New Jersey Renters Rebate 2025 – The New Jersey Renters Rebate Program offers qualifying renters a reimbursement of up to $1,000. The amount of the refund is determined by the renter’s income, the number of dependents, and the amount of rent paid. The tenant must have paid rent for at least four months out of the year and have a gross income of less than $50,000 in order to qualify for the rebate. The refund is sent as a check and can be applied against other expenditures like rent or utility bills.

How to Be Eligible for the Renters’ Refund in New Jersey

A rebate is given to qualifying renters who pay their rent on their principal residence in New Jersey under the New Jersey Renters Rebate program. The rebate, which has a $1,000 maximum, is based on a portion of the rent that was paid. Residents must fulfill exact payment and occupancy requirements in order to be suitable for the reimbursement.

Income Requirements

Tenants in New Jersey must make no more than $50,000 a year to be eligible for the renters’ rebate. All forms of income, such as earnings, salaries, interest, dividends, and pensions, are included in this.

requirements for residency

Renters must keep expended at least six months of the last year making New Jersey their primary residence in order to be eligible for the New Jersey Renters Refund. The tenant’s sole dwelling and principal residence must both be owned or rented.

Suitable Renters

Renters must have paid rent on their principal residence in New Jersey for at least six months of the year in order to be eligible for the New Jersey Renters Rebate. The landlord or a roommate who is not a relative must have received the rent. Rent for a rental period that started on or after January 1, 2020, has to be paid.

How to use

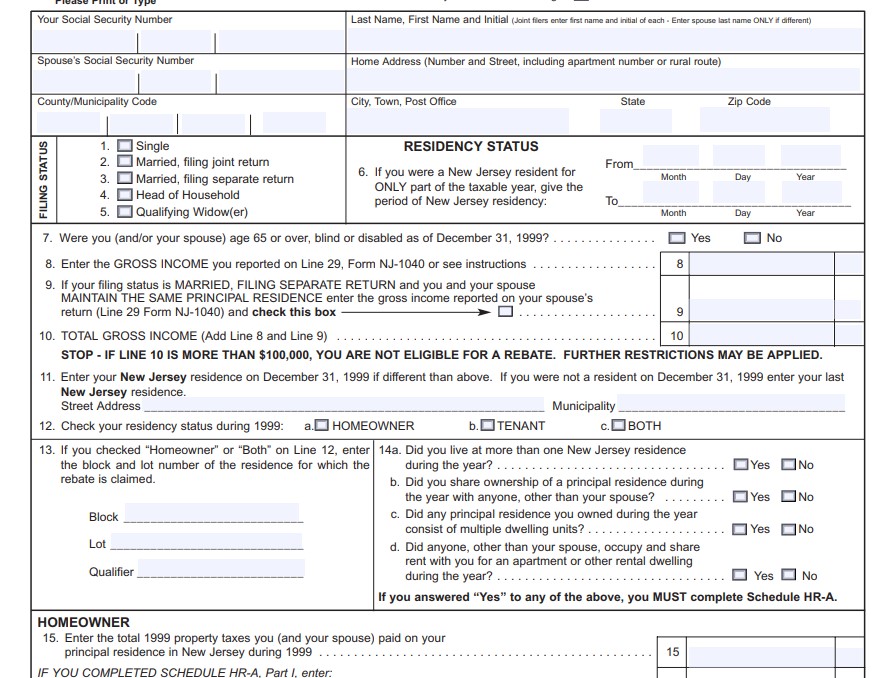

Online or postal applications exist taken for the New Jersey Renters Refund. Renters must create an account, fill out their contact and income details, and submit their application online. Renters can download and print an application from the New Jersey Division of Taxes website in order to submit it by mail.

A refund check will be mailed to tenants who meet the requirements for the New Jersey Renters Rebate. Within 4-6 weeks of the application’s receipt, the refund check will be provided.

The New Jersey Renters Rebate’s amount is

Tenants with low and moderate incomes who qualify are eligible for the New Jersey Renters Refund. Up to a maximum of $1,000, the credit is equal to 30% of the annual rent paid. Renters must have an annual income of $50,000 or less and have been in their present residence for a minimum of six months in order to qualify.

Both renters who own a house and those who do not are eligible for the credit. Nevertheless, the New Jersey renters’ refund is not available to people who qualify for the federal Earned Income Tax Credit (EITC).

The credit is claimed on the state income tax return and is refundable, which means that the taxpayer will get a refund for the difference if the credit exceeds the tax due.

Visit the New Jersey Division of Taxes website for additional details on the New Jersey Renters Refund.

The New Jersey renters’ refund is due on what date?

If you live in New Jersey and rent your property, you could be qualified for a renter’s refund. Your income and the amount of rent you paid over the course of the year are used to determine the rebate’s amount. You must have lived in New Jersey for at least six months of the previous year in order to be eligible, and your yearly gross income must not have exceeded $5,000. Also, you must have spent $250 or more on rent throughout the course of the year.

The application for the rebate must be submitted by August 1st. You must fill out a Renter’s Rebate Claim Form (RR-1) and submit it to your neighborhood government in order to apply. The New Jersey Division of Taxes website or the website for your municipality both have the form available. A reproduction of the state and any supportive materials should be kept for your records.

You should get in touch with your town or the New Jersey Division of Taxes if you have any questions concerning the New Jersey renter’s rebate or the application procedure.

How to Apply for the Renters’ Refund in New Jersey

A rebate is given to qualifying renters who pay their rent on their principal residence in New Jersey under the New Jersey Renters Rebate program. Up to a certain amount, the reimbursement is based on a percentage of the rent that was paid.

If you want to get the rebate, you have to:

-Reside in New Jersey

-Have a disability or be at least 62 years old.

-Generate a gross yearly income of $20,000 or less.

You can submit a renter’s rebate application by mail if you satisfy all of the aforementioned requirements. By October 1st of the year after the year that you made your rent payment, the application must have been mailed.

You must include details about your personal information, your rental property, and your income on the application. Also, copies of your rent receipts must be included.

Your application will be examined once it has been received to see if you qualify for the rebate. A check will be mailed to you within six to eight weeks if you are qualified.

Call the Division of Taxes at 1-609-292-6400 if you have any concerns regarding the refund or the application procedure.

Download New Jersey Renters Rebate 2025