Ohio Tax Rebate 2025 – Ohioans and businesses have an opportunity to benefit from the Ohio Tax Rebate program in 2025. This initiative offers tax credits, deductions and refunds to eligible taxpayers – providing an effective means to lower tax owed and increase refunds. We will discuss what exactly this Ohio Tax Rebate program entails as well as describe all available credits, deductions and refunds to Ohio residents and businesses alike. In this guide we’ll also outline any eligible credits which may apply.

Ohio Tax Rebate 2025 is an Ohio taxpayer assistance program offering tax credits, deductions and refunds to eligible taxpayers. It was developed to assist both Ohio residents and businesses save money when filing taxes – making managing finances simpler for both. Whether claiming tax credits is your focus or you own a business looking for deductions – Ohio Tax Rebate provides valuable opportunities to lower tax bills or boost refunds.

Ohio Residents may qualify for tax credits.

Ohio tax credits provide financial incentives that lower the amount owed in taxes. They may be available to residents who meet specific eligibility criteria, such as being first-time homebuyers, students or senior citizens. Some of the available Ohio tax credits include Ohio Historical Preservation Tax Credits, Motion Picture Tax Credits and Job Creation Tax Credits.

To claim a tax credit in Ohio, complete and provide documentation supporting your claim. The Ohio Department of Taxation offers comprehensive instructions on their website about claiming tax credits.

Ohio Businesses Can Avail of Tax Breaks for Reduced Business Income

Ohio tax deductions provide businesses in Ohio with another financial incentive that can reduce the amount of taxes owed. Deductions may be available depending on eligibility criteria such as engaging in certain industries such as manufacturing or research and development, among others. Tax deductions available include Ohio Job Retention Tax Credit, Research and Development Tax Credit and Enterprise Zone Program incentives.

To claim tax deductions, businesses must complete and provide supporting documentation of their claim. For further assistance on claiming tax deductions in Ohio, visit the Ohio Department of Taxation website.

Ohio Taxpayers may qualify for tax refunds.

Ohio tax refunds provide taxpayers with a way to receive part of their overpaid taxes back. To claim one, taxpayers must file their tax return with the Ohio Department of Taxation and provide evidence supporting their claim; once submitted, their review team will assess it to see if you qualify for one.

Qualification criteria for tax refunds can include having too much withheld from your paycheck, receiving unemployment benefits or qualifying for certain tax credits. To increase the odds of receiving a refund, it is vitally important that accurate records of income and expenses be kept and filed on time with the IRS.

Conclusion

Ohio Tax Rebate 2025 offers both Ohio residents and businesses an invaluable opportunity to save money on their taxes. From credits, deductions, or refunds – Ohio Tax Rebate can offer financial incentives that reduce taxes owed and boost refunds; taking advantage of Ohio Tax Rebate is sure to improve financial management and bring many rewards in return.

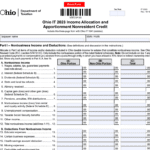

Download Ohio Tax Rebate 2025