking system or if you want more personalized information, consider reaching out to the Human Resources (HR) department or the specific recruitment contact listed in the job posting. You can inquire about the expected timeline for the hiring process and any updates on your application.

- Company’s Official Website: Check the company’s official website for any updates or announcements related to the hiring process. Companies often provide information about the stages of recruitment, and they may have a dedicated section for applicants.

- LinkedIn and Social Media: Some companies use social media platforms, especially LinkedIn, to share updates about their recruitment processes. Follow the company on these platforms to stay informed about any announcements or changes in the hiring process.

- Application Status Hotline: In some cases, companies provide a hotline or contact number specifically for checking application status. This information may be included in the confirmation email or on the company’s website.

- Patience and Follow-Up: Keep in mind that the hiring process can take time. It’s normal for there to be delays between application submission, initial review, interviews, and a final decision. If there are delays, consider following up politely with the contact person or department mentioned in the job posting or confirmation email.

Remember to be courteous and professional when reaching out for updates on your application. If there are no specific instructions provided, wait a reasonable amount of time before following up.

Missouri Rent Rebate vs Other Assistance Programs

The Missouri Rent Rebate Program distinguishes itself from other assistance initiatives through its unique focus on providing direct financial relief to eligible individuals or families facing challenges in meeting their rental obligations. Here, we will compare the Missouri Rent Rebate Program with other assistance programs to highlight its distinctive features.

1. Direct Financial Assistance:

- Missouri Rent Rebate Program: This program offers direct financial support to eligible individuals or families, specifically targeting rent-related expenses. Recipients receive a rebate, which can significantly alleviate their financial burden in meeting housing costs.

- Other Assistance Programs: Many assistance programs may provide support in various forms, such as food assistance, healthcare, or job training. However, the Missouri Rent Rebate Program stands out for its direct focus on addressing housing-related financial challenges.

2. Eligibility Criteria:

- Missouri Rent Rebate Program: Eligibility for the rent rebate is typically based on income levels and other criteria. The program is specifically designed to assist those who may not qualify for other types of assistance but still face challenges in affording rent.

- Other Assistance Programs: Eligibility for different programs may vary widely and often involves a range of criteria. Some assistance programs may have more restrictive eligibility requirements, making it challenging for certain individuals or families to qualify.

3. Targeted Support:

- Missouri Rent Rebate Program: The program is tailored to address the specific needs of individuals struggling with rental expenses. By targeting this area of financial strain, it provides a more focused and effective form of support.

- Other Assistance Programs: While other programs may offer support in various aspects of life, they may not directly target the pressing issue of rental affordability, making the Missouri Rent Rebate Program a crucial resource for those specifically facing housing challenges.

4. Application Process:

- Missouri Rent Rebate Program: The application process for the rent rebate is designed to be accessible and straightforward, allowing eligible individuals to apply easily for the financial assistance they need.

- Other Assistance Programs: Application processes for various assistance programs can vary in complexity, and some individuals may find them challenging to navigate. The streamlined application process of the Missouri Rent Rebate Program contributes to its user-friendly approach.

The Missouri Rent Rebate Program stands out for its targeted approach, providing direct financial assistance to individuals or families struggling with rental costs. Its streamlined application process and specific focus on housing affordability make it a unique and effective resource in comparison to broader assistance programs.

Financial Education and Resources

Beyond the immediate relief offered by the Missouri Rent Rebate Program, investing in financial education and leveraging additional resources is crucial for sustained financial well-being. Here’s a discussion on the importance of financial education and some available resources:

1. Financial Education:

- Importance: Providing financial education empowers individuals to make informed decisions about budgeting, saving, investing, and managing debt. It helps foster financial literacy, enabling people to build a foundation for long-term financial stability.

- Topics: Financial education programs often cover budgeting, understanding credit, managing debt, saving for emergencies, investing basics, and planning for future expenses like homeownership or retirement.

2. Local Community Workshops:

- Community Programs: Many communities and nonprofit organizations offer workshops and seminars on financial literacy. These sessions may cover a range of topics, providing practical tips and tools to manage finances effectively.

- Networking: Attending local workshops not only imparts valuable knowledge but also provides an opportunity to network with financial experts and other individuals facing similar challenges.

3. Online Financial Courses:

- Flexibility: Online platforms offer a variety of financial education courses that individuals can take at their own pace. These courses cover a wide range of topics, from basic financial literacy to more advanced investment strategies.

- Accessibility: Online courses are accessible to a broad audience, making them a convenient option for those with busy schedules or limited access to in-person resources.

4. Government and Nonprofit Resources:

- Financial Counseling Services: Government agencies and nonprofit organizations often provide free or low-cost financial counseling services. Trained counselors can offer personalized advice and guidance on budgeting, debt management, and long-term financial planning.

- Resource Portals: Many government websites compile resources on financial education, providing information on budgeting tools, guides on managing credit, and tips for financial success.

5. Library Resources:

- Books and Literature: Public libraries are valuable sources of financial education materials. Books, audiobooks, and other resources on personal finance can provide in-depth insights into various aspects of managing money.

- Workshops and Seminars: Some libraries host financial literacy workshops or partner with local organizations to bring financial education opportunities to the community.

6. Financial Apps and Tools:

- Budgeting Apps: Various mobile apps can assist individuals in creating and managing budgets, tracking expenses, and setting financial goals.

- Investment Platforms: For those interested in investing, there are user-friendly investment platforms and apps that provide educational resources along with tools for building a diversified portfolio.

Encouraging participation in these financial education programs and utilizing available resources can contribute significantly to the overall financial well-being of individuals and families, complementing the immediate assistance provided by programs like the Missouri Rent Rebate.

Tips for Responsible Renting

- Create a Realistic Budget: Start by assessing your monthly income and expenses. Be realistic about your financial situation, including rent, utilities, groceries, transportation, and other essential expenses. A well-planned budget helps you allocate funds appropriately and avoid overspending.

- Emergency Fund: Establishing an emergency fund is essential for unexpected expenses or income disruptions. Aim to save at least three to six months’ worth of living expenses. This fund can act as a safety net during challenging times and prevent you from falling behind on rent.

- Understand Lease Terms: Read and understand your lease agreement thoroughly before signing. Be aware of key terms such as lease duration, rent due dates, and any penalties for late payments. Knowing your rights and responsibilities can prevent misunderstandings with your landlord.

- Communicate with Your Landlord: Maintain open communication with your landlord. If you encounter financial difficulties, inform them as soon as possible. Some landlords may be willing to negotiate a temporary rent reduction or create a payment plan to accommodate your situation.

- Prioritize Rent Payments: Make rent a top priority in your budget. Paying rent on time not only ensures housing stability but also helps maintain a positive relationship with your landlord. Late payments can lead to fees and damage your rental history.

- Cut Unnecessary Expenses: Regularly review your spending habits and identify areas where you can cut costs. Eliminating non-essential expenses can free up funds for rent and other crucial bills. Prioritize needs over wants to maintain financial stability.

- Explore Additional Income Streams: Consider supplementing your income with part-time work, freelancing, or other side hustles. This additional income can help cover expenses and build a financial cushion. Be mindful of how any additional work may impact your primary job and overall well-being.

- Research Local Assistance Programs: Familiarize yourself with local housing assistance programs and financial resources. These programs may offer support during times of financial strain, helping you bridge gaps in your budget.

- Monitor Your Credit Score: Regularly check your credit score and address any discrepancies. A good credit score is essential for future financial opportunities, including renting or buying a home. Responsible financial behavior positively impacts your creditworthiness.

- Plan for Rent Increases: Be aware of the possibility of rent increases and factor them into your budget. If you anticipate changes in your financial situation, plan accordingly to accommodate potential rent adjustments.

By adopting responsible renting practices, you can enhance your financial stability and ensure a positive and sustainable living situation in the long term.

Community Engagement and Advocacy

The Missouri Rent Rebate Program thrives on community support. Discover how individuals can engage with their communities and advocate for improved assistance programs.

Conclusion

In conclusion, the Missouri Rent Rebate Form for 2025 is a valuable tool for those facing financial challenges in meeting their rental obligations. By understanding the eligibility criteria, navigating the application process, and avoiding common pitfalls, eligible individuals can access much-needed financial relief.

Download Missouri Rent Rebate Form 2025

Frequently Asked Questions (FAQs)

- How do I know if I am eligible for the Missouri Rent Rebate Program?

- Eligibility is based on factors such as income and residential status. Check the program’s guidelines for detailed information.

- Where can I find the Missouri Rent Rebate Form 2025?

- The form is available on the official program website and at local government offices. You can also request it by mail.

- What documents do I need to submit with my application?

- Commonly required documents include proof of income, lease agreements, and residency documentation. Refer to the guidelines for a comprehensive list.

- How is the rebate amount determined?

- The rebate calculation considers factors such as income, family size, and regional cost of living. The system aims for a fair and accurate distribution.

- Can I apply for the Missouri Rent Rebate Program if I’m receiving other forms of assistance?

- Yes, eligibility is assessed independently. Receiving other assistance does not automatically disqualify you.