New Jersey Tax Rebate 2025 – New Jersey residents could qualify for tax rebates under the state’s tax rebate program in 2025. Designed to offer financial relief to eligible taxpayers while helping maximize tax savings, this guide covers everything you need to know about New Jersey Tax Rebate 2025 including eligibility criteria, filing procedures, required documents, benefits of claiming rebates and more.

Eligibility Criteria for New Jersey Tax Rebates

To be eligible for the New Jersey Tax Rebate 2025, certain criteria must be fulfilled, such as being a resident and possessing a valid Social Security Number. Furthermore, you must have filed your taxes for the previous year as well as meeting specific income requirements – it’s wise to verify whether these criteria apply before filing for tax rebates to avoid disappointment!

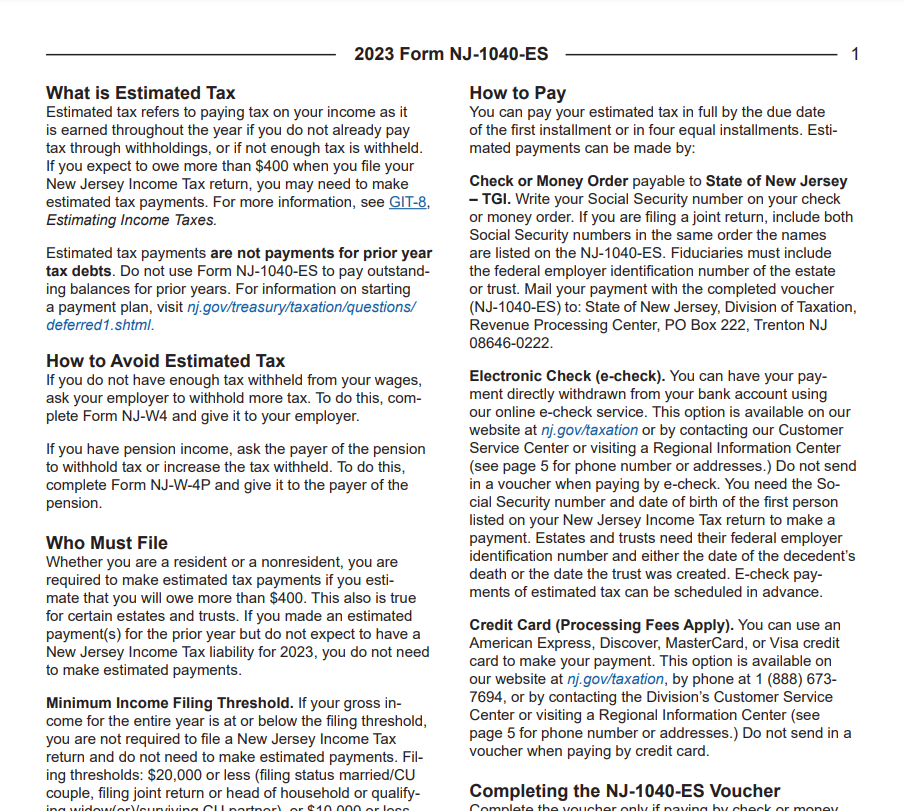

How to File for NJ Tax Rebates (Rebate).

Filing for New Jersey is an easy and straightforward process that can be accomplished both electronically and manually. Either use the state’s online filing system, or complete and mail in a paper tax return directly to its tax department. Before beginning to file for rebates, ensure you have all required documents on hand – W-2 forms and 1099 forms among others – to ensure a seamless filing experience.

Documents Necessary for Claiming New Jersey Tax Rebates

When applying for NJ Tax Rebates, certain documents will need to be presented to the state’s tax department. These include proof of your identity (like a driver’s license or passport) as well as residency proof like utility bills. In addition, W-2 forms and 1099 forms as well as other relevant tax documents should also be submitted as evidence of income.

Benefits of Claiming NJ Tax Refunds

Claiming NJ Tax Rebates can bring multiple advantages, including lowering your tax liability and giving more money back into your pocket. In addition, claiming rebates and taking advantage of other tax benefits will allow you to lower your tax burden and save more of what was earned over time.

Frequently Asked Questions about NJ Tax Rebates (FAQs)

- Q: Who Is Eligible for the New Jersey Tax Rebate 2025?

- A: In order to be eligible for the New Jersey Tax Rebate 2025, residents of the state, with valid Social Security Number and filed their taxes during 2018, as well as meeting certain income criteria are eligible.

- Q: How Can I File for NJ Tax Rebates?

- A: You have two filing options when filing for New Jersey tax rebates: 1) Filing online via the state’s online filing system or 2) mailing in a paper tax return and paying fees directly to their tax department.

- Q: Do I need documents to file for NJ Tax Rebates?

- A: When filing for NJ Tax Rebates, it is necessary to submit proof of identity, residency and income; such as a driver’s license or passport as well as proof that your utilities bill was paid, W-2 forms or 1099 forms (and any other relevant tax forms) as proof.

- Q: What are the advantages of claiming NJ Tax Rebates?

- A: By taking advantage of NJ Tax Rebates, you can reduce your tax liability and put more money back in your wallet. In addition, additional credits and deductions could lower your tax burden further and expand savings potential.

Conclusion

In conclusion, the New Jersey Tax Rebate 2025 offers eligible residents a fantastic opportunity to lower their tax liability and maximize savings. By following the steps outlined herein and taking full advantage of rebates, you can make sure you maximize your tax savings. For any inquiries or additional help on tax matters please reach out directly to your state’s tax department for additional support and guidance.

Download New Jersey Tax Rebate 2025