Oklahoma Tax Rebate 2024 – Oklahoma Tax Rebate 2024 is a program designed to provide financial relief to eligible residents of Oklahoma. The purpose of the rebate is to provide support to those who have been affected by the economic impact of the COVID-19 pandemic. This guide will provide all the information you need to understand the eligibility criteria, the claim process and how to maximize your rebate.

Eligibility for Oklahoma Tax Rebate 2024

In order to be eligible for Oklahoma Tax Rebate 2024, you must meet certain criteria. These criteria include being a resident of Oklahoma, having a valid Social Security number and having a taxable income within a certain range. To find out if you qualify for the rebate, you can check the eligibility criteria on the Oklahoma Tax Commission’s website.

How to Claim Oklahoma Tax Rebate 2024

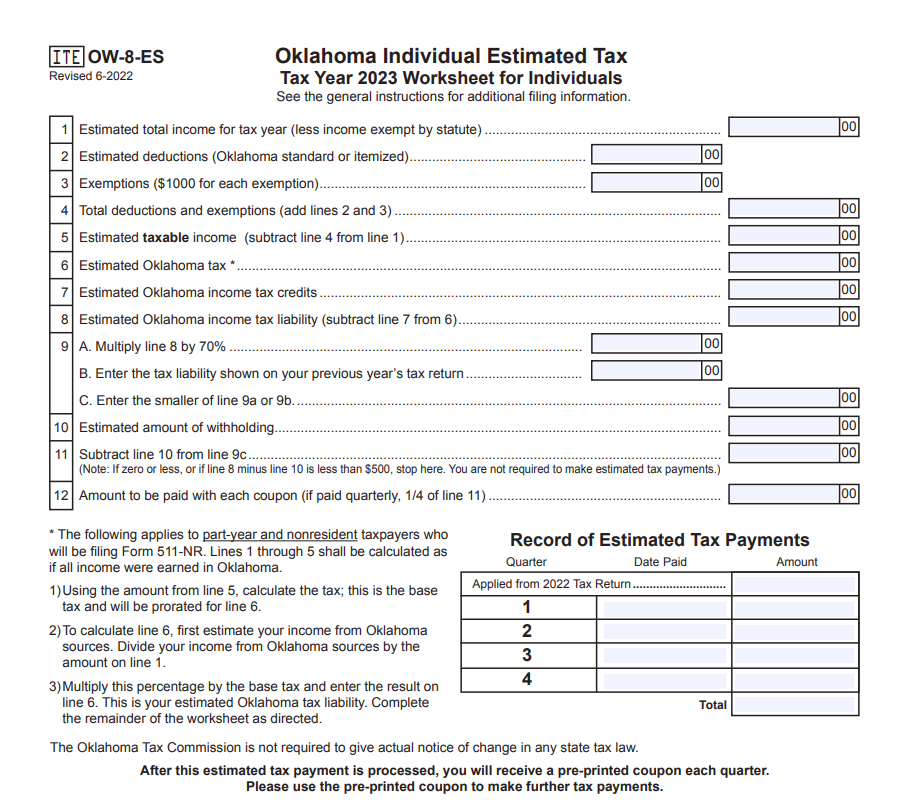

The process of claiming Oklahoma Tax Rebate 2024 is relatively straightforward. To apply, you will need to complete a tax return and provide any necessary documentation. You can complete your tax return either online or by mail. Once you have submitted your tax return, you can track the status of your rebate using the Oklahoma Tax Commission’s website.

Tax Credits to Maximize Your Rebate

In addition to the Oklahoma Tax Rebate 2024, there are a number of tax credits that you may be eligible for. These tax credits can help increase the amount of your rebate. Some of the most common tax credits include the Earned Income Tax Credit, the Child Tax Credit and the Education Tax Credit. To find out more about these tax credits and how they can increase your rebate, you can visit the Oklahoma Tax Commission’s website or consult with a tax professional.

Conclusion

In conclusion, Oklahoma Tax Rebate 2024 is a great opportunity for eligible residents of Oklahoma to receive financial support during these challenging times. By understanding the eligibility criteria, the claim process and how to maximize your rebate through tax credits, you can ensure that you receive the maximum amount of financial support available to you. It is important to remember to double-check your eligibility before applying and to submit your tax return before the deadline to avoid any common mistakes. If you need additional help or have any questions, you can visit the Oklahoma Tax Commission’s website or consult with a tax professional.

Download Oklahoma Tax Rebate 2024