Ohio Renters Rebate 2024 – For eligible tenants, Ohio Renters Rebate 2024. Based on the portion of your rent that you really paid in the previous year, you will receive a rebate. You must have resided in your rental possessions for at most diminutive six months out of the year and have a family income of under $20,000. Also, you must possess a current Ohio state ID or driver’s license.

You may be eligible for a reimbursement of up to $50. You will get the Rebate by check or as a credit on your Ohio utility account.

You must terminate an application and present it to the Ohio Department of Taxation in order to be considered for the rebate. The application is available on the department’s website. By June 30th, the application must have a postmark.

Call the Ohio Department of Taxation at 1-888-223-1183 if you have any concerns regarding the rebate or the application procedure.

How to become eligible for the Ohio Renters Rebate

Renters in Ohio who meet the requirements can take advantage of the Ohio Renters Rebate. Taxpayers who are eligible for the rebate must:

-Be 18 years of age or older.

-Have a combined household income in the tax year they are claiming the credit of $32,000 or less.

-Had their primary residence in Ohio for the tax year be rented for at least $350.

-Be exempt from being listed as a dependent on another person’s tax return.

Tenants who fulfill all of the aforementioned requirements are eligible to file an Ohio income tax return for a credit of up to $50. Renters who paid $2,400 or more in rent throughout the year were eligible for the maximum credit, which is determined by the total amount of rent paid during the year.

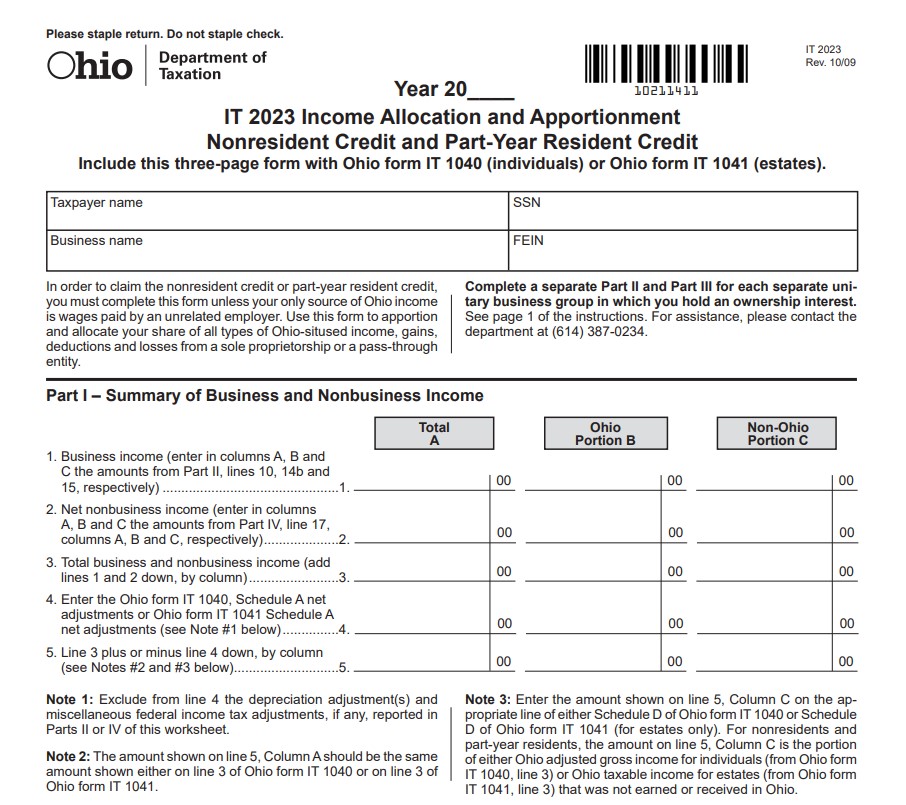

Taxpayers must fill out Form IT-R and send it to the Ohio Department of Taxation in order to claim the credit. By April 15 of the year that follows the tax year for which the distinction is living requested, the form must be postmarked. Taxpayers who made a rent payment in 2020, for instance, must submit their Form IT-R by April 15, 2021.

Please get in touch with the Ohio Department of Taxation if you have any concerns concerning the Ohio Renters Rebate or any other tax credit or deduction.

Application procedures for the Ohio Renters Rebate

For qualifying renters who pay rent on their principal residence in Ohio, the Ohio Renters Rebate program gives a reimbursement of up to $50. Based on the amount of rent paid, the renter’s income, and the number of months the renter lived in Ohio in a given year, the Rebate is determined.

Renters must complete and submit a Renter Rebate Application, which is accessible on the website of the Ohio Department of Revenue, in order to be eligible for the reimbursement. Prior to December 31 of the year for which the Rebate is being requested, the application must be postmarked.

In charge to be suitable for the Rebate, tenants must provide their name, address, and Social Security number, as well as the name, address, and contact information of their landlord or property management firm. They must also provide their yearly gross income as well as the amount of rent paid on their principal house.

The Department of Taxes will calculate the Rebate amount after receiving the application and send the claimant a check. After six to eight weeks of receiving the application, the reimbursement will be sent out.

Everything You Should Know About the Renters’ Rebate in Ohio

You could be qualified for a rent discount if you rent a home in Ohio. All qualifying renters who pay rent on their principal residence in Ohio are eligible for the Ohio Renters Rebate. You must have paid rent for at least three months out of the year and have a gross income below a particular threshold in order to qualify.

You can obtain a Rebate of up to 50% of your rent, up to a maximum of $50, if you qualify for the Ohio Renters Rebate. Your salary and the amount of rent you pay will determine how much you get back. A Rebateable tax credit is given as payment for the rebate.

You must submit a tax return for the year in which you made rent payments if you want to be eligible for the Ohio Renters Rebate. Together with a completed Ohio Renters Rebate form, you must provide your rent receipts. The form is available on the website of the Ohio Department of Taxation.

Call the Ohio Department of Revenue at 1-800-282-1780 if you have any questions concerning the Ohio Renters Rebate.

Download Ohio Renters Rebate 2024