Montana Tax Rebate 2025 – Ah, taxes! They’re a part of life no one can avoid, right? But what if there was a way to get some of it back? That’s exactly what we’re here to talk about today: Montana Tax Rebate 2025. Whether you’re a long-time resident of Montana or you’re just settling in, this guide will give you everything you need to know about this significant financial matter.

Understanding the Basics of Montana Tax System

Why Taxes Matter in Montana

We’ve all heard the old saying, “nothing is certain except death and taxes.” But why are taxes so important, especially in Montana? Well, taxes are the fuel that keeps the engine of the government running. They fund public services, infrastructure, schools, and a whole lot more.

The Concept of Tax Rebates

What are Tax Rebates?

You might be asking yourself, “What is a tax rebate anyway?” In simple terms, a tax rebate is a refund on taxes when the tax liability is less than the taxes paid. It’s like the government saying, “Hey, you overpaid. Here’s your money back.”

The Importance of Tax Rebates

Now, you might be wondering, “Why should I care about tax rebates?” Good question! Tax rebates can put some hard-earned cash back in your pocket. It can be a small windfall that helps you cover unexpected expenses, pay off debts, or just enjoy a little extra spending money.

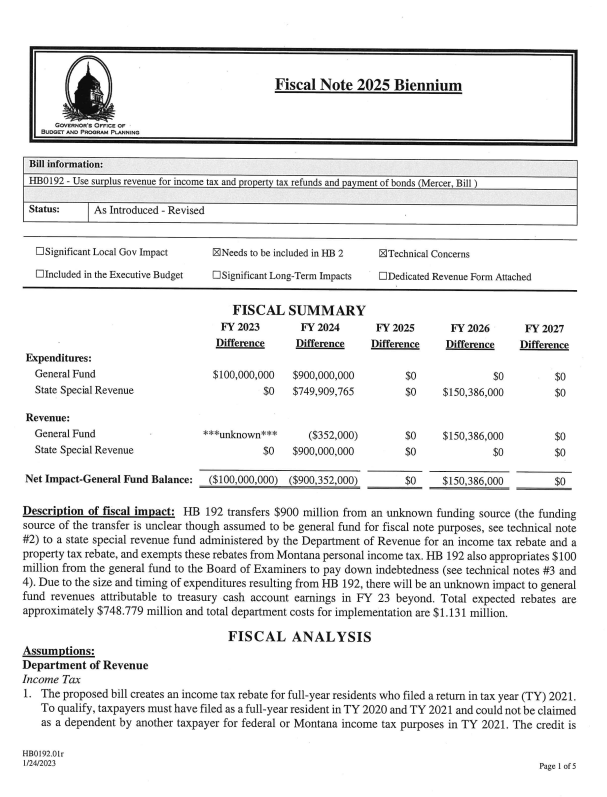

Montana Tax Rebate 2025: What’s New?

Main Changes in the Tax Rebate Scheme

As we welcome the dawn of 2025, an exciting year awaits us with a series of fresh changes in the Montana tax rebate scheme. This significant update holds great promise for individuals like yourself, as it opens up the possibility of putting more money back into your pocket! With these new adjustments, you can expect a potentially higher tax rebate that will contribute to your financial well-being and provide you with greater financial freedom. The updated scheme aims to maximize benefits for hardworking individuals like yourself, ensuring that you receive the full rewards and incentives that you deserve. So get ready to embrace the positive changes coming your way and take advantage of this opportunity in order to make the most out of your financial endeavors in 2025!

Impacts on Residents

The highly anticipated 2025 tax rebate holds significant implications for residents, as it not only alleviates the burden of tax payments but also serves as a catalyst for stimulating the local economy. By implementing this rebate, individuals and households will experience a much-needed financial relief, allowing them to allocate their hard-earned money towards other essential needs or future investments. This injection of funds into the pockets of residents will undoubtedly have a positive ripple effect on various sectors within the local economy.

How to Utilize the Changes

To truly capitalize on these transformative changes, it is essential to delve deep into the intricacies of the new rules and regulations. By gaining a comprehensive understanding of these updates, you will be equipped with the knowledge necessary to navigate the financial landscape with finesse. This newfound awareness will empower you to strategically plan and tailor your financial decisions to ensure maximum benefit in this dynamic environment. By embracing this proactive approach, you can confidently adapt your financial strategies and stay one step ahead amidst an ever-evolving landscape.

Eligibility for Montana Tax Rebate 2025

Eligibility Criteria

Determining eligibility for the highly anticipated Montana Tax Rebate 2025 is of utmost importance. It is essential to familiarize yourself with the specific criteria in order to ascertain whether you meet the requirements and are eligible to claim this enticing rebate. Keep in mind that not everyone will qualify, so it becomes imperative to gain a comprehensive understanding of the eligibility guidelines set forth by the Montana Department of Revenue. By doing so, you will be able to assess your own eligibility with confidence and take advantage of this lucrative opportunity if you meet all necessary qualifications.

Common Issues in Eligibility

Navigating through the potential roadblocks that often arise when it comes to determining eligibility can sometimes be a daunting task. However, there is no need to fret or become overwhelmed, as we are here to provide you with some invaluable tips and strategies that will help you smoothly maneuver your way through these challenges. Our expert guidance will ensure that you have all the necessary tools at your disposal to confidently tackle any eligibility-related hurdles that may come your way. So, rest assured and let us assist you in successfully navigating through this process with ease and efficiency.

Addressing Eligibility Issues

If you find yourself facing challenges with your eligibility, rest assured that there is always a solution waiting to be discovered. Let’s embark on a journey together to explore the various avenues available for addressing this issue and finding a resolution that will not only meet your needs but also exceed your expectations. With our expertise and commitment to finding innovative solutions, we will navigate through any obstacles that stand in your way and guide you towards achieving the outcomes you desire. So, let’s dive in and uncover the possibilities that lie ahead!

Applying for Montana Tax Rebate 2025

Steps to Apply for Tax Rebate

To successfully apply for the tax rebate and ensure a seamless application process, it is crucial to follow these carefully curated steps. By adhering to these guidelines, you can confidently navigate the process with ease and maximize your chances of receiving the rebate you are entitled to. So, let’s dive into the steps that will empower you to successfully apply for your tax rebate without any unnecessary hassle or confusion.

Avoiding Common Mistakes

In the competitive world we live in, even the slightest mistakes can have significant consequences, often leading to rejections and missed opportunities. However, fear not! Our unwavering commitment lies in assisting you in navigating through this treacherous terrain by providing valuable guidance and support that will empower you to avoid these pitfalls altogether. We understand the importance of perfection and are here to ensure that your journey is smooth, successful, and free from any hindrances that may impede your progress towards achieving your desired goals.

Ensuring Successful Applications

If you are eager to increase your chances of success in your application, it is essential to prioritize thorough preparation and unwavering diligence. These two key factors can significantly impact the outcome of your endeavor. By investing time and effort into preparing yourself adequately, such as researching the company or institution you are applying to and tailoring your application materials accordingly, you demonstrate your commitment and dedication towards securing a favorable outcome. Furthermore, remaining diligent throughout the entire application process showcases your perseverance and determination to achieve your goals. Remember, success often comes to those who go the extra mile in their preparations and exhibit unwavering diligence towards their aspirations.

Conclusion on Montana Tax Rebate 2025

That’s a wrap on the Montana Tax Rebate 2025! It’s an opportunity not to be missed if you’re eligible. Understanding and navigating the tax system might be daunting, but with the right information and professional advice, it can lead to significant financial benefits. Always remember: when it comes to taxes, knowledge is power!