NJ Rent Rebate Form 2024 – If you’re a tenant in New Jersey who qualifies for the new direct property tax relief program, there’s good news for you. You can now submit an application for a rent rebate form and receive financial assistance. To ensure that you receive your reimbursement on time, it is important to complete the necessary form and submit it before the specified due date. Don’t miss out on this opportunity to ease your financial burden!

application deadline

Exciting news for renters in New Jersey this year! The ANCHOR program is bringing an extra benefit to the table. Along with a state tax credit for most of their property taxes, eligible renters will also receive an immediate check of $450. While it may not seem like much, this additional support can make a significant difference for individuals with limited financial resources. It’s a small yet meaningful gesture that can help ease some financial burdens and provide peace of mind.

Democrats are the ones who came up with the ANCHOR program. It is intended to assist citizens of states with exorbitant property taxes. It is currently only available to tenants and homeowners in certain localities. For individuals who were severely impacted by the real estate bubble, this is a positive thing.

Half of the two million homeowners and tenants who are anticipated to benefit from the ANCHOR program have applied, according to a Monday announcement by the Murphy Administration. This is significant since the program is being hailed as a huge success for state taxpayers and one that will lower living costs for everyone in the Garden State.

eligibility criteria

The NJ Rent Rebate Form 2024 may be appropriate for you if you’re interested in getting a tax refund. The program accepts applications by phone, mail, or the internet. The deadline for applications is January 31, 2024.

If you want to be eligible for the program, you must fulfill specific income requirements. These specifications are determined by your 2019 gross household income. Additionally, your salary must be below the threshold for qualifying. The program is mostly restricted to individuals.However, if you are 65 or older, you will also be qualified.

The amount of savings you can receive is up to $1,500, depending on your salary. This benefit is expected to be available to more than 1.2 million homes.

The perk would provide renters with up to $450 to help with rising rent costs. The Homeowner’s Tax Credit Scheme is the model for this program.

Individuals who meet the eligibility criteria for the benefit will receive a check. Rest assured, payments will be promptly delivered in either May or June.

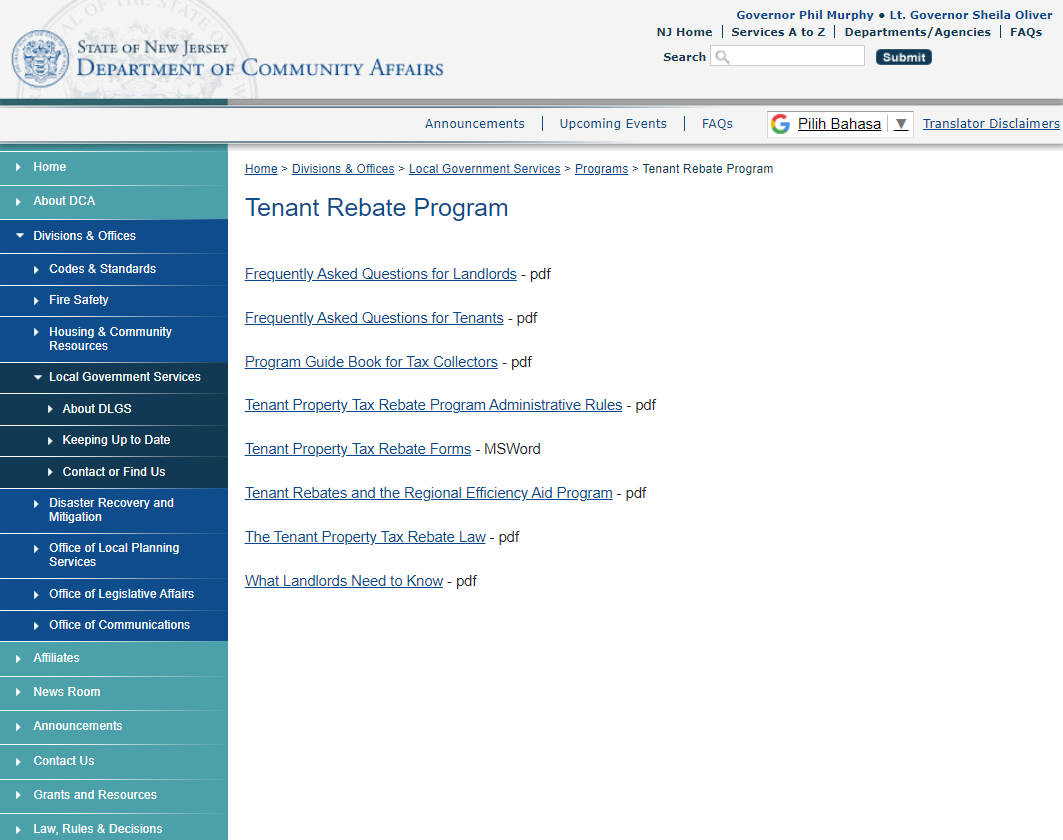

The new direct property tax relief program in New Jersey

The ANCHOR tax relief program is an effective solution to tackle the rising property taxes in New Jersey. It offers great benefits to both renters and homeowners. Renters can enjoy a $450 credit to offset any rent increases, while homeowners receive an average annual credit of $971. The program has been incredibly popular, with an astounding 1.2 million families already applying for it as of now. Don’t miss out on this opportunity to ease your financial burden – join the numerous families who have already benefited from this program!

The nation’s greatest property tax burden falls on New Jersey residents. Since 2011, the average cost has increased by more than $1,500 before accounting for inflation. The entire amount of incentives for reducing property taxes was raised to $2 billion in the state’s most recent budget.

Republicans have presented a plan to put the rebate program up for a vote on the Senate floor, even though it hasn’t yet been renewed beyond the current fiscal year. It would add $50,000 to the maximum income threshold for beneficiaries. This would give another 300,000 tenants access to the scheme.

Nevertheless, less than 25% of individuals who are qualified have applied for the state tax rebate program. Some locals have expressed frustration at their inability to contact the state’s ANCHOR hotline.

Anchor’s Toll-Free Number

Governor Phil Murphy introduced the Anchor tax relief program during the presentation of the state budget. Tenants will receive up to $450 and homeowners up to $1,500 under this new program. The state’s strategy to combat New Jersey’s increasing property taxes includes these perks.

Additionally, the state is expanding the population that is eligible for benefits while raising the income threshold. As a result, a larger proportion of the state’s population will qualify.

Online or postal applications for the program are both accepted. A check will be issued for benefits. 2019 homeowners with a gross income of under $150,000 are eligible for up to $1,000. People who make less than $250,000 annually can get up to $500.

The application procedure can be challenging and time-consuming. Benefits from ANCHOR are exempt from federal income tax. The typical property tax expense for a house in New Jersey is 16 percent; however, they can be utilized to reduce that amount.