Missouri Renters Rebate 2025 – The Missouri Renters Rebate may be available to Missouri residents who pay property taxes. This tax credit is intended to assist elderly and handicapped individuals in maintaining their homes.

By quickly filling out Form MO-CRP and safely sending it, you may begin the Missouri Renters Rebate process. The signNow platform is simple to use and complies with HIPAA and GDPR.

What is Missouri Renters Rebate?

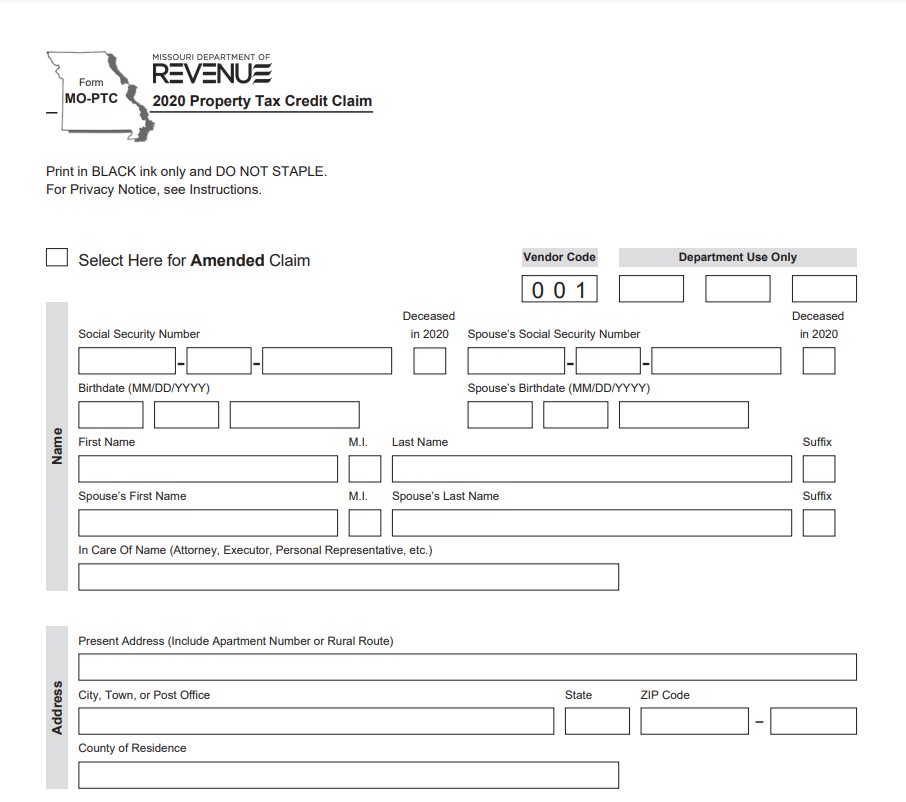

The Missouri Renters Rebate program helps seniors and people with disabilities save money on their property taxes.It is also known as the Missouri Property Tax Credit and the Circuit Breaker (M-PTC).

It is a well-known tax credit designed to assist the elderly and people with disabilities in remaining in their homes.Owners of residential rental buildings with five or more rental units are eligible for this program.

Tenants who resided in certain residential rental buildings during the year are also eligible for the credit. These consist of persons residing in nursing homes and assisted living centers.

You must submit one Form MO-CRP to the state in order to get the reimbursement. This form has a blank area for your completion and a place for you to attach your rent receipt.

A replica of the facade and rear of your check is sufficient if you are unable to attach your rent receipt.

Your Renters’ Rebate form may be easily customized using the online editor, and it can be finished fast and accurately with idEval. You can create new fillable sections, add text, and insert photos and symbols thanks to its user-friendly interface. With a few mouse clicks, you may also eSign and distribute your papers.

How to Get Missouri Renters Rebate

For a part of the actual estate taxes they pay on their primary house, Missouri grants a property tax credit to its elderly seniors and 100% handicapped individuals. For renters and homeowners who paid real estate taxes on their principal residence during the tax year, this incentive is a stunning $750 and $1,100, respectively.

In summary, Form MO-CRP must be completed and submitted by December 31st, preferably electronically online. This is the best approach to receiving this nod. A rent receipt (or a signed declaration) will suffice as proof of residency. In order for them to confirm and validate your eligibility for the aforementioned honors, be sure to provide the name of your landlord and the address of your present residence in the signature line.

To make the process simple, enjoyable, and painless, use a HIPAA and GDPR-compliant solution like signNow. The application will guide you through the entire process with a straightforward drag-and-drop interface. Easily add, remove, and reorganize pages, as well as quickly add photos, videos, and links. The best aspect is that you can store your work in a safe, password-protected cloud repository for later use.

How to Track Missouri Renters Rebate

It’s crucial to keep track of your earnings and outgoings if you want to be eligible for the Missouri Renters Rebate. Using the free web tool DocHub, you can securely submit forms and manage your documents.Without printing or scanning, you may start with a basic form and add or update documents in a matter of minutes. It is specifically made to assist you in streamlining your process and improving document management effectiveness.

For each inhabited dwelling that you rented during 2013, you must complete a Form MO-CRP. For whatever rent you claim, you must have your rent receipt(s) or a written declaration from your landlord. Additionally, up to a maximum of $750, you may deduct the share of real estate taxes that you pay for each inhabited dwelling.

Download Missouri Renters Rebate 2025